Mr. Cooper (COOP) Prolongs Tender Offer for Home Point Buyout

Mr. Cooper Group Inc. COOP extended the deadline of the tender offer to buy Home Point Capital Inc.’s HMPT all outstanding shares. The deal was earlier scheduled to close on Jun 27.

As of the previous closing date, 98.2%, or around 136 million shares of the acquiree had been validly tendered. However, some approval and regulatory conditions are yet to be met before the deal concludes. Hence, Mr. Cooper’s subsidiary, Heisman Merger Sub, has extended the deadline to Jul 21 to allow more time for fulfilling the required conditions.

No action is required from the shareholders following the extension, who have already tendered their shares. The planned acquisition was first announced in May when Mr. Cooper agreed to purchase Home Point Capital’s all outstanding shares for around $324 million in cash.

Per the previous announcement, COOP was expected to assume Home Point’s outstanding 5% senior notes, which are due in February 2026. The company expects the notes to serve as a low-cost funding source. Following the close of the deal, Mr. Cooper intends to provide a friction-free experience to Home Point’s high-valued borrowers with high FICO scores.

The acquisition is expected to bump up COOP’s customer base, which was at 4.1 million in the first quarter. It will also likely enhance the acquirer’s servicing portfolio with Home Point’s $84 billion portfolio. In the first quarter, Mr. Cooper’s Servicing unit generated an adjusted pre-tax profit of $157 million.

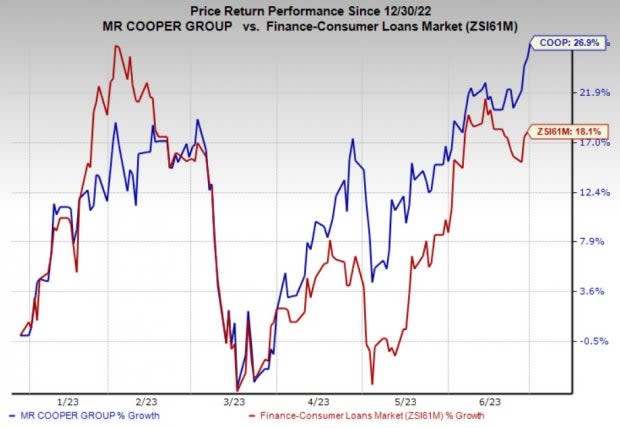

Price Performances

Shares of the company have jumped 26.9% in the year-to-date period, outperforming the 18.1% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Mr. Cooper currently has a Zacks Rank #3 (Hold). Some better-ranked stocks from the broader finance space are World Acceptance Corporation WRLD and Old Republic International Corporation ORI, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Based in Greenville, SC, World Acceptance is a finance company providing personal loan solutions and tax preparation, as well as filing services. The Zacks Consensus Estimate for WRLD’s current year earnings indicates a more than 200% year-over-year increase.

Headquartered in Chicago, Old Republic International has an insurance underwriting business and related services. The Zacks Consensus Estimate for ORI’s 2023 earnings has improved 9.1% over the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

World Acceptance Corporation (WRLD) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

MR. COOPER GROUP INC (COOP) : Free Stock Analysis Report

Home Point Capital Inc. (HMPT) : Free Stock Analysis Report