How Much Did Carpenter Technology's(NYSE:CRS) Shareholders Earn From Share Price Movements Over The Last Year?

Even the best stock pickers will make plenty of bad investments. And there's no doubt that Carpenter Technology Corporation (NYSE:CRS) stock has had a really bad year. The share price is down a hefty 55% in that time. To make matters worse, the returns over three years have also been really disappointing (the share price is 48% lower than three years ago). Shareholders have had an even rougher run lately, with the share price down 14% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

View our latest analysis for Carpenter Technology

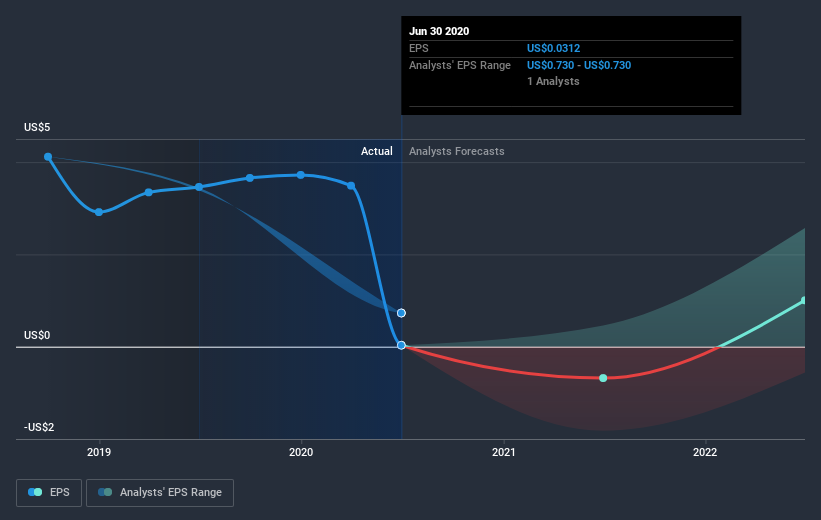

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unfortunately Carpenter Technology reported an EPS drop of 99% for the last year. The share price fall of 55% isn't as bad as the reduction in earnings per share. It may have been that the weak EPS was not as bad as some had feared. With a P/E ratio of 660.57, it's fair to say the market sees an EPS rebound on the cards.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Carpenter Technology's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Carpenter Technology's TSR of was a loss of 54% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Investors in Carpenter Technology had a tough year, with a total loss of 54% (including dividends), against a market gain of about 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7.3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Carpenter Technology is showing 5 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.