MP Materials Corp Reports Mixed Results Amid Market Headwinds

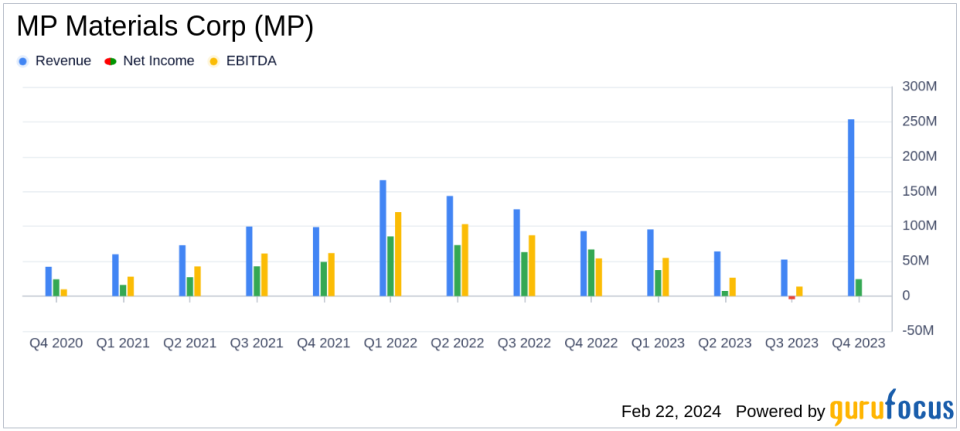

Revenue: MP Materials Corp reported a 52% year-over-year decline in revenue for the full year 2023.

Net Income: Net income for the year decreased by 92% compared to 2022.

Adjusted EBITDA: The company saw a 74% drop in Adjusted EBITDA for the full year.

Production: Despite the downturn, MP Materials maintained production, exceeding 40,000 metric tons of REO for the third consecutive year.

Expansion: The company commenced production of separated rare earth products and began trial production of NdPr metal.

Financial Position: MP Materials ended 2023 with $997.8 million in cash, cash equivalents, and short-term investments.

On February 22, 2024, MP Materials Corp (NYSE:MP) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, which is the largest producer of rare earth materials in the Western Hemisphere and operates the Mountain Pass Rare Earth Mine and Processing Facility, faced significant challenges in the market, resulting in a substantial decline in revenue and profitability.

For the full year 2023, MP Materials reported revenue of $253.4 million, a sharp decrease from the previous year's $527.5 million. Net income plummeted to $24.3 million, down from $289 million in 2022. Adjusted EBITDA also fell to $102.5 million, a 74% decrease from the prior year's $388.6 million. These declines were attributed to a combination of lower realized sales prices for rare earth oxide (REO) in concentrate, a softer pricing environment driven by reduced growth in magnetic products demand, and a transition to midstream production of neodymium-praseodymium (NdPr) oxide.

Despite the financial downturn, MP Materials achieved several operational milestones. The company produced 41,557 metric tons of REO in concentrate and commenced the production of separated rare earth products, including 200 metric tons of NdPr oxide. Additionally, the company began trial production of NdPr metal and secured significant NdPr oxide-to-metal tolling capacity, which is expected to expand midstream sales opportunities.

MP Materials' financial achievements in a challenging market underscore the importance of its strategic initiatives, including the expansion of its downstream capabilities. The company's ability to maintain production levels and advance its operations positions it to potentially benefit from future market improvements.

The company's balance sheet remains strong, with nearly $1 billion in cash, cash equivalents, and short-term investments. This financial position provides MP Materials with the flexibility to navigate the current market conditions and continue investing in strategic growth initiatives.

James Litinsky, Chairman and CEO of MP Materials, commented on the company's performance, stating:

MP executed diligently throughout 2023 despite formidable market headwinds. We exceeded 40,000 tons of REO production for the third consecutive year, achieved first production and sales of NdPr, and added substantial depth to our team and capability set."

Looking ahead, MP Materials is focused on its conservative approach to capital deployment while seeking to create significant shareholder value through the cycle. The company's expansion into metal and alloy production equipment in Fort Worth, Texas, and the commencement of NdPr metal trial production are key steps in its strategy to provide a full supply chain solution from materials to magnetics.

Value investors may find MP Materials' commitment to operational efficiency and strategic growth initiatives appealing, despite the current market challenges. The company's focus on maintaining a strong balance sheet and advancing its position in the rare earth materials market could position it well for long-term success.

For more detailed financial information and operational highlights, investors are encouraged to review the full 8-K filing and consider the potential opportunities with MP Materials Corp.

Explore the complete 8-K earnings release (here) from MP Materials Corp for further details.

This article first appeared on GuruFocus.