Motorcar Parts of America Reports Mixed Fiscal Q3 Results Amidst Record Nine-Month Sales

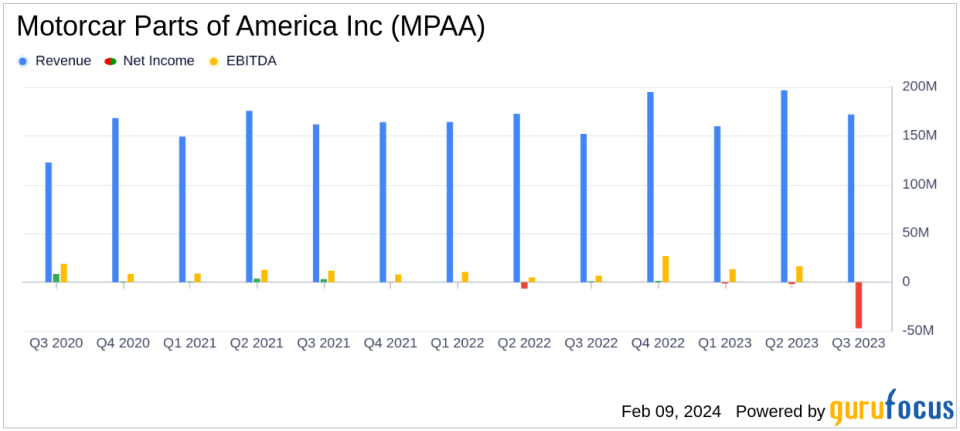

Net Sales: Increased by 13.2% to $171.9 million in Q3 and by 8.2% to $528.2 million over nine months.

Gross Profit: Rose by 43.1% to $30.0 million in Q3 with gross margin improvement to 17.5%.

Operating Income: Surged by 170.1% to $9.5 million in Q3.

Net Loss: Reported at $47.2 million in Q3, primarily due to non-cash items including a large deferred tax asset valuation allowance.

Cash Flow: Generated $53.6 million from operating activities in Q3 and reduced net bank debt by $43.7 million over nine months.

Interest Expense: Increased to $18.3 million in Q3 due to higher market rates and accounts receivable discount programs.

On February 9, 2024, Motorcar Parts of America Inc (NASDAQ:MPAA) released its 8-K filing, announcing its financial results for the fiscal third quarter and nine months ended December 31, 2023. The company, a leading manufacturer and distributor of aftermarket automotive parts, reported a significant increase in net sales and operating income, alongside a strong cash flow from operating activities.

Despite these positive developments, MPAA faced a net loss for the quarter, largely attributable to non-cash items, including a substantial deferred tax asset valuation allowance. The company's interest expenses also rose due to higher market interest rates and increased utilization of accounts receivable discount programs.

Financial Performance and Challenges

Motorcar Parts of America Inc experienced a robust increase in sales, with a record $528.2 million over nine months, up 8.2% from the previous year. Gross profit for the third quarter jumped to $30.0 million, a 43.1% increase, with gross margin improving to 17.5% from 13.8% in the prior year. This margin expansion reflects MPAA's ability to manage costs effectively and improve operational efficiency.

However, the company reported a net loss of $47.2 million for the quarter, compared to a net income of $1.0 million in the same period last year. This loss was driven by non-cash items, including a $37.5 million deferred tax asset valuation allowance, which, while not affecting operating metrics, significantly impacted the bottom line. The company's interest expense also increased by $6.8 million due to higher market interest rates and greater use of customer accounts receivable discount programs.

Strategic Focus and Outlook

Chairman, President, and CEO Selwyn Joffe commented on the company's strategic initiatives, emphasizing the focus on increasing cash flow, neutralizing working capital, and boosting sales and profitability. Despite industry softness in the latter part of the quarter, MPAA's brake-related products are gaining momentum, and the company expects further operational improvements as volumes increase.

"Our year-to-date results reflect significant progress in achieving three major initiatives: increasing cash flow from profits and neutralizing working capital, and increasing sales and profitability, despite some unexpected softness throughout the industry in November and December. Our brake-related product categories continue to gain momentum, and we expect to realize ongoing improvements in operational efficiencies as volume further increases. Finally, we remain focused on executing our strategic plans and leveraging our leadership position," said Selwyn Joffe.

The company's financial achievements, particularly in gross profit and operating income, are crucial for sustaining growth and competitiveness in the Vehicles & Parts industry. MPAA's ability to generate cash from operations and reduce debt is also a positive indicator of financial health and operational efficiency.

Investor Considerations

Motorcar Parts of America Inc's financial results present a mixed picture for investors. The record sales and improved gross margins are encouraging signs of the company's market position and operational capabilities. However, the net loss and increased interest expenses may raise concerns about the impact of market conditions and financial leverage on the company's profitability.

Investors are advised to consider both the non-GAAP measure of EBITDA and the GAAP measures to gain a comprehensive understanding of the company's financial performance. The reconciliation of EBITDA to net income is provided in the financial tables, offering insight into the non-cash and cash items affecting the company's results.

For a more detailed analysis and to access the earnings conference call and webcast, investors can visit Motorcar Parts of America's website or refer to the company's filings with the SEC.

Motorcar Parts of America Inc remains committed to its strategic initiatives and is poised to capitalize on its market leadership in the automotive aftermarket parts industry.

Explore the complete 8-K earnings release (here) from Motorcar Parts of America Inc for further details.

This article first appeared on GuruFocus.