MS Global Franchise Portfolio Adjusts Holdings with a Notable Decrease in Reckitt Benckiser ...

Investment Moves Reflect a Discerning Strategy in the Fourth Quarter of 2023

MS Global Franchise Portfolio (Trades, Portfolio), known for its disciplined investment approach and focus on high-quality franchise businesses, has revealed its N-PORT filing for the fourth quarter of 2023. The portfolio, managed by a seasoned investment team, emphasizes companies with sustainable, high returns on invested capital, strong free cash flow generation, and robust intangible assets. The team's investment decisions are driven by a meticulous bottom-up stock selection process, ensuring that each holding aligns with their stringent criteria for quality and valuation.

Summary of New Buy

MS Global Franchise Portfolio (Trades, Portfolio) expanded its portfolio with a new addition:

The most significant new position was in Veralto Corp (NYSE:VLTO), acquiring 169,374 shares, which now represents 0.49% of the portfolio and holds a total value of $13.93 million.

Key Position Increases

The portfolio also saw an increase in several existing positions:

Universal Music Group NV (XAMS:UMG) saw a substantial addition of 536,381 shares, bringing the total to 796,530 shares. This represents a 206.18% increase in share count, impacting the current portfolio by 0.53%, with a total value of 22.74 million.

Pernod Ricard SA (XPAR:RI) was the second-largest increase, with an additional 33,356 shares, bringing the total to 415,782. This adjustment marks an 8.72% increase in share count, with a total value of 73.48 million.

Key Position Reduces

Conversely, the portfolio reduced its stake in several companies:

Reckitt Benckiser Group PLC (LSE:RKT) was reduced by 338,163 shares, leading to a -15.6% decrease in shares and a -0.88% impact on the portfolio. The stock traded at an average price of 55.57 during the quarter and has returned 8.31% over the past 3 months and 7.71% year-to-date.

Lvmh Moet Hennessy Louis Vuitton SE (XPAR:MC) saw a reduction of 17,128 shares, resulting in a -24.47% decrease in shares and a -0.48% impact on the portfolio. The stock traded at an average price of 705.29 during the quarter and has returned 22.92% over the past 3 months and 15.92% year-to-date.

Portfolio Overview

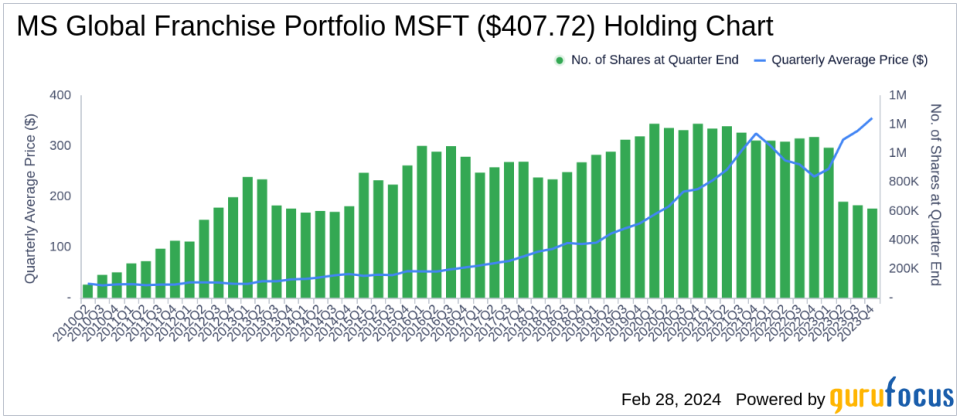

As of the fourth quarter of 2023, MS Global Franchise Portfolio (Trades, Portfolio)'s holdings spanned across 37 stocks, with top positions in Microsoft Corp (NASDAQ:MSFT), Philip Morris International Inc (NYSE:PM), Accenture PLC (NYSE:ACN), SAP SE (XTER:SAP), and Visa Inc (NYSE:V). These top holdings reflect the portfolio's concentration in sectors such as Technology, Consumer Defensive, Healthcare, Financial Services, Industrials, Consumer Cyclical, and Communication Services, showcasing the team's expertise in identifying leading companies across diverse industries.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.