Will MP Materials (MP) Retain Its Earnings Beat Streak in Q4?

MP Materials Corp. MP is scheduled to report fourth-quarter 2021 results after the closing bell on Feb 24.

Q4 Estimates

The Zacks Consensus Estimate for fourth-quarter revenues is currently pegged at $89.7 million, suggesting a 113% year-over-year growth. The consensus mark for earnings stands at 21 cents per share. Compared with earnings per share of 18 cents reported in the fourth quarter of 2020, the estimate indicates an improvement of 16.7%. The earnings estimate for the to-be-reported quarter has remained unchanged over the past 30 days.

Q3 Results

In the last reported quarter, MP Materials reported year-over-year improvement in both revenues and earnings. Both the metrics beat the Zacks Consensus Estimate. MP Material’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 33.6%.

MP Materials Corp. Price and EPS Surprise

MP Materials Corp. price-eps-surprise | MP Materials Corp. Quote

Factors to Note

The accelerating global transformation toward electrification and decarbonization has been creating strong demand for critical rare earth materials. The company has been implementing efficiency improvements in the processing of rare earth materials, which has resulted in significantly higher production of rare earth oxide (REO) starting in the second half of 2019. In the third quarter of 2021, MP Materials produced 11,998 metric tons of contained REO in concentrate, up 18% year over year due to a modest improvement in the efficiency of processing operations including higher recoveries, mill feed rates and production hours. REO sales volume surged 36% year over year to 12,824 Mt in the third quarter. This trend is expected to have continued in the fourth quarter courtesy of the efficiency improvement efforts of the company.

Realized sales price of rare earth oxide is expected to have been higher in the fourth quarter due to elevated market prices supported by strong demand and tight supply. Higher sales volume and prices may have contributed to the company’s fourth-quarter performance.

Higher raw material costs and COVID-19 impacted logistics costs witnessed through the fourth quarter might have weighed on margins. Nevertheless, per unit production costs owing to continued operational efficiencies, benefits from higher sales volumes and increased realized pricing driven by higher market prices may have offset some of this impact on the company’s bottom-line performance in the quarter to be reported.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for MP Materials this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for MP Materials is +21.88%.

Zacks Rank: The company currently has a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

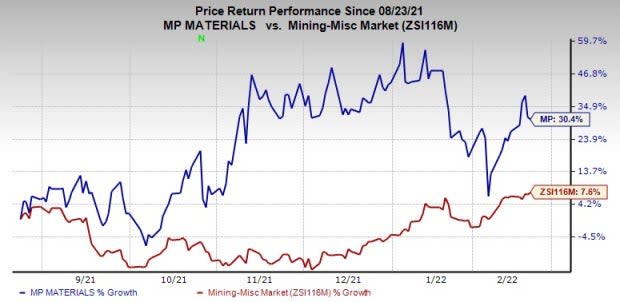

Price Performance

Image Source: Zacks Investment Research

MP Materials’ shares have gained 30.4% in the past year compared with the industry’s rally of 7.6%.

Other Stocks Poised to Beat Estimates

Here are some other companies worth considering as our model shows that these too have the right combination of elements to beat on earnings this season:

Vale S.A VALE currently has an Earnings ESP of +11.77% and a Zacks Rank of 1. VALE is scheduled to report fourth-quarter 2021 results on Feb 24. The Zacks Consensus Estimate for Vale’s quarterly revenues is pegged at $12.98 billion, indicating a decline of 12% from the prior-year quarter.

The Zacks Consensus Estimate for Vale’s bottom line has moved up 15% in the past 30 days to 85 cents per share. The consensus mark for earnings suggests a decrease of 22% from the year-ago reported figure. VALE has a trailing four-quarter earnings surprise of 11.96%, on average.

Newmont Mining NEM currently has an Earnings ESP of +3.59% and a Zacks Rank #3. NEM is scheduled to report fourth-quarter fiscal 2021 numbers on Feb 24, before the market opens. The Zacks Consensus Estimate for the company’s quarterly revenues is pegged at $3.34 billion, which indicates an decline of 1.2% from the prior-year quarter.

The Zacks Consensus Estimate for earnings per share for the fourth quarter is currently pegged at 76 cents, which suggests a fall of 28% from the year-ago quarter’s reported figure. The estimate has moved up 1% over the past 30 days. NEM has a trailing four-quarter earnings surprise of 0.99%, on average.

National Steel SID currently has an Earnings ESP of +3.57% and a Zacks Rank of 3. SID is scheduled to report fourth-quarter fiscal 2021 numbers on Mar 9. The Zacks Consensus Estimate for its quarterly revenues is pegged at $2.11 billion, which suggests growth of 16% from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for National Steel’s quarterly earnings per share of 28 cents suggests a 46% plunge from the year-ago period’s reported number. The estimate has been revised 15% downward over the past 30 days. SID has a trailing four-quarter negative earnings surprise of 10.69%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

National Steel Company (SID) : Free Stock Analysis Report

VALE S.A. (VALE) : Free Stock Analysis Report

Newmont Corporation (NEM) : Free Stock Analysis Report

MP Materials Corp. (MP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research