Murphy USA (MUSA) Q4 Earnings Beat on Merchandise Strength

Murphy USA Inc. MUSA reported fourth-quarter 2019 earnings per share of $1.54, beating the Zacks Consensus Estimate of $1.45. The outperformance could be attributed to robust contribution from the motor fuel retailer’s merchandise unit.

However, the bottom line was below the year-earlier quarter's earnings of $2.38 per share due to weak retail gallons and margins, which fell 1.6% and 34.6% year over year, respectively.

Murphy USA’s operating revenues of $3.5 billion fell 1.2% year over year and missed the Zacks Consensus Estimate by $111 million, primarily hurt by lower retail gasoline prices and fuel volumes. To be precise, average retail gasoline prices during the quarter were $2.30 per gallon, falling from $2.34 per gallon a year ago. Meanwhile, monthly fuel gallons fell 3.4%.

Revenues from petroleum product sales came in at $2.8 billion, down 3.4% from the fourth quarter of 2018. However, merchandise sales, at $674 million rose 9.5% year over year.

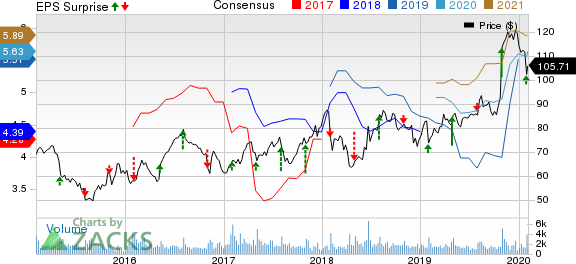

Murphy USA Inc. Price, Consensus and EPS Surprise

Murphy USA Inc. price-consensus-eps-surprise-chart | Murphy USA Inc. Quote

Key Takeaways

The company’s total fuel contribution was down 16% year over year to $183.1 million, impacted by volume and margin contraction. Total fuel contribution (including retail fuel margin plus product supply and wholesale results) came in at 17.1 cents per gallon, deteriorating from 20 cents per gallon in the fourth quarter of 2018.

Retail fuel contribution slumped 35.9% year over year to $159.5 million as margins decreased to 14.9 cents per gallon (from 22.8 cents in the corresponding period of 2018). Retail gallons edged down 1.6% from the year-ago period to 1,071.9 million in the quarter under review. Volumes on an SSS basis (or, fuel gallons per month) fell 3.4% from the fourth quarter of 2018.

Contribution from Merchandise increased 3% to $105.2 million on higher sales and strong performance from new stores even as unit margins, at 15.6%, fell from the year-ago period’s 16.6%. On SSS basis, total merchandise contribution was up 2.1% year over year in the quarter under review on the back of higher tobacco margins that increased 8.1%. Meanwhile, merchandise sales rose 7.4% on SSS basis.

Fuel gallons fell 3% while merchandise sales increased 7.9% on average per store month (or APSM) basis.

Balance Sheet

As of Dec 31, Murphy USA — which opened 10 new retail location to bringing its store count to 1,489 — had cash and cash equivalents of $280.3 million, and long-term debt (including lease obligations) of $999.3 million, with a debt-to-capitalization ratio of 55.4%.

During the quarter, the company bought back shares worth $26.6 million.

Guidance

Murphy USA’s 2020 guidance assumes certain cost headwinds. SG&A expenses (at the midpoint of the projected range) are expected to be up more than 3% versus 2019. Meanwhile, operating costs per store is projected to increase between 1% and 3%. Assuming a fuel margin of 16.2 cents per gallon, management sees adjusted EBITDA at $440 million – up from $423 million reported last year. Further, the company’s 2020 guidance include 30 new stores and up to 25 raze-and-rebuilds, $430-$435 million in merchandise margin contribution, and $225-$275 million in capital expenditures.

Zacks Rank & Key Picks

Murphy USA, which came into existence following the 2013 spin-off of Murphy Oil Corporation’s MUR downstream business into a separate, independent and publicly-traded entity, holds a Zacks Rank #3 (Hold).

Some better-ranked players in the energy space are Marathon Oil Corporation MRO and Hess Corporation HES, carrying a Zacks Rank #2 (Buy).

Over the past 30 days, the Zacks Consensus Estimate for Marathon Oil's 2020 earnings has surged 100%.

The Zacks Consensus Estimate for Hess indicates 115.8% earnings per share growth over 2019.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Marathon Oil Corporation (MRO) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

Murphy Oil Corporation (MUR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research