MPLX LP Reports Solid Growth in Fourth-Quarter and Full-Year 2023 Financial Results

Net Income: $1.1 billion for Q4 and $3.9 billion for the full year, reflecting growth from the previous year.

Adjusted EBITDA: Increased to $1.6 billion in Q4 and $6.3 billion for the full year, demonstrating strong operational performance.

Distributable Cash Flow: Reached $1.4 billion in Q4 and $5.3 billion for the full year, supporting a 10% increase in quarterly distributions.

Capital Expenditure Outlook: Set at $1.1 billion for 2024, focusing on growth and maintenance projects.

Leverage Ratio: Maintained at 3.3x, indicating a stable financial position.

On January 30, 2024, MPLX LP (NYSE:MPLX) released its 8-K filing, detailing the financial results for the fourth quarter and the full year of 2023. MPLX, a large-cap master limited partnership, is known for its diversified midstream energy infrastructure and logistics assets, including pipelines, storage facilities, and processing plants predominantly in the Appalachian region.

Financial Performance Highlights

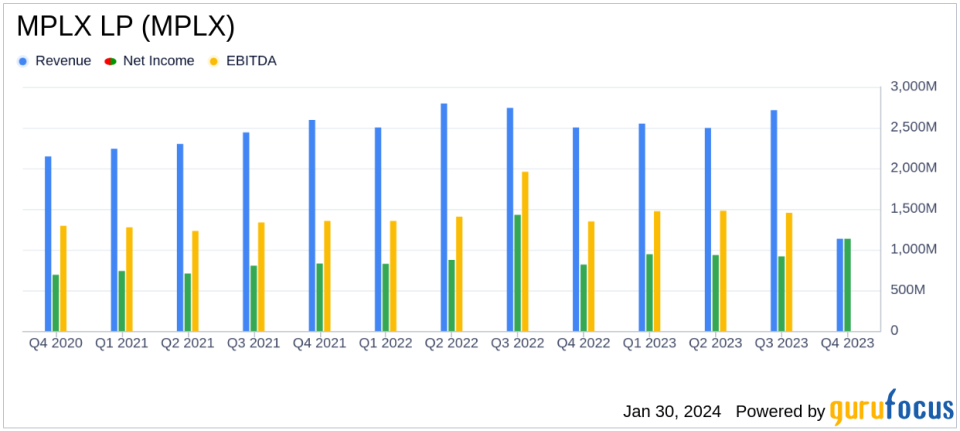

MPLX reported a net income attributable to MPLX of $1.1 billion for the fourth quarter, a significant increase from $816 million in the same quarter of the previous year. The full-year net income reached $3.9 billion, slightly below the $3.944 billion reported in 2022. The company's adjusted EBITDA for the fourth quarter was $1.6 billion, up from $1.4 billion in Q4 2022, while the full-year adjusted EBITDA grew to $6.3 billion from $5.8 billion in the previous year.

The distributable cash flow for the fourth quarter was $1.4 billion, with a full-year total of $5.3 billion, up from $4.981 billion in 2022. This robust cash flow enabled MPLX to return $3.3 billion of capital to unitholders, marking a 10% increase in its quarterly distribution for the second consecutive year.

Operational and Strategic Developments

The Logistics and Storage (L&S) segment saw a $110 million increase in adjusted EBITDA for Q4, driven by higher rates and throughputs. Pipeline throughputs averaged 5.8 million barrels per day (bpd), a 3% increase from Q4 2022. The Gathering and Processing (G&P) segment also reported growth, with adjusted EBITDA increasing by $59 million due to higher gathering and processing volumes.

Strategically, MPLX is advancing its Permian growth strategy, having acquired the remaining interest in a G&P joint venture for approximately $270 million. The 2024 capital spending outlook is focused on expanding and de-bottlenecking existing L&S assets and increasing G&P capacity to meet customer demand.

Financial Position and Liquidity

As of December 31, 2023, MPLX had $1.0 billion in cash and $3.5 billion available through credit facilities and an intercompany loan agreement. The leverage ratio was maintained at 3.3x, indicating a stable financial position.

Michael J. Hennigan, MPLX chairman, president, and chief executive officer, commented on the results:

"In 2023, strong operational performance and contributions from organic growth projects drove nearly 9% growth in MPLXs adjusted EBITDA and over 7% growth in distributable cash flow. This enabled MPLX to return $3.3 billion of capital to unitholders, which included a 10% increase in its quarterly distribution for the second year in a row."

For more detailed information on MPLX LP's financial results, including income statements, balance sheets, and cash flow statements, interested parties are encouraged to review the full 8-K filing.

MPLX's continued focus on operational efficiency and strategic growth initiatives, particularly in the Permian and Marcellus basins, positions the company well for sustained financial performance. The company's ability to generate strong distributable cash flow and maintain a stable leverage ratio underscores its commitment to delivering value to unitholders and maintaining a robust financial foundation.

Investors and stakeholders looking for value in the Oil & Gas industry may find MPLX's consistent performance and strategic investments in infrastructure and logistics assets to be of particular interest. The company's financial achievements and operational advancements reflect its resilience in a dynamic energy market and its potential for continued growth.

Explore the complete 8-K earnings release (here) from MPLX LP for further details.

This article first appeared on GuruFocus.