MRC Global Inc. (MRC) Reports Mixed 2023 Financial Results Amidst Market Challenges

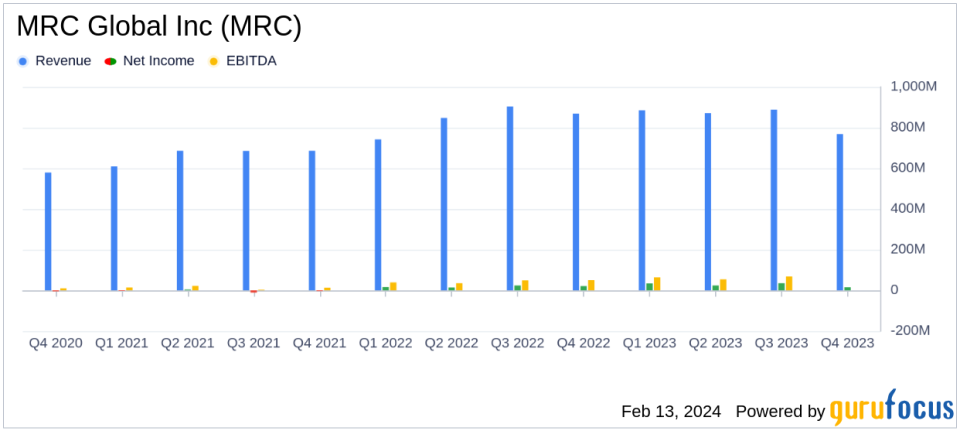

Net Income: Q4 net income holds steady at $15 million; Full year net income jumps to $90 million from $51 million in 2022.

Sales: Full year sales marginally up by 1% to $3,412 million; Q4 sales down by 12% year-over-year.

Adjusted EBITDA: Full year adjusted EBITDA at $250 million, representing 7.3% of sales.

Gross Profit: Q4 gross profit stands at $153 million, with adjusted gross profit margin improving to 21.9%.

Cash Flow and Leverage: Operating cash flow reaches $181 million; Leverage ratio at a historic low of 0.7x.

MRC Global Inc (NYSE:MRC) released its 8-K filing on February 13, 2024, detailing its full year and fourth quarter results for 2023. The company, a leading distributor of pipes, valves, fittings, and related products and services to the energy industry, reported a steady net income of $15 million for Q4, maintaining the same level as the previous year. However, full year net income saw a significant rise to $90 million, up from $51 million in 2022, showcasing the company's resilience and strategic focus on capital returns and cost control.

Financial Performance and Challenges

MRC Global's performance in 2023 reflects a mixed outcome amidst market challenges. While the company achieved a slight increase in full year sales, Q4 sales experienced a 12% decline compared to the same quarter in 2022. This decrease was primarily driven by lower activity in the Gas Utilities sector, followed by the Production & Transmission Infrastructure (PTI) sector. Despite these challenges, MRC Global managed to maintain strong gross profit margins and adjusted EBITDA margins throughout the year.

The importance of these financial achievements cannot be overstated for a company in the volatile Oil & Gas industry. The ability to generate strong cash flow and maintain a low leverage ratio, as evidenced by the historic low of 0.7x, provides MRC Global with financial stability and the capacity to navigate through uncertain market conditions.

Key Financial Metrics

Key details from the financial statements reveal that MRC Global's adjusted gross profit as a percentage of sales remained robust, with two consecutive years above 21%. The company's selling, general and administrative (SG&A) expenses were $125 million, or 16.3% of sales, for Q4 2023, slightly up from the previous year. Adjusted SG&A expenses were closely managed, reflecting the company's commitment to efficiency and cost control.

Rob Saltiel, MRC Globals President and CEO, commented on the company's performance, stating:

Our revenue grew for a third straight year in 2023 to $3.4 billion, and we generated $181 million of operating cash flow, resulting in our lowest net debt level ever as a public company. We maintained strong gross and adjusted EBITDA margins across all four quarters in 2023 that reflect our continued focus on capital returns and cost control."

Looking ahead, Saltiel anticipates a pick-up in business activity in the second half of 2024, supported by an improving economy and lower interest rates. The company is targeting $200 million in cash from operations, further strengthening its balance sheet and enabling the payoff of its maturing Term Loan B without additional financing.

Analysis of Company's Performance

Despite the downturn in Q4 sales, MRC Global's overall performance in 2023 demonstrates the company's ability to adapt to market dynamics and maintain profitability. The company's strategic focus on working capital efficiency and SG&A expense reduction positions it well for future growth and capital distribution to shareholders.

For a more detailed analysis of MRC Global Inc (NYSE:MRC)'s financial results, including reconciliations of non-GAAP measures to GAAP measures, please refer to the full 8-K filing.

MRC Global's commitment to providing innovative supply chain solutions, technical product expertise, and a robust digital platform continues to serve its diverse customer base effectively, as evidenced by its sustained financial performance in a challenging environment.

For further information and updates, investors are encouraged to attend the company's conference call on February 14, 2024, or access the webcast on MRC Global's website.

Explore the complete 8-K earnings release (here) from MRC Global Inc for further details.

This article first appeared on GuruFocus.