MPLX Beats Q4 Earnings Estimates, Hikes '24 Capex Budget

MPLX LP MPLX reported fourth-quarter earnings of $1.10 per unit, which beat the Zacks Consensus estimate of 95 cents. The bottom line also increased from the year-ago quarter’s 78 cents.

Total quarterly revenues of $2.97 billion surpassed the Zacks Consensus Estimate of $2.94 million and increased from the prior-year quarter’s $2.66 billion.

Strong quarterly results were primarily driven by higher contributions from both segments. A decline in total costs and expenses also contributed to the solid quarterly performance.

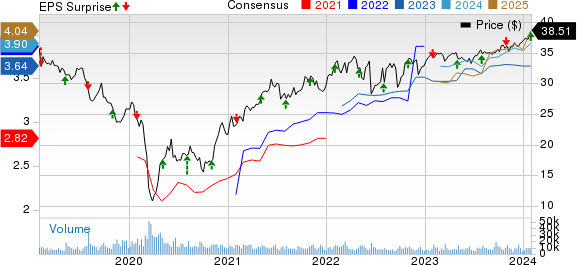

MPLX LP Price, Consensus and EPS Surprise

MPLX LP price-consensus-eps-surprise-chart | MPLX LP Quote

Segmental Highlights

MPLX’s adjusted EBITDA from the Logistics and Storage segment increased to $1.09 billion from $979 million a year ago. Increased rates and growth in throughput aided the segment. Total pipeline throughputs in the fourth quarter were 5.8 million barrels per day, up 3% from the year-ago period.

Adjusted EBITDA from the Gathering and Processing segment totaled $534 million, up from $475 million in the prior-year quarter. The segment was favored by increased gathering and processing throughput volumes. Gathering throughput volumes averaged 6.3 billion cubic feet per day (Bcf/d), implying a marginal 1% improvement from the year-ago period’s level. Natural gas processed volumes of 9.4 Bcf/d marked a 9% increase year over year.

Costs and Expenses

In fourth-quarter 2023, MPLX’s total costs and expenses were $1.59 billion, down from the year-ago quarter’s $1.6 billion. The decline in total costs and expenses can be attributed to lower operating expenses (including purchased product costs).

Cash Flow

Distributable cash flow in the quarter totaled $1.38 billion, providing 1.6X distribution coverage, up from $1.27 billion in the year-ago quarter.

Adjusted free cash flow in the quarter under review declined to $964 million from $1.09 billion in the corresponding period of 2022.

Balance Sheet

As of Dec 31, 2023, the partnership’s cash and cash equivalents were $1.05 billion. Its total debt amounted to $20.4 billion.

Outlook

For 2024, MPLX stated its capital spending outlook of $1.1 billion, which includes $950 million of growth capital and $150 million of maintenance capital. The metric indicates an increase from the $838 million reported in 2023.

Zacks Rank & Stocks to Consider

MPLX currently carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector may look at some better-ranked companies mentioned below. The three companies presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Vaalco Energy EGY is an independent energy company principally engaged in the acquisition, exploration, development and production of crude oil and natural gas.

The Zacks Consensus Estimate for EGY’s 2024 EPS is pegged at $1.49. It has witnessed upward earnings estimate revisions for 2024 in the past 60 days. EGY’s earnings for 2024 are expected to surge 325.7% year over year.

Subsea 7 S.A. SUBCY helps build underwater oil and gas fields. It is a top player in the Oil and Gas Equipment and Services market, which is expected to grow as oil and gas production moves further offshore.

The Zacks Consensus Estimate for SUBCY’s 2024 EPS is pegged at 89 cents. It has witnessed upward earnings estimate revisions for 2024 in the past 30 days. The company’s earnings for 2024 are expected to soar 242.3% year over year.

Oceaneering International, Inc. OII is one of the leading suppliers of offshore equipment and technology solutions to the energy industry.

The Zacks Consensus Estimate for OII’s 2024 EPS is pegged at $1.52. It has a Zacks Style Score of A for Growth and B for Value. OII’s earnings for 2024 are expected to surge 76.4% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

Vaalco Energy Inc (EGY) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report

Subsea 7 SA (SUBCY) : Free Stock Analysis Report