Murray Stahl Closes Out Texas Pacific Land Trust Holding

- By Graham Griffin

Murray Stahl (Trades, Portfolio) has revealed that he has sold out of his holding in Texas Pacific Land Trust (NYSE:TPL) according to GuruFocus' Real-Time Picks, a Premium feature.

Stahl co-founded Horizon Kinetic in 1994. The New York-based firm takes a long-term fundamental value investment approach to achieve strong returns. It takes a contrarian approach and measures risk as an impairment of capital.

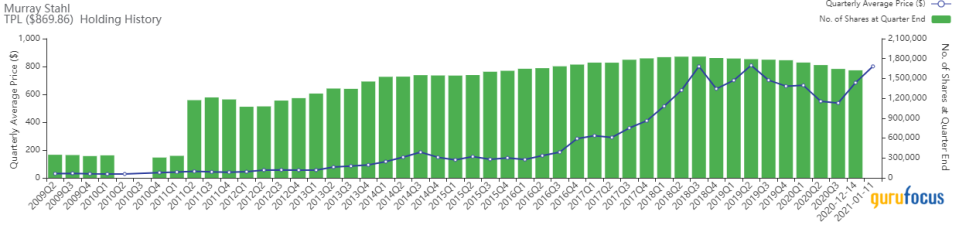

On Jan. 11, after a consistent selling pattern since 2018, Stahl sold out of the remaining 1.62 million shares of the oil land management trust. On the day of the transaction, the shares traded at an average price $801. Overall, the sale had an impact of -45.31% on the equity portfolio and GuruFocus estimates the total gain of the holding at 698.69%.

Texas Pacific Land Trust is mainly engaged in sales and leases of land owned, retaining oil and gas royalties and the overall management of the land owned. The company operates its business in two segments, including land and resource management and water service and operations. Texas Pacific owns approximately 900,000 acres of land located in various countries. The trust derives revenue from all avenues of managing the land, which includes oil and gas royalties, grazing leases, easements, commercial leases and land and material sales.

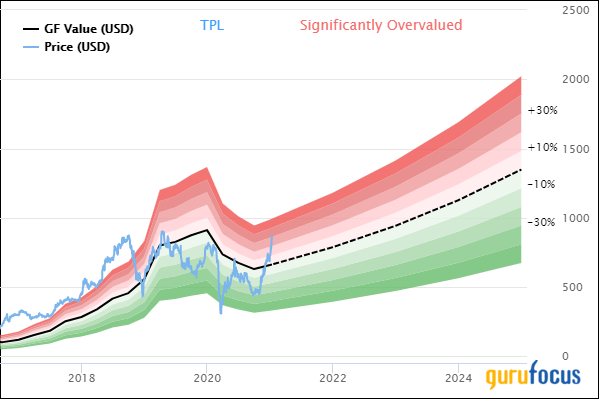

On Jan. 12, the stock was trading at $869.50 per share with a market cap of $6.74 billion. According to the GF Value Line, the stock is significantly overvalued.

GuruFocus gives the trust a financial strength rating of 7 out of 10, a profitability rank of 10 out of 10 and a valuation rank of 5 out of 10. There are currently four severe warning signs, including declining gross and operating margins and assets growing faster than revenue. The current cash-to-debt ratio of 105.89 ranks the trust higher than 83.38% of the industry and cash flows have increased steadily over the years.

Prior to selling the holding, Stahl was by far the largest shareholder with 20.91% of shares outstanding. Other top shareholders include Morgan Stanley (Trades, Portfolio), First Manhattan Co. (Trades, Portfolio), SoftVest Advisors, LLC (Trades, Portfolio), Epoch Investment Partners, Inc. (Trades, Portfolio) and Pacific Heights Asset Management LLC (Trades, Portfolio).

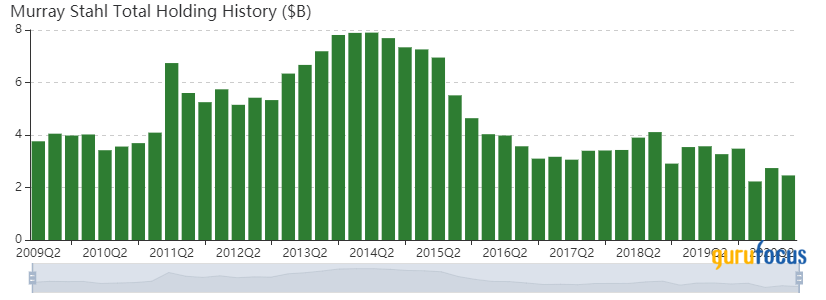

Portfolio overview

At the end of the third quarter, Stahl's portfolio contained 362 stocks, with 20 new holdings. It was valued at $2.46 billion and has seen a turnover rate of 2%. The top holdings were Texas Pacific Land Trust, Wheaton Precious Metals Corp. (NYSE:WPM), Franco-Nevada Corp. (NYSE:FNV), CACI International Inc. (NYSE:CACI) and Brookfield Asset Management Inc. (NYSE:BAM).

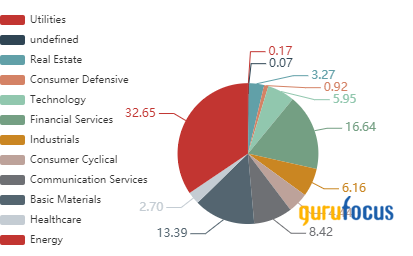

By weight, the top three sectors represented were energy (32.65%), financial services (16.64%) and basic materials (13.39%).

Disclosure: Author owns no stocks mentioned.

Read more here:

FedEx Cut Down to Size by Dodge & Cox

Brandes Investment Boosts Long-Term Embraer Holding

Bill Ackman Reduces Chipotle Mexican Grill Stake

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.