MSA Safety Inc (MSA) Reports Solid Growth in Q4 and Full Year 2023 Earnings

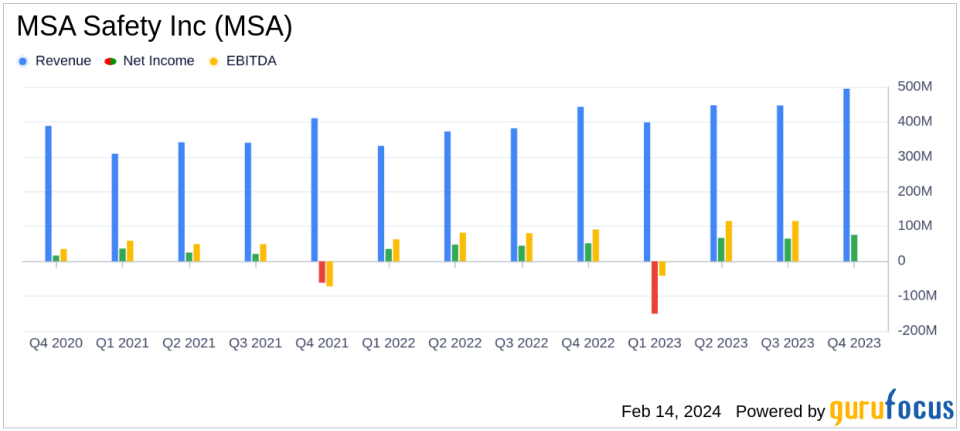

Net Sales: Q4 net sales increased by 12% year-over-year to $495 million; full-year sales up 17% to $1.8 billion.

Operating Income: Q4 GAAP operating income rose 45% to $102 million; adjusted operating income for the full year increased by 37% to $398 million.

Net Income: GAAP net income for Q4 was $76 million, a 48% increase; adjusted net income for the year reached $278 million.

Earnings Per Share (EPS): Q4 EPS grew to $1.93, up 47%; full-year adjusted EPS was $7.03, a 24% increase.

Debt Repayment: MSA repaid $289 million of debt, strengthening its financial position with a net leverage of 1.0x at year-end.

On February 14, 2024, MSA Safety Inc (NYSE:MSA), a global leader in the development and manufacture of safety products, released its 8-K filing, detailing the company's financial results for the fourth quarter and full year ended December 31, 2023. MSA Safety Inc is known for its comprehensive range of safety products, including breathing apparatuses, fall protection, and gas detection systems, primarily serving industries such as oil and gas, mining, and utilities, with a significant portion of its revenue generated in North America.

Financial Performance and Challenges

MSA Safety's performance in Q4 and throughout 2023 reflects a resilient demand for its products, leading to a substantial increase in net sales and operating income. The company's adjusted net income and EPS also saw significant growth, indicating a strong market position and effective cost management. However, the company acknowledges the backdrop of macroeconomic and geopolitical uncertainty, which may pose challenges moving forward. Despite these potential headwinds, MSA's management remains focused on delivering mid-single digit sales growth in 2024.

Financial Achievements and Importance

The company's financial achievements, particularly the repayment of a substantial portion of its debt, are crucial for maintaining a strong balance sheet and ensuring financial flexibility. The net leverage ratio of 1.0x demonstrates MSA's commitment to prudent financial management and positions the company well for sustainable growth. These achievements are particularly important in the Business Services industry, where financial stability can significantly impact a company's ability to invest in innovation and growth opportunities.

Key Financial Metrics

MSA Safety's financial strength is further illustrated by its income statement, balance sheet, and cash flow statement. The company's gross profit for the full year was $852 million, and it maintained a healthy adjusted operating margin of 22.2%. The balance sheet shows a solid cash position of $146 million, and the company's total assets amount to $2.17 billion. MSA's cash flow from operations was robust at $158 million for Q4, enabling the company to invest in its business while returning value to shareholders through dividends.

Our strong performance in the fourth quarter capped an outstanding 2023 for MSA," said Nish Vartanian, MSA Safety Chairman and Chief Executive Officer. "We enter 2024 with strong momentum and an ongoing focus on delivering value for all our stakeholders."

Analysis of Company's Performance

MSA Safety's strategic investments in product development and commercial strategy have paid off, as evidenced by the strong sales growth and margin expansion. The company's disciplined capital allocation strategy, including significant debt repayment and shareholder dividends, underscores its commitment to long-term value creation. MSA's performance is a testament to its ability to navigate a complex global market while staying true to its mission of worker safety.

For more detailed information on MSA Safety Inc's financial performance, investors and interested parties are encouraged to review the full 8-K filing and join the conference call scheduled for February 15, 2024.

MSA Safety will also be hosting an Investor Day on May 22, 2024, providing an opportunity for institutional investors and financial analysts to engage with executive management.

For additional insights and analysis on MSA Safety Inc and other value investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from MSA Safety Inc for further details.

This article first appeared on GuruFocus.