Most Shareholders Will Probably Agree With Cracker Barrel Old Country Store, Inc.'s (NASDAQ:CBRL) CEO Compensation

The performance at Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL) has been rather lacklustre of late and shareholders may be wondering what CEO Sandy Cochran is planning to do about this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 17 November 2022. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

View our latest analysis for Cracker Barrel Old Country Store

Comparing Cracker Barrel Old Country Store, Inc.'s CEO Compensation With The Industry

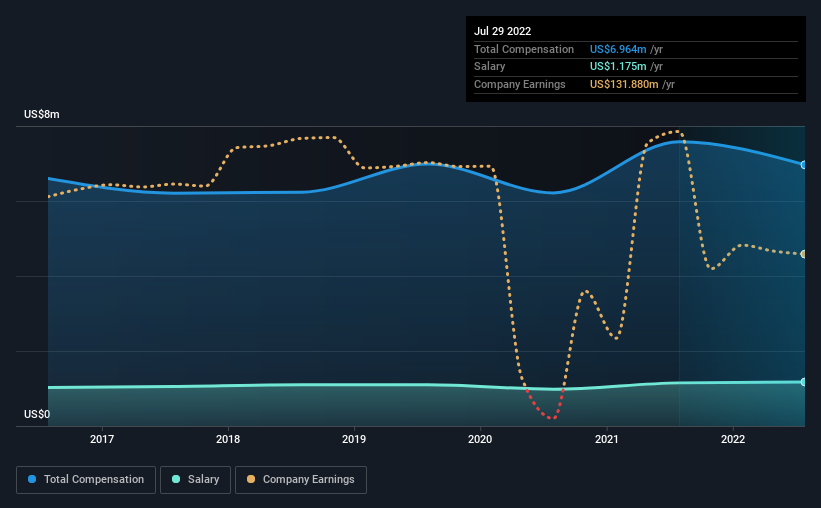

According to our data, Cracker Barrel Old Country Store, Inc. has a market capitalization of US$2.6b, and paid its CEO total annual compensation worth US$7.0m over the year to July 2022. Notably, that's a decrease of 8.1% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at US$1.2m.

For comparison, other companies in the same industry with market capitalizations ranging between US$2.0b and US$6.4b had a median total CEO compensation of US$14m. Accordingly, Cracker Barrel Old Country Store pays its CEO under the industry median. Furthermore, Sandy Cochran directly owns US$19m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2022 | 2021 | Proportion (2022) |

Salary | US$1.2m | US$1.2m | 17% |

Other | US$5.8m | US$6.4m | 83% |

Total Compensation | US$7.0m | US$7.6m | 100% |

Talking in terms of the industry, salary represented approximately 14% of total compensation out of all the companies we analyzed, while other remuneration made up 86% of the pie. Cracker Barrel Old Country Store pays out 17% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Cracker Barrel Old Country Store, Inc.'s Growth Numbers

Over the last three years, Cracker Barrel Old Country Store, Inc. has shrunk its earnings per share by 14% per year. It achieved revenue growth of 16% over the last year.

Investors would be a bit wary of companies that have lower EPS But on the other hand, revenue growth is strong, suggesting a brighter future. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Cracker Barrel Old Country Store, Inc. Been A Good Investment?

Since shareholders would have lost about 21% over three years, some Cracker Barrel Old Country Store, Inc. investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The loss to shareholders over the past three years is certainly concerning. The downward trend in share price performance may be attributable to the the fact that earnings growth has gone backwards. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for Cracker Barrel Old Country Store (of which 1 is significant!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here