How Much Is XRF Scientific Limited (ASX:XRF) CEO Getting Paid?

Vance Stazzonelli became the CEO of XRF Scientific Limited (ASX:XRF) in 2012, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether XRF Scientific pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for XRF Scientific

Comparing XRF Scientific Limited's CEO Compensation With the industry

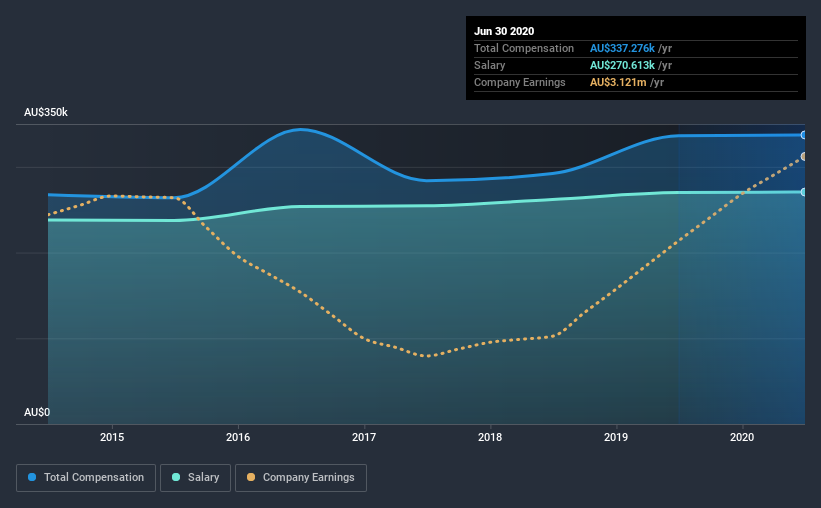

At the time of writing, our data shows that XRF Scientific Limited has a market capitalization of AU$39m, and reported total annual CEO compensation of AU$337k for the year to June 2020. That is, the compensation was roughly the same as last year. We note that the salary portion, which stands at AU$270.6k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below AU$278m, we found that the median total CEO compensation was AU$368k. So it looks like XRF Scientific compensates Vance Stazzonelli in line with the median for the industry. What's more, Vance Stazzonelli holds AU$153k worth of shares in the company in their own name.

Component | 2020 | 2019 | Proportion (2020) |

Salary | AU$271k | AU$270k | 80% |

Other | AU$67k | AU$66k | 20% |

Total Compensation | AU$337k | AU$336k | 100% |

Talking in terms of the industry, salary represented approximately 76% of total compensation out of all the companies we analyzed, while other remuneration made up 24% of the pie. XRF Scientific is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

XRF Scientific Limited's Growth

XRF Scientific Limited has seen its earnings per share (EPS) increase by 58% a year over the past three years. The trailing twelve months of revenue was pretty much the same as the prior period.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has XRF Scientific Limited Been A Good Investment?

We think that the total shareholder return of 87%, over three years, would leave most XRF Scientific Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

As previously discussed, Vance is compensated close to the median for companies of its size, and which belong to the same industry. Investors would surely be happy to see that returns have been great, and that EPS is up. Although the pay is close to the industry median, overall performance is excellent, so we don't think the CEO is paid too generously. In fact, shareholders might even think the CEO deserves a raise as a reward due to the fantastic returns generated.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 2 warning signs for XRF Scientific that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.