How Much Did EVO Payments'(NASDAQ:EVOP) Shareholders Earn From Share Price Movements Over The Last Year?

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in EVO Payments, Inc. (NASDAQ:EVOP) have tasted that bitter downside in the last year, as the share price dropped 11%. That falls noticeably short of the market return of around 31%. EVO Payments may have better days ahead, of course; we've only looked at a one year period. Unhappily, the share price slid 1.7% in the last week.

See our latest analysis for EVO Payments

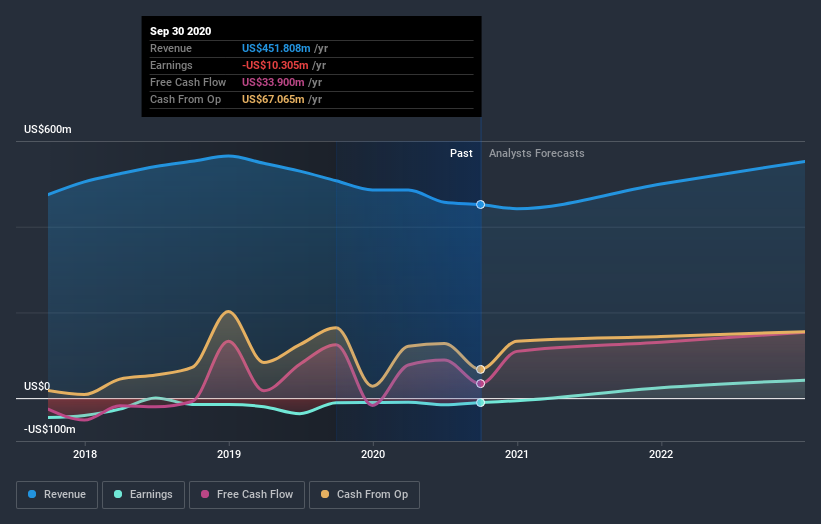

EVO Payments isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

EVO Payments' revenue didn't grow at all in the last year. In fact, it fell 11%. That's not what investors generally want to see. Shareholders have seen the share price drop 11% in that time. What would you expect when revenue is falling, and it doesn't make a profit? It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling EVO Payments stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While EVO Payments shareholders are down 11% for the year, the market itself is up 31%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 2.7%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand EVO Payments better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for EVO Payments you should know about.

EVO Payments is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.