MSC Industrial (MSM) to Expand in Canada With KAR Acquisition

MSC Industrial Direct Company, Inc. MSM announced that it acquired a metalworking distributor, KAR Industrial Inc. This move expands MSM’s metalworking footprint in Canada.

Founded in 1954 in Montreal, KAR operates three facilities in Mississauga, Montreal and Edmonton. It has 45 affiliates across Canada. KAR expects $16 million in revenues for 2023. KAR will now operate as an MSC company retaining its current names, including its Duramill and Omnitool divisions.

MSC intends to capitalize on KAR's metalworking technical experience, knowledge of the Canada market, and value-added services. It will provide KAR customers with access to MSC's 2.4 million-plus product catalog to meet all their metalworking and MRO needs, as well as an e-commerce sales channel through mscdirect.com.

MSM reported first-quarter fiscal 2024 adjusted earnings per share of $1.25, missing the Zacks Consensus Estimate of $1.30. The bottom line fell 16% year over year. MSC Industrial generated revenues of around $954 million in the quarter under review, down 0.4% from the $958 million reported in the year-ago quarter.

MSC Industrial expects average daily sales growth of flat to 5% for fiscal 2024. The adjusted operating margin is expected between 12.0% and 12.8%.

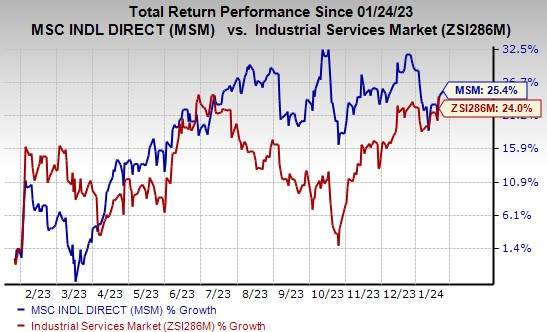

Price Performance

MSC Industrial’s shares have gained 25.4% in the past year compared with the industry’s growth of 24%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

MSC Industrial currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are AZZ Inc. AZZ, Applied Industrial Technologies AIT and A. O. Smith Corporation AOS. AZZ currently sports a Zacks Rank #1 (Strong Buy), and AIT and AOS carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AZZ’s fiscal 2024 earnings per share is pegged at $4.19. The consensus estimate for 2024 earnings has moved north by 2% in the past 60 days. The company has a trailing four-quarter average earnings surprise of 37.6%. AZZ shares have rallied 46.4% in the past year.

Applied Industrial has an average trailing four-quarter earnings surprise of 13.9%. The Zacks Consensus Estimate for AIT’s 2024 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have been constant in the past 60 days. The company’s shares have gained 46.2% in a year.

The Zacks Consensus Estimate for A. O. Smith’s 2024 earnings is pegged at $4.03 per share. The consensus estimate for 2024 earnings has moved 1% north in the past 60 days and suggests year-over-year growth of 6.8%. The company has a trailing four-quarter average earnings surprise of 14%. AOS shares have gained 37.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

AZZ Inc. (AZZ) : Free Stock Analysis Report

MSC Industrial Direct Company, Inc. (MSM) : Free Stock Analysis Report