Murphy Oil (MUR) Q3 Earnings and Sales Surpass Estimates

Murphy Oil Corporation MUR delivered third-quarter 2023 adjusted net earnings of $1.59 per share, beating the Zacks Consensus Estimate of $1.34 by 18.7%. The bottom line declined 13.6% from the year-ago quarter’s earnings of $1.84.

Revenues

In the quarter under review, Murphy Oil’s revenues of $960 million beat the Zacks Consensus Estimate of $899 million by 6.7%. The top line declined 26.3% from the prior-year quarter’s $1,303 million.

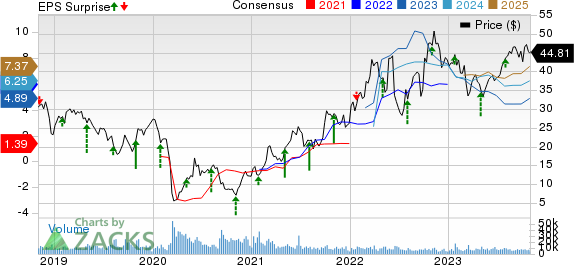

Murphy Oil Corporation Price, Consensus and EPS Surprise

Murphy Oil Corporation price-consensus-eps-surprise-chart | Murphy Oil Corporation Quote

Operational Highlights

Murphy Oil produced 201,705 barrels of oil equivalent per day (“BOE/D”) in the third quarter (excluding noncontrolling interest in GOM) compared with 188,487 BOE/D in third-quarter 2022. Out of the total third-quarter 2023 production, 51% was oil or 103,000 barrels of oil per day (BOPD). MUR’s third-quarter production exceeded the upper end of expected production volumes in the range of 188,000-1,96,000 BOE/D. A strong performance from Tupper Montney and the Gulf of Mexico drove third-quarter volumes.

In the quarter under review, Murphy Oil’s total costs and expenses amounted to $582.1 million, up 5.8% from $550.4 million in the prior-year quarter.

The company incurred net interest charges of $29.9 million, down nearly 20% from $37.4 million in the prior-year quarter.

Murphy Oil achieved its debt reduction goal of $650 million in 2022 through senior note redemptions, partial tender and open market transactions, which lowered annual interest expenses. The company aims to lower its debts further by another $500 million in 2023 and is on course to achieve the target, with $251 million remaining to be reduced in the final quarter.

The company has repurchased shares worth $75 million or 1.7 million shares, at an average price of $44.53 per share. Murphy Oil increased the share repurchase authorization by $300 million, with $525 million remaining in the share repurchase fund.

Financial Condition

The company had cash and cash equivalents of $327.8 million as of Sep 30, 2023 compared with $492 million as of Dec 31, 2022. It had $1.1 billion of liquidity as of Sep 30, 2023.

Long-term debt totaled $1,576.3 million on Sep 30, 2023 compared with $1,822.5 million as of Dec 31, 2022.

Net cash provided by continuing operational activities in the first nine months of 2023 was $1,205.7 million compared with $1,678.7 million provided in the first nine months of 2022.

Guidance

MUR expects its fourth-quarter 2023 production guidance, excluding NCI, in the range of 181,500-189,500 BOE/D.

The company reiterated its 2023 capital expenditures to the range of $950- $1,025 million. MUR is raising its 2023 production volumes to the range of 1,85,000–1,87,000 from an earlier range of 1,80,000–1,86,000 BOE/D, excluding NCI. Production for 2023 is expected to consist of 53% oil and 59% liquid volumes.

Zacks Rank

Murphy Oil currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Devon Energy DVN is going to report third-quarter 2023 earnings on Nov 7, after market close. The Zacks Consensus Estimate of $1.55 for the third quarter reflects an increase of 6.9% in the last 60 days.

Devon’s long-term (three- to five-year) earnings growth rate is currently pinned at 51.4%. The consensus estimate for 2023 EPS is pegged at $5.94, indicating an increase of 5.9% in the last 60 days.

Occidental Petroleum OXY is going to report third-quarter 2023 earnings on Nov 7, after market close. The Zacks Consensus Estimate of 89 cents for the third quarter reflects a decrease of 3.3% in the last 60 days.

Occidental’s long-term earnings growth rate is currently pinned at 22%. The consensus estimate for 2023 EPS is pegged at $4, indicating a decrease of 5% in the last 60 days.

Diamondback Energy, Inc. FANG is going to report third-quarter 2023 earnings on Nov 6, after market close. The Zacks Consensus Estimate of $4.90 for the third quarter reflects an increase of 9.6% in the last 60 days.

Diamondback Energy’s long-term earnings growth rate is currently pinned at 21.9%. The consensus estimate for 2023 EPS is pegged at $17.95, indicating an increase of 4.1% in the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

Murphy Oil Corporation (MUR) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report