MRC Global (MRC) Q2 Earnings Miss Estimates, Revenues Up Y/Y

MRC Global Inc. MRC reported second-quarter 2023 adjusted earnings (excluding 4 cents from non-recurring items) of 25 cents per share, which missed the Zacks Consensus Estimate of adjusted earnings of 36 cents per share. The bottom line declined 7.4% year over year.

Total revenues of $871 million missed the consensus estimate of $910 million. However, the top line increased 2.7% year over year owing to growth in the Production and Transmission Infrastructure (PTI) sector and the Gas Utilities sector.

Revenues by Product Line

Based on MRC Global’s product line, revenues from carbon pipe, fittings and flanges decreased 0.4% year over year to $247 million. The same from valves, automation, measurement and instrumentation was up 6.8% from the year-ago quarter’s figure to $299 million.

Gas product revenues grew 8.1% to $214 million. Sales for general products increased 17.2% to $75 million. The same for stainless steel, alloy pipe and fittings declined 37.9% to $36 million.

Revenues by Sector

Effective first-quarter 2023, MRC Global combined its Upstream Production and Midstream Pipeline into one sector, which is the PTI sector.

Based on the sectors served, revenues from the Gas utilities sector increased 2.9% year over year to $323 million, while the DIET sector sales declined 5.4% year over year to $245 million. Increased capex spending for modernization and replacement activity in the U.S. region drove the Gas Utilities sector’s revenues, while the culmination of biofuel refinery projects affected DIET sector sales. Sales from the PTI sector augmented 10.2% year over year to $303 million due to increased customer facility infrastructure activity in the Permian and Rockies. Increased pipeline activity in Haynesville and Northeast also supported the segment.

Revenues by Segment

Sales generated from the U.S. segment (representing 83.4% of second-quarter revenues) totaled $727 million, rising 1% year over year. The results benefited from improvements in PTI and Gas Utilities sectors.

Revenues from the Canada segment (4.4% of the quarter’s revenues) dipped 5% year over year to $38 million due to weakness in Canada sales within the DIET and Gas Utility sectors.

Sales from the International segment (12.2% of the quarter’s revenues) surged 16% to $106 million due to higher revenues from the PTI sector, primarily in Australia and the U.K., and the DIET sector in the Netherlands, Singapore and the U.K.

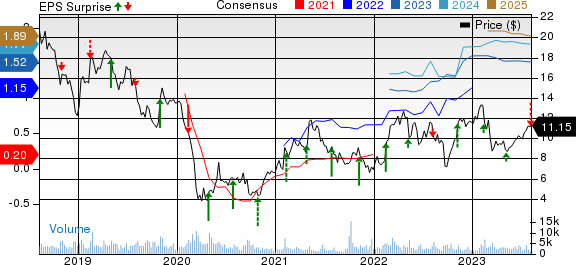

MRC Global Inc. Price, Consensus and EPS Surprise

MRC Global Inc. price-consensus-eps-surprise-chart | MRC Global Inc. Quote

Margin Profile

In the quarter under review, MRC Global’s cost of sales decreased marginally year over year to $696 million. The adjusted gross profit in the quarter increased 3.3% year over year to $187 million. The adjusted gross margin was 21.5% in the reported quarter, compared with 21.3% in the year-ago period. Selling, general and administrative expenses were up 8.3% year over year to $130 million. Adjusted EBITDA decreased 3.1% year over year to $63 million.

Balance Sheet and Cash Flow

Exiting the second quarter, MRC Global had a cash balance of $31 million, compared with $32 million at the end of December 2022. Long-term debt, net, was $340 million at the end of the second quarter, compared with $337 million at the end of December 2022.

In the second quarter, MRC Global used net cash of $10 million in operating activities, compared with $63 million cash used in the year-ago period. Capital spent on purchasing property, plant and equipment was $5 million, in line with the year-ago reported number.

In the first six months, MRC paid dividends of $12 million, flat year over year.

Outlook

For third-quarter 2023, the company expects its revenues to increase in the upper single-digit percentage, sequentially.

For 2023, MRC expects revenues to increase by the upper single-digit percentage from the 2022 reported figure. The company expects capital expenditures of $10-15 million for 2023 and cash flow from operations of approximately $90 million. The tax rate in the year is expected to be 27-29%

Zacks Rank & Stocks to Consider

MRC currently carries a Zacks Rank #4 (Sell). Some better-ranked companies from the Industrial Products sector are discussed below:

Caterpillar Inc. CAT presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

CAT’s earnings surprise in the last four quarters was 18.5%, on average. In the past 60 days, estimates for Caterpillar’s earnings have increased 7.3% for 2023. The stock has gained 51.6% in the past year.

A. O. Smith Corp. AOS presently carries a Zacks Rank #2 (Buy). AOS’ earnings surprise in the last four quarters was 10.5%, on average.

In the past 60 days, estimates for A. O. Smith’s earnings have increased 2.6% for 2023. The stock has gained 20.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

MRC Global Inc. (MRC) : Free Stock Analysis Report