MRC Global (MRC) Q3 Earnings Beat, Surge Y/Y on Higher Sales

MRC Global Inc. MRC reported third-quarter 2022 adjusted earnings (excluding 21 cents from non-recurring items) of 42 cents per share, beating the Zacks Consensus Estimate of 31 cents. The bottom line surged more than 300% year over year. Results benefited from higher sales generation and improved margins.

Total revenues of $904 million surpassed the Zacks Consensus Estimate of $885.2 million. The top line increased approximately 32% year over year, owing to growth in gas utilities and downstream, industrial and energy transition (DIET) sectors.

Revenues by Product Line

Based on MRC Global’s product line, revenues from carbon pipe, fittings and flanges increased 46.7% year over year to $292 million. The same from valves, automation, measurement and instrumentation was up 26.1% from the year-ago quarter’s figure to $290 million. Gas product revenues grew 21.3% to $205 million. Sales for general products increased 23.1% to $64 million. The same for stainless steel, alloy pipe and fittings climbed 51.4% to $53 million.

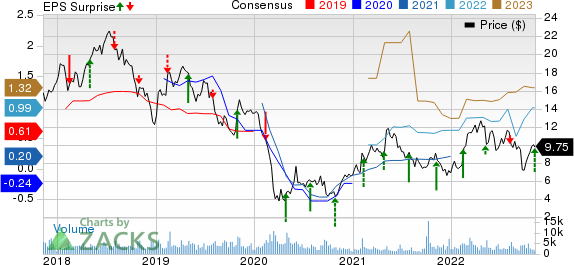

MRC Global Inc. Price, Consensus and EPS Surprise

MRC Global Inc. price-consensus-eps-surprise-chart | MRC Global Inc. Quote

Revenues by Sector

Based on the sectors served, revenues from upstream production were $176 million, up 33% from the year-ago quarter’s level. Midstream pipeline sales totaled $93 million, up 9% from the year-ago quarter’s tally, while sales for gas utilities totaled $359 million, increasing 32% year over year. DIET sales were $276 million, reflecting year-over-year growth of 40%.

Revenues by Segment

Sales generated from the U.S. segment (representing 85% of third-quarter revenues) totaled $768 million, rising 35% year over year. The results benefited from improvements in DIET, gas utilities, upstream production and midstream pipeline sectors.

Revenues from the Canada segment (4.1% of the quarter’s revenues) moved up 23% year over year to $37 million on the back of strength in the upstream production sector.

Sales from the International segment (10.9% of the quarter’s revenues) increased 16% to $99 million due to strength in the DIET sector, primarily in the Netherlands, U.K. and New Zealand.

Margin Profile

In the quarter under review, MRC Global’s cost of sales increased 25.2% year over year to $739 million. The adjusted gross profit in the quarter increased 44.5% year over year to $198 million. Adjusted gross margin was 21.9% in the reported quarter compared with 20% in the year-ago period. Adjusted selling, general and administrative expenses were up 17.6% year over year to $120 million. Adjusted EBITDA increased more than 100% year over year to $82 million.

Balance Sheet and Cash Flow

Exiting the third quarter, MRC Global had a cash balance of $29 million compared with $48 million at the end of December 2021. Long-term debt, net, increased to $338 million at the end of the third quarter compared with $295 million at the end of December 2021.

In the first nine months of 2022, MRC Global used net cash of $30 million from operating activities compared with $16 million of net cash generated in the year-ago period. Capital spent on purchasing property, plant and equipment was $8 million, up 33.3% year over year.

In the first nine months of the current year, MRC repurchased shares worth $2 million and paid out dividends totaling $18 million.

Zacks Rank & Key Picks

MRC Global currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies within the broader Industrial Products sector are as follows:

Enerpac Tool Group Corp. EPAC delivered an average four-quarter earnings surprise of 3.4%. EPAC presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

Enerpac Tool’s estimated earnings growth rate for the current fiscal year is 44.6%. Shares of the company have jumped 32.5% in the past six months.

Applied Industrial Technologies, Inc. AIT presently flaunts a Zacks Rank #1. The company delivered a trailing four-quarter earnings surprise of 24.8%, on average.

Applied Industrial has an estimated earnings growth rate of 14.3% for the current fiscal year. Shares of the company have gained 22.8% in the past six months.

IDEX Corporation IEX presently has a Zacks Rank of 2 (Buy). IDEX pulled off a trailing four-quarter earnings surprise of 5.7% on average.

IDEX has an estimated earnings growth rate of 28.3% for the current year. Shares of the company have rallied 21.7% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

MRC Global Inc. (MRC) : Free Stock Analysis Report

Enerpac Tool Group Corp. (EPAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research