New Mountain Finance Corp Reports Steady Earnings Amid Economic Headwinds

Net Investment Income (NII): Reported at $0.40 per share for Q4 2023.

Net Asset Value (NAV): Slight decline to $12.87 per share as of December 31, 2023, from $13.06 on September 30, 2023.

Total Investment Portfolio: Valued at approximately $3.03 billion across 111 portfolio companies.

Regular and Supplemental Distributions: Declared at $0.32 and $0.04 per share, respectively, for Q1 2024.

Statutory Debt/Equity Ratio: Stood at 1.14x, reflecting a stable leverage position.

Portfolio Risk Rating: Majority of investments rated Green, indicating performance in line with or above expectations.

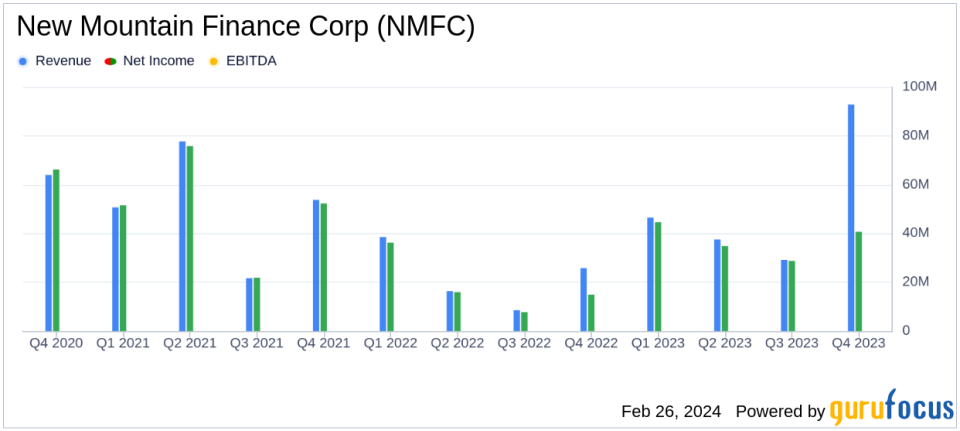

New Mountain Finance Corp (NASDAQ:NMFC), a closed-end, non-diversified management investment company, released its 8-K filing on February 26, 2024, detailing its financial results for the quarter and year ended December 31, 2023. NMFC's investment strategy focuses on generating current income and capital appreciation through debt securities at various levels of the capital structure, as well as direct equity investments in private companies.

Financial Performance and Challenges

NMFC reported a net investment income of $0.40 per weighted average share for the fourth quarter, with a net asset value per share of $12.87. This represents a slight decline from the previous quarter's NAV of $13.06, excluding the impact of a $0.10 special dividend paid at the end of 2023. The company's investment portfolio was valued at $3.03 billion across 111 portfolio companies, with a weighted average yield to maturity at cost of approximately 10.9%. Despite the economic headwinds, NMFC's disciplined investment approach in defensive growth sectors has allowed it to maintain a steady performance.

However, the company did face challenges, including a competitive market for investment opportunities and the potential for economic downturns affecting portfolio companies. These challenges underscore the importance of NMFC's defensive growth strategy and its focus on sectors that perform well across economic cycles.

Financial Achievements and Industry Significance

NMFC's financial achievements, including consistent earnings growth and the ability to outpace its regular dividend for the fourth consecutive quarter, are significant for an asset management company. These achievements demonstrate the company's ability to generate stable returns for shareholders, which is particularly important in the asset management industry where investor confidence is critical.

The company's statutory debt to equity ratio of 1.14x indicates a prudent use of leverage, which is important for maintaining financial stability and flexibility. Additionally, the majority of NMFC's investments were rated Green in its Risk Rating system, suggesting that most portfolio companies are performing in line with or above expectations, which is a positive indicator of portfolio health.

Key Financial Metrics and Commentary

Selected key financial metrics from NMFC's earnings report include:

"Our fourth quarter results reflect another successful quarter for 2023," said Steven B. Klinsky, NMFC Chairman. "New Mountain continues to benefit from our disciplined, defensive growth strategy that is focused on end markets that perform well in all economic cycles."

John R. Kline, CEO, commented, "New Mountain closed out the fourth quarter with year-over-year earnings growth, outpacing its regular dividend for the fourth consecutive quarter. Additionally, NMFC distributed a $0.10 special dividend at the end of 2023 as a result of our teams ability to monetize the Haven Midstream equity investment. Our focus on defensive growth sectors of the economy remains a competitive advantage, and we believe NMFC remains well positioned to execute while continuing to deliver strong and stable dividends to our shareholders."

Analysis of NMFC's Performance

NMFC's performance in the fourth quarter and throughout 2023 demonstrates resilience in a challenging economic environment. The company's focus on defensive growth sectors and disciplined investment approach have contributed to its ability to maintain stable dividends and a strong portfolio. While the slight decline in NAV per share is a point of attention, the overall health of the portfolio, as evidenced by the Risk Rating and the statutory debt to equity ratio, suggests that NMFC is well-positioned to navigate future market conditions.

For more detailed information on NMFC's financial results, please refer to the full earnings release and the supplemental investor presentation available on the company's website.

Investors interested in the asset management sector and NMFC's strategic approach to investment may find the company's steady performance and disciplined strategy appealing, especially in the face of broader market uncertainty.

Explore the complete 8-K earnings release (here) from New Mountain Finance Corp for further details.

This article first appeared on GuruFocus.