MP Materials (MP) to Report Q3 Earnings: Here's What to Expect

MP Materials MP is scheduled to report third-quarter 2023 results after the closing bell on Nov 2.

Q3 Estimates

The Zacks Consensus Estimate for third-quarter revenues is pegged at $50.7 million, suggesting a 59% year-over-year decline. The consensus mark for third-quarter earnings is pegged at break-even earnings. The company had reported earnings per share of 36 cents in the third quarter of 2022. The consensus estimate for earnings for the to-be-reported quarter has been unchanged over the past 30 days.

Q2 Results

In the last reported quarter, MP Materials reported a year-over-year declines in revenues and earnings. The company, however, beat the Zacks Consensus Estimate on both metrics.

MP Material’s earnings have outpaced the consensus estimate in each of the trailing four quarters, the average surprise being 72.7%.

MP Materials Corp. Price and EPS Surprise

MP Materials Corp. price-eps-surprise | MP Materials Corp. Quote

Factors to Note

In August 2023, the company reported that it had begun producing refined rare earth products at Mountain Pass, an important milestone for the company. It had stated that it expects to report neodymium-praseodymium oxide shipments in the third quarter of 2023.

In the second quarter of 2023, rare earth oxide (REO) sales and production volumes were 10,863 and 10,271 MT, respectively. Production and sales volumes were up 5% and 3% compared with last year’s quarter, respectively.

The company had earlier stated that as it is currently engaged in commissioning activities for Stage II, significant volumes of REO produced from Stage I operations will be retained for separation rather than being sold as concentrate.

MP’s sales volumes are thus expected to have been impacted by this in the to-be-reported quarter.

Revenues in the second quarter of 2023 bore the impact of a 55% slump in the realized price of REO in concentrate due to a softer pricing environment for rare earth products as compared with the prior-year period when prices had peaked.

During the quarter, rare earth prices were lower compared with the very high levels seen last year. Prices have, however, moved up, near the end of the third quarter as Chinese quotas for Heavy Rare Earths remained flat and exports from Myanmar to China continued to be limited.

Rare earth mines in Myanmar were instructed to cease operations on September 4 for scheduled inspections. They remain suspended with no notification regarding when they might resume their activities. Malaysia plans to ban the export of rare earth raw materials, though the implementation date has not been specified. China has also imposed restrictions on the export of certain metals crucial to the semiconductor industry, raising concerns about potential limitations on the export of other critical minerals, including rare earths.

Higher raw material and logistic costs are likely to have weighed on MP’s earnings in the third quarter. The company has been incurring higher production costs as it is expanding its workforce and preparing its facilities to support separated rare earth (Stage II) production. Other general and administrative costs, as well as advanced projects and development costs, are also anticipated to have dented margins.

What Our Zacks Model Indicates

Our proven model does not conclusively predict an earnings beat for MP Materials this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat.

You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for MP Materials is 0.00%.

Zacks Rank: MP currently carries a Zacks Rank of 3.

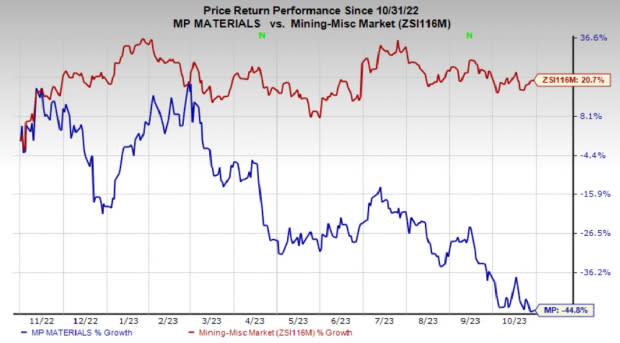

Price Performance

MP Materials’ shares have fallen 28.5% in the past year against the industry’s 8.4% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some stocks with the right combination of elements to post an earnings beat in their upcoming releases.

Kinross Gold Corporation KGC, scheduled to release third-quarter earnings on Nov 8, has an Earnings ESP of +2.96% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Kinross Gold’s earnings for the third quarter is pegged at 10 cents per share. The company has an average trailing four-quarter earnings surprise of 31.7%.

CF Industries CF, expected to release earnings on Nov 1, has an Earnings ESP of +4.79% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CF Industries’ earnings for the third quarter is pegged at 94 cents per share. CF has an average trailing four-quarter earnings surprise of 4.8%.

Innospec IOSP, scheduled to release earnings on Nov 7, currently has an Earnings ESP of +1.73% and a Zacks Rank of 3.

The Zacks Consensus Estimate for IOSP’s earnings for the third quarter is pegged at $1.45 per share. The company has an average trailing four-quarter earnings surprise of 7.2%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

MP Materials Corp. (MP) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report