Motorola (MSI) Q3 Earnings Beat on Record Revenues, View Up

Motorola Solutions, Inc. MSI reported strong third-quarter 2023 results, driven by the diligent execution of operational plans and healthy growth dynamics backed by solid order trends. Both adjusted earnings and revenues surpassed the respective Zacks Consensus Estimate. In addition, Motorola achieved record third-quarter revenues, earnings, cash flow and backlog, which further exemplified the strength of its portfolio. The company expects this growth momentum to continue in the near term on robust demand patterns.

Net Earnings

On a GAAP basis, net earnings in the third quarter were $464 million or $2.70 per share compared with $279 million or $1.63 per share in the year-earlier quarter. The year-over-year improvement was primarily attributable to top-line growth and lower cost of sales.

Excluding non-recurring items, non-GAAP earnings in the quarter were $547 million or $3.19 per share compared with $514 million or $3.00 per share in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by 17 cents.

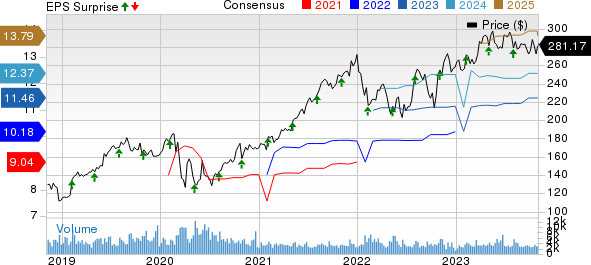

Motorola Solutions, Inc. Price, Consensus and EPS Surprise

Motorola Solutions, Inc. price-consensus-eps-surprise-chart | Motorola Solutions, Inc. Quote

Revenues

Quarterly net sales were record high at $2,556 million, up 7.7% year over year, with solid sales in both segments across all regions driven by the strength of its business model and the value of its mission-critical integrated ecosystem. The company witnessed strong demand for video security, command center software and LMR (land mobile radio) services. The top line beat the consensus estimate of $2,516 million.

Region-wise, quarterly revenues were up 5.7% in North America to $1,783 million due to growth in LMR, command center software and video security products. International revenues were up 12.7% to $773 million, with growth in video security products, LMR and command center software. Acquisitions contributed $19 million to revenues, while foreign exchange tailwinds were $13 million.

Segmental Performance

Net sales from Products and Systems Integration increased to $1,612 million from $1,529 million in the year-ago quarter, driven by higher demand for LMR and video security solutions. It also exceeded our revenue estimates of $1,552 million. The segment’s backlog was up $62 million to $4.9 billion, primarily due to high LMR demand in North America.

Net sales from Software and Services were up 11.8% to $944 million, with solid performance across command center software, LMR and video security services. However, the segment revenues missed our estimates of $962.8 million. The segment’s backlog increased $702 million to $9.4 billion, primarily due to higher multi-year software and services contracts in North America and favorable currency impact, partially offset by revenue recognition for the Airwave contract.

Other Quarterly Details

GAAP operating earnings increased to $639 million from $373 million in the prior-year quarter, while non-GAAP operating earnings were up to $741 million from $676 million. The company ended the quarter with a record backlog of $14.3 billion, up $764 million year over year.

Overall GAAP operating margin was 25%, up from 15.7%, while non-GAAP operating margin was 29% compared with 28.5% in the year-ago quarter. The increase in GAAP operating margin was primarily due to higher sales.

Non-GAAP operating earnings for Products and Systems Integration were up 12% to $420 million for a margin of 26.1%. Non-GAAP operating earnings for Software and Services were $321 million, up 7% year over year, for a non-GAAP operating margin of 34%.

Cash Flow and Liquidity

Motorola generated $714 million cash from operating activities in the reported quarter compared with an operating cash flow of $388 million a year ago. Free cash flow in the third quarter was $649 million. The company repurchased $322 million worth of stock during the third quarter. As of Sep 30, 2023, MSI had $910 million of cash and cash equivalents with $4,704 million of long-term debt.

Guidance Up

With solid quarterly results and robust demand patterns, the company raised its earlier guidance for 2023. Non-GAAP earnings for 2023 are currently expected in the $11.65-$11.70 per share range, up from $11.40-$11.48 on revenues of $9.930 billion to $9.945 billion, up from $9.875 billion to $9.900 billion estimated earlier, with a rise in both segments on higher demand.

For fourth-quarter 2023, non-GAAP earnings are expected in the $3.60-$3.65 per share range on year-over-year revenue improvement of approximately 4% due to healthy demand trends.

Moving Forward

Motorola is poised to gain from disciplined capital deployment and a strong balance sheet position. The company expects strong demand across LMR products, the video security portfolio, services and software while benefiting from a solid foundation.

Motorola currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 18.7% and delivered an earnings surprise of 12%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Bandwidth Inc. BAND, carrying a Zacks Rank #2, is another key pick from the broader industry. It delivered an earnings surprise of 372.9%, on average, in the trailing four quarters.

Headquartered in Raleigh, NC, Bandwidth operates as a Communications Platform-as-a-Service provider, offering avant-garde software application programming interfaces for voice and messaging services. It is the only application programming interface platform provider that owns a Tier 1 network with enhanced network capacity, primarily catering to business enterprises.

United States Cellular Corporation USM, carrying a Zacks Rank #2, is the fourth largest full-service wireless carrier in the United States. The company provides a range of wireless products and services, and a high-quality network to increase the competitiveness of local businesses and improve efficiency of government operations.

U.S. Cellular has taken concrete steps to accelerate subscriber additions and improve churn management. The company aims to offer the best wireless experience to customers by providing superior quality network and national coverage. It is well-positioned to support the investment required for network enhancements, including the deployment of 5G technology. The company is well-positioned for continued demand for broadband.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Cellular Corporation (USM) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Bandwidth Inc. (BAND) : Free Stock Analysis Report