Motorola (MSI) Tops Q4 Earnings Estimates on Record Revenues

Motorola Solutions, Inc. MSI reported strong fourth-quarter 2023 results, driven by the diligent execution of operational plans and healthy growth dynamics backed by solid order trends.

Both adjusted earnings and revenues surpassed the respective Zacks Consensus Estimate. In addition, Motorola generated record fourth-quarter revenues, which further exemplified the strength of its portfolio. The company expects this growth momentum to continue in the near term on robust demand patterns.

Net Earnings

On a GAAP basis, net earnings in the fourth quarter were $595 million or $3.47 per share compared with $589 million or $3.43 per share in the year-earlier quarter. The year-over-year improvement was primarily attributable to top-line growth.

Excluding non-recurring items, non-GAAP earnings in the quarter were $668 million or $3.90 per share compared with $618 million or $3.60 per share in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by 27 cents.

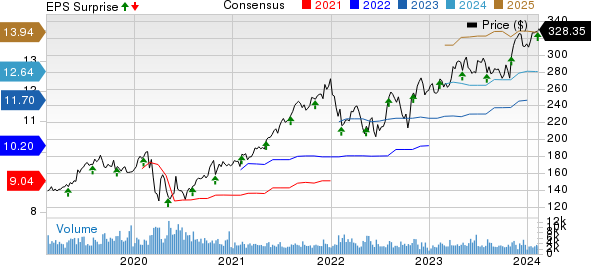

Motorola Solutions, Inc. Price, Consensus and EPS Surprise

Motorola Solutions, Inc. price-consensus-eps-surprise-chart | Motorola Solutions, Inc. Quote

For 2023, GAAP earnings improved to $1,709 million or $9.93 per share from $1,363 million or $7.93 per share in 2022. Non-GAAP earnings for 2023 were $2,057 million or $11.95 per share, up from $1,780 million or $10.36 per share a year ago.

Revenues

Quarterly net sales were record high at $2.85 billion, up 5.2% year over year, with solid sales in both segments across all regions driven by the strength of its business model and the value of its mission-critical integrated ecosystem. The company witnessed strong demand for video security, command center software and LMR (land mobile radio) services. The top line beat the consensus estimate of $2.81 billion. For 2023, revenues increased 9.5% year over year to $9.98 billion.

Region-wise, quarterly revenues were up 6.2% in North America to $2.02 billion due to growth in LMR, command center software and video security products. International revenues were up 3% to $832 million, with growth in video security products, LMR and command center software. Acquisitions contributed $17 million to revenues, while foreign exchange tailwinds were $16 million.

Segmental Performance

Net sales from Products and Systems Integration increased to $1.89 billion from $1.81 billion in the year-ago quarter, driven by higher demand for LMR and video security solutions. It also exceeded our estimates of $1.82 billion. The segment’s backlog was up $93 million to $5 billion, primarily due to high LMR demand in North America.

Net sales from Software and Services were up 6.9% to $958 million, with solid performance across command center software, LMR and video security services. However, the segment revenues missed our estimates of $990 million. The segment’s backlog decreased $181 million to $9.3 billion, primarily due to revenue recognition for the Airwave contract, partially offset by higher multi-year software and services contracts in North America and favorable currency impact.

Other Quarterly Details

GAAP operating earnings increased to $738 million from $692 million in the prior-year quarter, while non-GAAP operating earnings were up to $870 million from $822 million. The company ended the quarter with a backlog of $14.3 billion, down $88 million year over year.

Overall GAAP operating margin was 25.9%, up from 25.6%, while non-GAAP operating margin was 30.5% compared with 30.4% in the year-ago quarter. Non-GAAP operating earnings for Products and Systems Integration were up 10% to $567 million for a margin of 30%. Non-GAAP operating earnings for Software and Services were $303 million, down 2% year over year, for a non-GAAP operating margin of 31.6%.

Cash Flow and Liquidity

Motorola generated $1.25 billion in cash from operating activities in the reported quarter compared with an operating cash flow of $1.27 billion a year ago, bringing the respective tallies for 2023 and 2022 to $2.04 billion and $1.82 billion. Free cash flow in the fourth quarter was $1.16 billion. The company repurchased $117 million worth of stock during the fourth quarter. As of Dec 31, 2023, MSI had $1.71 billion of cash and cash equivalents with $4.71 billion of long-term debt compared with respective tallies of $1.33 billion and $6.01 billion in the prior-year period.

Guidance

With solid quarterly results and robust demand patterns, the company offered bullish guidance for 2024. Non-GAAP earnings for 2024 are currently expected in the $12.62-$12.72 per share range on revenue growth of 6%, with a rise in both segments on higher demand.

For first-quarter 2024, non-GAAP earnings are expected in the $2.50-$2.55 per share range on year-over-year revenue improvement of approximately 8% due to healthy demand trends.

Moving Forward

Motorola is poised to gain from disciplined capital deployment and a strong balance sheet position. The company expects strong demand across LMR products, the video security portfolio, services and software while benefiting from a solid foundation.

Motorola currently has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

Arista Networks, Inc. ANET, sporting a Zacks Rank #1, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 19.8% and delivered an earnings surprise of 12%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Headquartered in Wilmington, DE, InterDigital, Inc. IDCC is a pioneer in advanced mobile technologies that enable wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular as well as wireless 3G, 4G and IEEE 802-related products and networks.

This Zacks Rank #2 (Buy) stock has a long-term earnings growth expectation of 17.4% and has surged 75.3% in the past year. A well-established global footprint, diversified product portfolio and ability to penetrate different markets are key growth drivers for InterDigital. The addition of technologies related to sensors, user interface and video to its already strong portfolio of wireless technology solutions is likely to drive considerable value, given the massive size of the market it offers licensing technologies to.

Ubiquiti Inc. UI, carrying a Zacks Rank #2 at present, is a key pick in the broader industry. Headquartered in New York, it offers a comprehensive portfolio of networking products and solutions for service providers and enterprises at disruptive prices.

It boasts a proprietary network communication platform that is well-equipped to meet end-market customer needs. In addition, it is committed to reducing operational costs by using a self-sustaining mechanism for rapid product support and dissemination of information by leveraging the strength of the Ubiquiti Community.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report