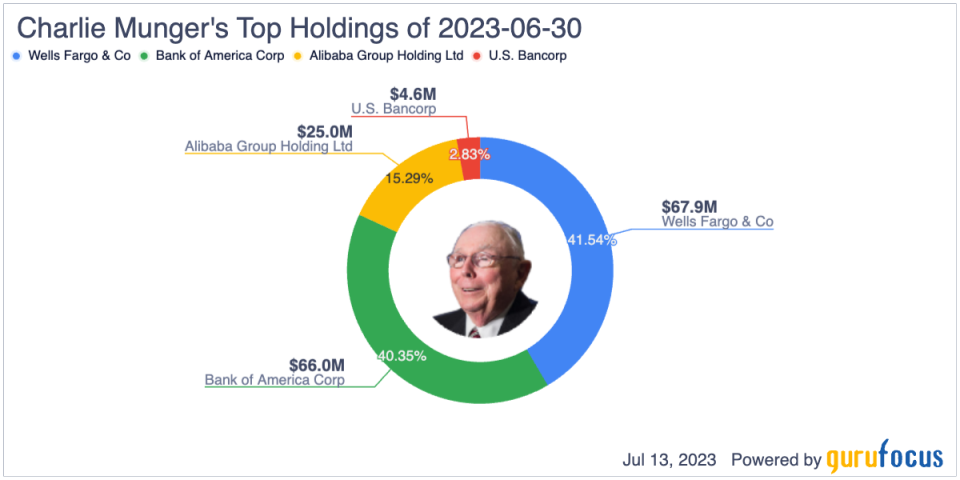

Munger Is Holding On to Alibaba

In the dynamic world of investing, even the most experienced investors can change their minds. In February, Charlie Munger (Trades, Portfolio), a director at Daily Journal Corp. (NASDAQ:DJCO), acknowledged the position in Alibaba Group Holding Co. (NYSE:BABA) was a mistake.

While the decision to hold on to Alibaba may seem perplexing to some, underlying factors shed light on Munger's rationale. Acknowledging this misstep underscores the significance of comprehensive risk assessment and the potential consequences of venturing into politically sensitive environments.

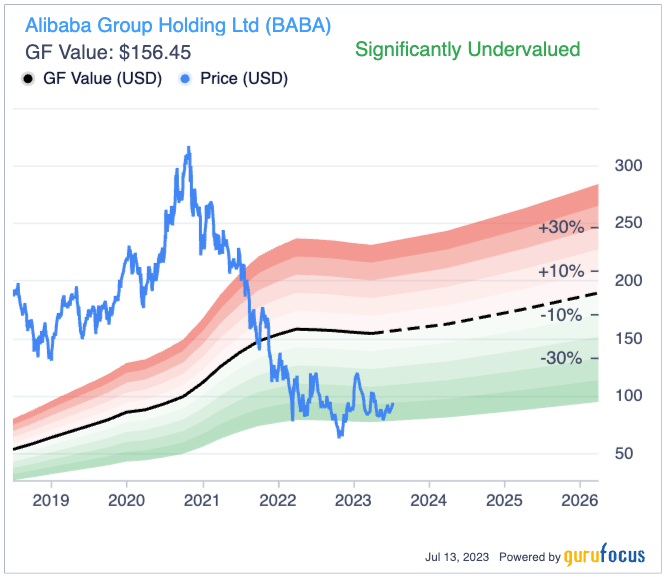

The discussion delves into the details of Munger's mistake, his investment correction and his enduring confidence in Alibaba's future amid dynamic market conditions. Despite the political uncertainty that drives the stock, it remains undervalued.

The Munger mistake

Earlier this year, Munger admitted that investing in Alibaba was a mistake and said he regretted overlooking its nature as a retailer. He acknowledged the shares were purchased with leverage, which goes against his usual investment philosophy of operating without leverage. He justified this decision by noting the opportunities presented were exceptionally good, leading him to deviate from his usual approach. It highlights the importance of assessing leveraging investments' potential returns and risks.

Regarding geopolitical events and their impact on foreign investments, Munger said that founder Jack Ma's comments offended the Chinese government, resulting in his disappearance from public view and the subsequent negative impact on the company. The incident highlights the potential risks of investing in companies operating in politically sensitive environments and the importance of considering geopolitical factors when making investment decisions.

Further, Munger said he underestimated the competitive nature of the internet retailing industry. He acknowledged he got carried away with the idea of Alibaba's position on the Chinese internet and failed to recognize that it was still fundamentally a retailer. It serves as a reminder that even with technological advancements, traditional business dynamics and competition still apply.

Lastly, regarding Munger's self-assessment and learning from mistakes, he admitted that his overestimation of Alibaba's future returns was a bad idea and emphasized the value of reflecting on and learning from past mistakes.

The correction

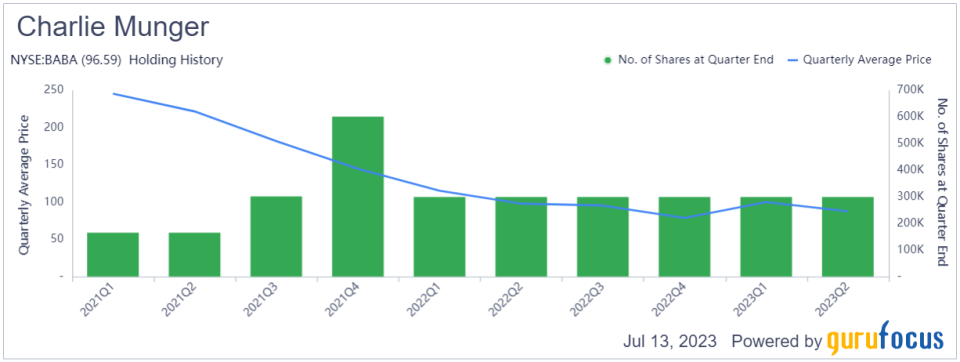

Munger made a significant correction to his investment in Alibaba. Munger systematically modified the position from an initial investment of 165,320 shares in the first quarter of 2021 to a peak of 602,060 shares in the fourth quarter of 2021. He then reduced the holding to 300,000 shares in the first quarter of 2022. The guru has maintained this position since then.

Additionally, the reduction could indicate that Munger recognized a potential mistake or unfavorable trend in Alibaba's performance. By reducing Daily Journal's position, he sought to mitigate potential losses and possibly re-evaluate the investment strategy.

One possible rationale for Munger's decision to hold a steady position could be the anticipation of a turnaround in Alibaba's valuation. The end of regulatory scrutiny and the implementation of a new organizational and governance structure could be a catalyst for bullish sentiment.

Notably, the new organizational structure aims to empower Alibaba's businesses by making them more agile, improving decision-making processes and enabling faster responses to market changes. Furthermore, it promotes innovation to capture opportunities in their respective markets and industries.

Introducing more flexibility for each group to raise outside capital and potentially seek initial public offerings could unlock further value for Alibaba's various businesses. However, it is important to note that Taobao Tmall Business Group will remain wholly owned by Alibaba Group, indicating a different approach for that particular business unit.

Considering these factors, Munger's decision to maintain the position in Alibaba suggests a cautiously optimistic outlook. He may be waiting for the company to reach a breakeven point and take advantage of potential gains resulting from the regulatory changes and the new organizational structure.

Enduring confidence in Alibaba

Alibaba has experienced a period of regulatory scrutiny, with its financial arm, Ant Group, being a major focus. However, recent developments indicate a potential shift in the regulatory environment, leading to a more positive outlook for the company.

Notably, announcing a 7.12 billion yuan ($985 million) fine for Ant Group suggests Beijing's crackdown on technology companies is coming to an end. The fine, along with the resolution of outstanding issues related to the financial businesses of platform companies, indicates a move toward "normalized supervision" in the domestic tech industry. As a result, Alibaba's internationally-listed shares may continue to rise, reflecting investor optimism about the regulatory situation.

Despite the positive sentiment, the end of regulatory scrutiny may take time. Regulators have emphasized the need for broader industry-wide regulations, which could be equally stringent. This suggests Alibaba and Ant Group's growth rates could be significantly restricted. The restructuring of Alibaba's businesses earlier this year was a potential sign that the Chinese government might loosen its grip on the tech industry.

Takeaway

Looking ahead, Munger may continue to consider the regulatory environment and its potential impact on Alibaba's operations. While recent developments indicate a more positive outlook, regulatory uncertainties still exist.

The guru may also hold the position in Alibaba for the long term as the fine on Ant Group and the potential relaxation of oversight on tech companies may serve as a preliminary catalyst to support bullish momentum in its market valuation. Further developments may boost the company's efficiency after the new structural organization in the coming quarters, the resolution of the trade war and the generalization of macroeconomic adversities.

This article first appeared on GuruFocus.