Most Shareholders Will Probably Find That The Compensation For Ames National Corporation's (NASDAQ:ATLO) CEO Is Reasonable

Performance at Ames National Corporation (NASDAQ:ATLO) has been rather uninspiring recently and shareholders may be wondering how CEO John Nelson plans to fix this. At the next AGM coming up on 28 April 2021, they can influence managerial decision making through voting on resolutions, including executive remuneration. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We think CEO compensation looks appropriate given the data we have put together.

See our latest analysis for Ames National

Comparing Ames National Corporation's CEO Compensation With the industry

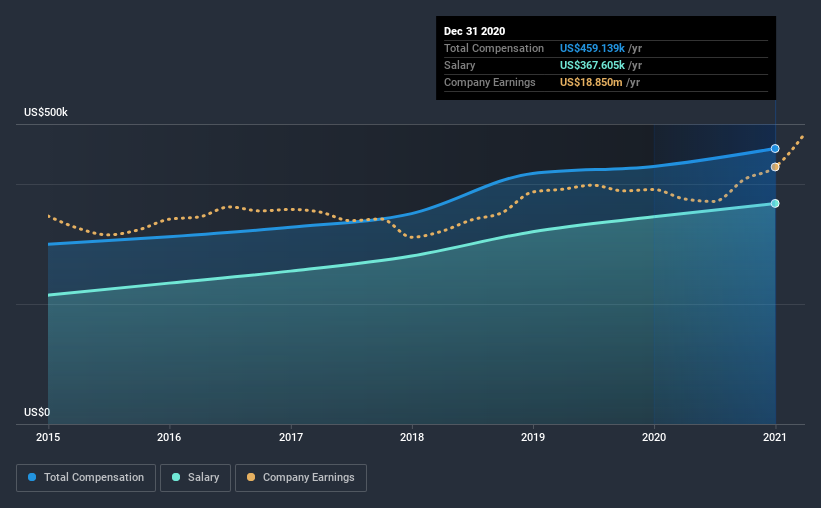

At the time of writing, our data shows that Ames National Corporation has a market capitalization of US$230m, and reported total annual CEO compensation of US$459k for the year to December 2020. That's a modest increase of 6.9% on the prior year. In particular, the salary of US$367.6k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between US$100m and US$400m, we discovered that the median CEO total compensation of that group was US$777k. Accordingly, Ames National pays its CEO under the industry median. Moreover, John Nelson also holds US$291k worth of Ames National stock directly under their own name.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$368k | US$345k | 80% |

Other | US$92k | US$84k | 20% |

Total Compensation | US$459k | US$429k | 100% |

On an industry level, roughly 42% of total compensation represents salary and 58% is other remuneration. According to our research, Ames National has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Ames National Corporation's Growth

Ames National Corporation's earnings per share (EPS) grew 15% per year over the last three years. Its revenue is up 17% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Ames National Corporation Been A Good Investment?

Since shareholders would have lost about 0.9% over three years, some Ames National Corporation investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

The uninspiring share price returns contrasts with the strong EPS growth, suggesting that there may be other factors at play causing it to diverge from fundamentals. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

Shareholders may want to check for free if Ames National insiders are buying or selling shares.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.