Mr. Cooper Group Inc (COOP) Reports Growth Amid Market Challenges in Q4 2023

Net Income: Reported $46 million, reflecting a 4.3% return on common equity (ROCE).

Servicing Portfolio: Grew by 14% year-over-year to $992 billion.

Share Repurchase: 1.3 million shares repurchased for $72 million.

Senior Notes Issuance: $1 billion senior notes issued post-quarter with a 7.125% coupon.

Book Value: Increased to $66.29 per share, with tangible book value at $63.67 per share.

Operational Performance: Strong focus and execution led to record servicing profits.

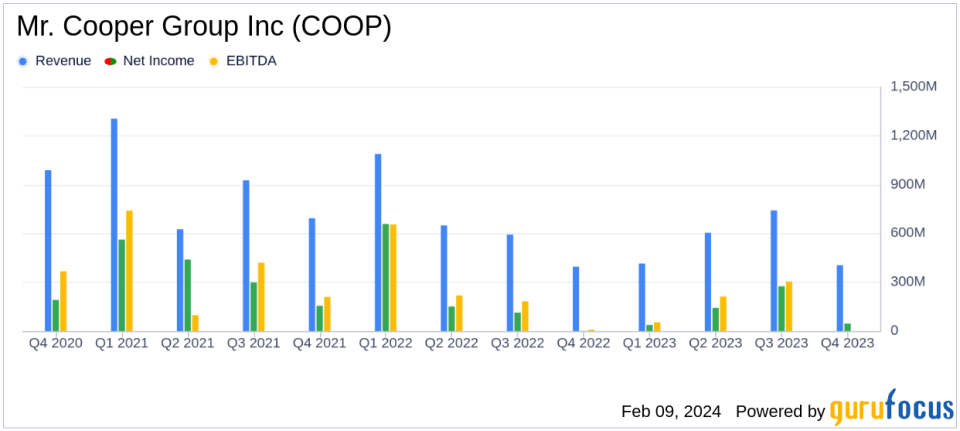

On February 9, 2024, Mr. Cooper Group Inc (NASDAQ:COOP) released its 8-K filing, detailing the financial outcomes for the fourth quarter of 2023. The company, a prominent home loan servicer, reported a net income of $46 million, which includes a mark-to-market loss of $41 million. This translates to a return on common equity (ROCE) of 4.3% and an operating return on tangible common equity (ROTCE) of 11.1%. The book value per share and tangible book value per share have increased to $66.29 and $63.67, respectively.

Mr. Cooper Group Inc operates through two segments: Servicing, which manages mortgage servicing rights and customer service operations, and Originations, which focuses on residential mortgage loan creation and acquisition. The Servicing segment reported a pretax income of $184 million, including a mark-to-market of $41 million, and ended the quarter with a servicing portfolio of $992 billion. The Originations segment earned a pretax income of $9 million.

Financial Highlights and Challenges

The company's servicing portfolio experienced significant growth, reaching nearly $1 trillion, a strategic target for Mr. Cooper. Despite the challenges posed by rising interest rates, the company's operational performance has been strong, with record servicing profits and agile performance in the Originations segment. The company also repurchased 1.3 million shares of common stock for $72 million, demonstrating confidence in its financial stability.

However, the company faced headwinds, including a $27 million impact related to a previously disclosed cyber event and other adjustments. These challenges highlight the importance of robust cybersecurity measures and the potential financial impact of such events.

Income Statement and Balance Sheet Summary

Mr. Cooper Group Inc's income statement reflects a net income of $46 million on total revenues of $404 million for the fourth quarter. The balance sheet shows total assets of $14.196 billion, with cash and cash equivalents at $571 million. The company's liabilities include $3.151 billion in unsecured senior notes and $4.302 billion in advance and warehouse facilities.

Chairman and CEO Jay Bray commented, "The fourth quarter closed out an exceptionally productive year for Mr. Cooper, with steadily rising return on equity throughout the year and very substantial growth which puts us on the cusp of achieving our $1 trillion portfolio strategic target."

Vice Chairman Chris Marshall added, "Operational performance this year has benefited from strong focus and vigorous execution. Accomplishments include record servicing profits and very agile performance by our originations unit despite headwinds from rising interest rates."

Analysis of Performance

Mr. Cooper Group Inc's performance in the fourth quarter demonstrates resilience in a challenging market environment. The growth of the servicing portfolio and the increase in book value per share are positive indicators for investors. The company's proactive measures, such as share repurchases and the issuance of senior notes, also suggest a strategic approach to capital management and a commitment to shareholder value.

For detailed financial tables and further information, investors and stakeholders are encouraged to review the full 8-K filing.

Investor Contact: Kenneth Posner, SVP Strategic Planning and Investor Relations (469) 426-3633 Shareholders@mrcooper.com

Media Contact: Christen Reyenga, VP Corporate Communications MediaRelations@mrcooper.com

Explore the complete 8-K earnings release (here) from Mr. Cooper Group Inc for further details.

This article first appeared on GuruFocus.