Motorola Solutions Inc (MSI) Posts Record Q4 and Full-Year Sales, EPS Growth

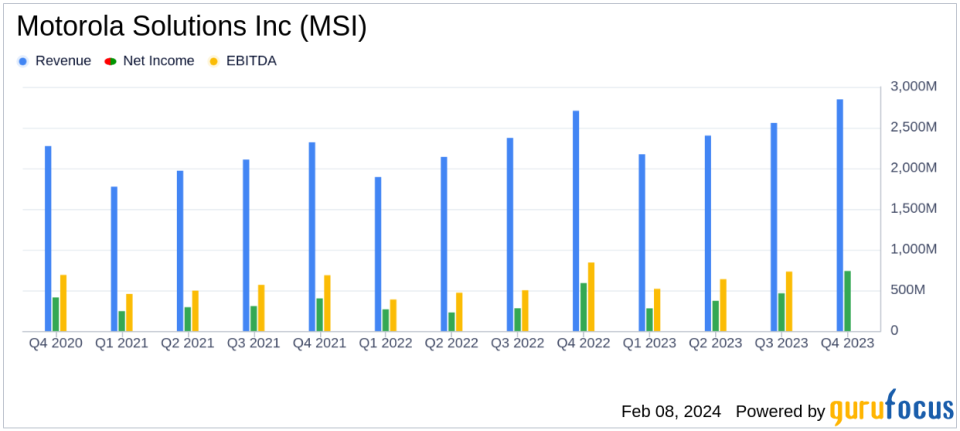

Revenue Growth: Q4 sales increased by 5% to $2.8 billion, with a full-year rise of 10% to nearly $10 billion.

Earnings Per Share: GAAP EPS for Q4 climbed 1% to $3.47, with a full-year surge of 25% to $9.93.

Operating Cash Flow: Q4 operating cash flow reached $1.2 billion, contributing to a 12% full-year increase to $2.0 billion.

Backlog: Ending backlog stood at $14.3 billion, signaling strong future revenue potential.

Acquisitions and Share Repurchases: MSI acquired IPVideo and announced a $2.0 billion increase in share repurchase authorization.

On February 8, 2024, Motorola Solutions Inc (NYSE:MSI) released its 8-K filing, detailing a robust financial performance for the fourth quarter and the full year of 2023. The company, a leader in communications and analytics for public safety and commercial customers, has reported record-breaking figures, reflecting strong demand for its products and services.

Motorola Solutions' success is underpinned by its extensive portfolio, which includes land mobile radios, radio network infrastructure, surveillance equipment, and dispatch software. With a customer base that spans over 100 countries and includes government agencies, schools, and private businesses, MSI's global reach and diversified offerings have contributed to its financial achievements.

Financial Performance and Challenges

MSI's fourth-quarter sales saw a 5% increase to $2.8 billion, with the Products and Systems Integration segment growing by 4% and the Software and Services segment by 7%. Full-year sales reached nearly $10 billion, a 10% increase from the previous year. The company's GAAP earnings per share (EPS) for the fourth quarter was $3.47, a 1% increase, while the full-year EPS jumped by 25% to $9.93. Non-GAAP EPS also saw an uptick, with an 8% rise in Q4 to $3.90 and a 15% increase for the full year to $11.95.

The company's operating cash flow for the fourth quarter was $1.2 billion, contributing to a full-year total of $2.0 billion, marking a 12% increase. This strong cash flow performance is crucial for MSI as it supports ongoing investments in innovation and strategic acquisitions, such as the recent purchase of IPVideo, creator of the HALO Smart Sensor.

Despite these achievements, MSI faces challenges, including the imposition of a price control on Airwave by the UK's Competition and Markets Authority (CMA), which has led to a reduction in backlog by $777 million. Additionally, the company is navigating a complex macroeconomic environment, with efforts to improve its supplier network and manage supply chain risks.

Key Financial Metrics

Motorola Solutions' financial health can be further assessed through key metrics from its income statement, balance sheet, and cash flow statement. The company's GAAP operating margin improved slightly to 25.9% in Q4, while non-GAAP operating margin remained stable at 30.5%. The GAAP effective tax rate increased to 15.7% in Q4, driven by lower benefits from a partial release of a valuation allowance in the prior year.

MSI's capital allocation strategy included $146 million in dividends, $117 million in stock repurchases, and $81 million in capital expenditures during the quarter. The company's backlog, a key indicator of future revenue, stood at $14.3 billion at year-end, despite a slight decrease from the previous year.

"2023 was an exceptional year, with record sales, earnings and operating cash flow," said Greg Brown, Chairman and CEO of Motorola Solutions. "The strong growth we achieved reflects the continued robust demand for our safety and security solutions that help protect people, property and places. The momentum of our business is strong and Im very pleased with our position for another year of revenue and earnings growth in 2024."

Looking Ahead

For the first quarter of 2024, MSI expects revenue growth of approximately 8% and non-GAAP earnings per share in the range of $2.50 to $2.55. For the full year, the company anticipates revenue growth of about 6% and non-GAAP EPS between $12.62 and $12.72. These projections underscore MSI's confidence in its continued growth trajectory and its ability to navigate the challenges ahead.

Motorola Solutions' strong financial performance, driven by increased demand for its safety and security solutions, positions the company well for sustained growth. Investors and potential GuruFocus.com members can find more detailed information and analysis on MSI's earnings and financial health at GuruFocus.com.

Explore the complete 8-K earnings release (here) from Motorola Solutions Inc for further details.

This article first appeared on GuruFocus.