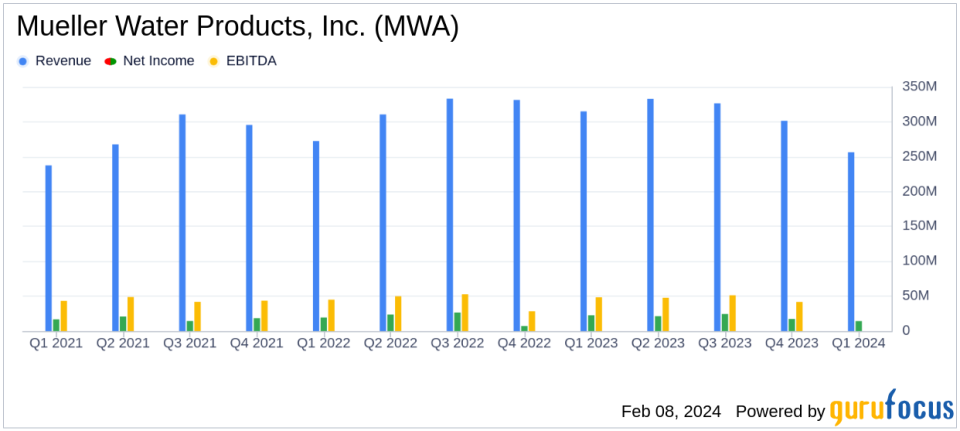

Mueller Water Products, Inc. (MWA) Faces Sales Decline but Improves Margins and Cash Flow in Q1 2024

Net Sales: Decreased by 18.6% to $256.4 million in Q1 2024 from $314.8 million in Q1 2023.

Operating Income: Dropped to $22.8 million from $34.0 million year-over-year, while adjusted operating income slightly decreased to $29.4 million.

Net Income: Reported at $14.3 million, or $0.09 per diluted share, compared to $22.5 million, or $0.14 per diluted share in the previous year.

Adjusted EBITDA: Increased by 1.4% to $44.8 million with an improved margin of 17.5%.

Free Cash Flow: Significantly increased to $62.2 million, compared to a negative $16.4 million in the prior year.

Debt Leverage: Net debt leverage ratio stood at 1.1 times, reflecting a solid balance sheet.

Mueller Water Products, Inc. (NYSE:MWA) released its 8-K filing on February 8, 2024, detailing the financial results for its fiscal first quarter ended December 31, 2023. The company, a leading manufacturer and marketer of products and services used in the transmission, distribution, and measurement of water, reported a decrease in net sales by 18.6% to $256.4 million, compared to $314.8 million in the same quarter of the previous year. The decline was primarily attributed to lower volumes in both Water Flow Solutions and Water Management Solutions segments, partially offset by higher pricing across most product lines.

Despite the sales downturn, Mueller Water Products managed to improve its adjusted operating margin to 11.5% from 9.6% year-over-year, and its adjusted EBITDA margin to 17.5% from 14.0%. The company's net income per diluted share was reported at $0.09, consistent with the prior year's adjusted figure, while adjusted net income per diluted share remained stable at $0.13. A notable achievement was the significant increase in free cash flow, which surged to $62.2 million from a negative $16.4 million in the prior year's quarter, reflecting improvements in working capital management and lower capital expenditures.

CEO Martie Edmunds Zakas highlighted the company's resilience and efficiency improvements, stating:

"I am proud of the work our team has done to deliver outstanding customer service and drive efficiencies within our operations and supply chain, while working tirelessly to address the October 2023 cybersecurity incident. We had a solid start to the year reflecting expanded margins on the expected lower volumes compared with the first quarter of last year."

The company's balance sheet remains robust, with total debt standing at $447.4 million and cash and cash equivalents at $216.7 million as of December 31, 2023. The net debt leverage ratio was reported at 1.1 times. Mueller Water Products did not have any borrowings under its ABL Agreement at quarter end, and there are no maturities on the companys debt financings until June 2029.

Looking ahead, Mueller Water Products has slightly improved its fiscal 2024 outlook, expecting consolidated net sales to decrease between 2 and 6 percent compared with fiscal 2023. The company also anticipates adjusted EBITDA to increase between 3 and 7 percent and expects free cash flow as a percentage of adjusted net income to be more than 65 percent in fiscal 2024.

Despite the challenges posed by the external environment, including a cybersecurity incident in October 2023, Mueller Water Products is focused on delivering value to customers and driving further efficiencies in operations and supply chain. The company's capital investments have positioned it to benefit from increased federal infrastructure funding beyond 2024, which is expected to help increase volumes and margins.

Investors and stakeholders are encouraged to review the detailed financial statements and management's discussion for a comprehensive understanding of Mueller Water Products' performance during the quarter.

Explore the complete 8-K earnings release (here) from Mueller Water Products, Inc. for further details.

This article first appeared on GuruFocus.