Murphy Oil (MUR) to Report Q2 Earnings: What's in the Offing?

Murphy Oil Corporation MUR is slated to report second-quarter 2023 financial results on Aug 3, before market open. The company delivered an earnings surprise of 30.5% in the last reported quarter.

Let’s discuss the factors that are likely to have impacted the quarterly performance.

Factors to Consider

Murphy Oil’s second-quarter results are likely to have benefited from the Gulf of Mexico region’s strong production. However, the planned downtime of 9.7 thousand barrels of oil equivalent per day (MBOEPD) for the maintenance of assets in the Gulf of Mexico is likely to have impacted production volumes. Murphy Oil’s ongoing debt-reduction initiatives are expected to have lowered capital servicing expenses, thus boosting margins.

Second-quarter exploration expenses for the company are likely to be higher than the year-ago level due to an increase in exploration activities. A drop in realized prices of commodities compared with the previous year’s quarter might have adversely impacted the second quarter’s earnings.

Expectations

The Zacks Consensus Estimate for second-quarter 2023 sales is pegged at $781.28 million, indicating a decline of 29.04% from the year-ago reported figure. The Zacks consensus estimate for second-quarter earnings per share is pegged at 75 cents, implying a decline of 61.14% from the year-ago reported figure.

Murphy Oil anticipates second-quarter production in the range of 173-181 MBOEPD. Out of the expected production, 54% is anticipated to be oil. The Gulf of Mexico region’s assets are expected to be the largest contributor to its total production with 81 MBOEPD. Our model projects second-quarter production of 173 MBOEPD, with oil production expected to be 100.9 MBOEPD.

What Our Quantitative Model Predicts

Our proven model does not conclusively predict an earnings beat for Murphy Oil this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is not the case here, as you will see below.

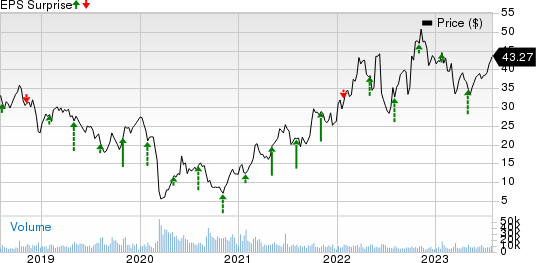

Murphy Oil Corporation Price and EPS Surprise

Murphy Oil Corporation price-eps-surprise | Murphy Oil Corporation Quote

Earnings ESP: Murphy Oil has an Earnings ESP of -2.22%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: MUR currently carries a Zacks Rank #3.

Stocks to Consider

Investors can consider the following players from the same sector that have the right combination of elements to beat on earnings this reporting cycle.

Murphy USA Inc. MUSA is likely to deliver an earnings surprise when it reports second-quarter earnings on Aug 2, 2023. MUSA has an Earnings ESP of +1.80% and currently sports a Zacks Rank #1. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for 2023 earnings of MUSA suggests a year-over-year decline of 26.1%.

Texas Pacific Land Corporation TPL is likely to deliver an earnings surprise when it posts second-quarter earnings on Aug 2, 2023, after market close. TPL has an Earnings ESP of +1.04% and a Zacks Rank #2.

The Zacks Consensus Estimate for TPL’s 2023 earnings implies a year-over-year decline of 18.9%.

Pembina Pipeline PBA is likely to deliver an earnings surprise when it posts second-quarter earnings on Aug 2, 2023, after market close. TPL has an Earnings ESP of +1.48% and a Zacks Rank #2.

The Zacks Consensus Estimate for PBA’s 2023 earnings implies a year-over-year decline of 23.5%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Murphy Oil Corporation (MUR) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Pembina Pipeline Corp. (PBA) : Free Stock Analysis Report

Texas Pacific Land Corporation (TPL) : Free Stock Analysis Report