Motorola (MSI) Unveils LTE-Enabled Superior Body-Worn Cameras

Motorola Solutions, Inc. MSI recently augmented its mobile video portfolio with the launch of LTE-enabled V500 body-worn cameras for improved safety and security of frontline officers. With critical real-time field intelligence to emergency response backed by LTE connectivity, the cameras facilitate security personnel to respond quickly and efficiently to any adverse situation.

The V500 body-worn cameras are designed to capture high-quality video from the wearer’s viewpoint with an intuitive recording function, delivering transparency with an extended battery life of up to 12 hours of operation. The device can be easily activated by the wearer without manual intervention when the equipment is unholstered.

In addition to live streaming facilities for enhanced situational awareness with 128GB storage capacity, it speeds up evidentiary workflows by enabling officers to tag footage from the camera and send it to the backend software immediately. When their shift is over, the remaining footage can be offloaded quickly over a gigabit ethernet connection to free up cameras for the next shift.

Motorola’s VideoManager evidence management software further helps to seamlessly upload and manage the recorded video. The body-worn cameras will enable security officers to record audio and video events with an optional pre- and post-recording capability for capturing every interaction from start to finish. It also seamlessly integrates with radio and in-car video systems, control room solutions and Holster Aware Bluetooth sensors, which can activate video recording and live-streaming if an officer draws a weapon.

Riding on such state-of-the-art products, Motorola expects to record strong demand across video security and services, land mobile radio products and related software while benefiting from a solid foundation. These systems drive the demand for additional device sales and promote software upgrades and infrastructure expansion. The comprehensive suite of services ensures continuity and reduces risks related to critical communications operations.

Motorola intends to fortify its position in the public safety domain by entering into alliances with other players in the ecosystem. It remains poised to benefit from organic growth and acquisition initiatives, disciplined capital deployment and a favorable global macroeconomic environment. Its competitive position and an attractive portfolio for a large addressable market augur well for long-term growth.

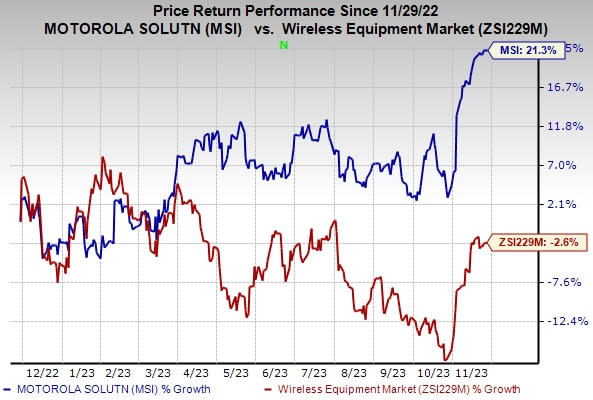

The stock has gained 21.3% over the past year against the industry’s decline of 2.6%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Motorola currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Comtech Telecommunications Corp. CMTL, carrying a Zacks Rank #2 (Buy), is a solid pick. Headquartered in Melville, NY, the company is a leading global provider of next-generation 911 emergency systems and secure wireless communications technologies to commercial and government customers.

Comtech’s key satellite earth station modems incorporate forward error correction and bandwidth compression technologies, which enable its customers to optimize their satellite networks by either reducing their satellite transponder lease costs or increasing data.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 20.4% and delivered an earnings surprise of 12%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

AudioCodes Ltd. AUDC sports a Zacks Rank #1. It has a long-term earnings growth expectation of 24.8% and delivered an earnings surprise of 14%, on average, in the trailing four quarters.

Headquartered in Lod, Israel, AudioCodes offers advanced communications software, products, and productivity solutions for the digital workplace. It provides a broad range of innovative products, solutions and services that are used by large multi-national enterprises and leading tier-1 operators around the world.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report