Murray Stahl's Firm Reduces Stake in Texas Pacific Land Corp

Overview of Murray Stahl (Trades, Portfolio)'s Recent Transaction

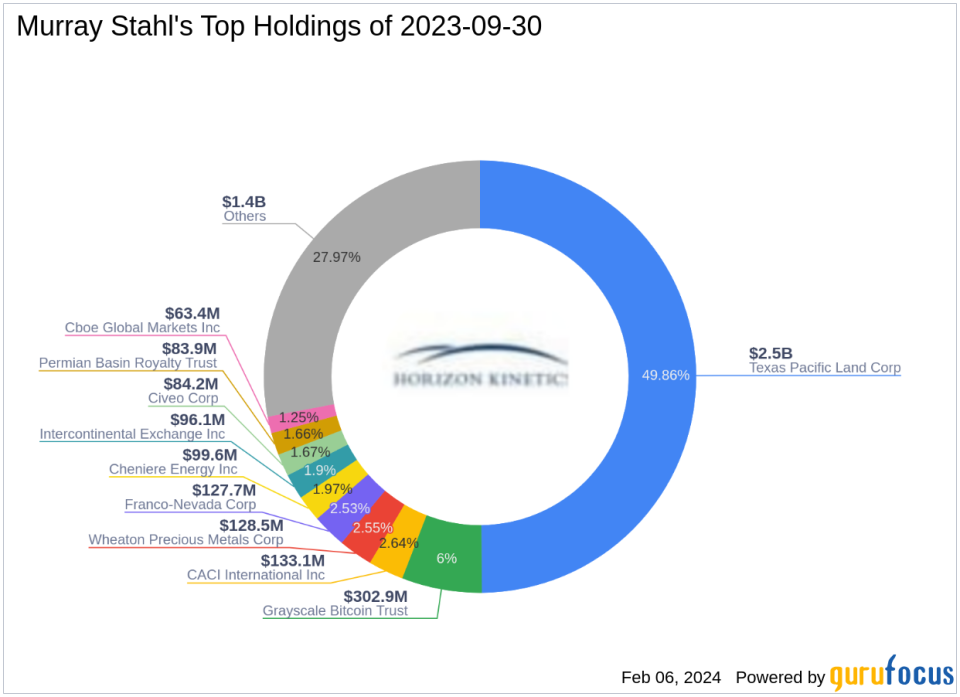

On January 31, 2024, Murray Stahl (Trades, Portfolio)'s investment firm Horizon Kinetics made a notable adjustment to its investment portfolio by reducing its stake in Texas Pacific Land Corp (NYSE:TPL). The transaction involved the sale of 75,126 shares at a price of $1,461.33 each. This move resulted in a -5.52% change in the firm's holdings in TPL, impacting the portfolio by -2.17%. After the transaction, the firm held a total of 1,287,085 shares, representing 38.08% of the portfolio and 16.77% of the firm's holdings in TPL.

Investment Guru: Murray Stahl (Trades, Portfolio)

Murray Stahl (Trades, Portfolio) stands as the CEO and Chairman of Horizon Kinetics, a firm he co-founded, bringing over three decades of investment expertise to the table. Stahl's investment philosophy is rooted in value investing with a contrarian edge, emphasizing the importance of extending investment horizons beyond short-term market trends. Horizon Kinetics is known for its fundamental, fact-based approach, seeking opportunities that arise from the market's short-term focus. Stahl's extensive background includes a tenure at Bankers Trust Company and leadership roles in several investment committees and exchanges.

Introduction to Texas Pacific Land Corp

Texas Pacific Land Corp, trading under the symbol TPL, is a company with a rich history dating back to its IPO on May 29, 1975. The company operates primarily within the oil and gas industry, focusing on land sales and leases, retaining oil and gas royalties, and managing its extensive land holdings across 19 counties. TPL's business is divided into two segments: Land and Resource Management, and Water Service and Operations. These segments encompass a range of services from water sourcing and recycling to infrastructure development and analytics.

Details of the Trade

The specifics of Stahl's firm's trade reveal a strategic reduction in TPL shares. The trade price was set at $1,461.33, and the post-transaction holdings of 1,287,085 shares now constitute a significant 38.08% of the firm's portfolio. This move reflects a substantial 16.77% position of the firm's holdings in TPL, indicating a meaningful shift in the investment strategy regarding this particular stock.

Analysis of Texas Pacific Land Corp's Stock Metrics

As of the latest data, TPL's stock price stands at $1,428.98, with a market capitalization of $10.97 billion. The stock's PE percentage is 28.04, suggesting profitability, and it is currently deemed modestly undervalued with a GF Value of $1,905.41. The price to GF Value ratio is 0.75, indicating that the stock may be trading below its intrinsic value. Despite a recent -2.21% decline since the transaction, TPL has experienced an astronomical 206,998.55% increase since its IPO and a -10.95% change year-to-date.

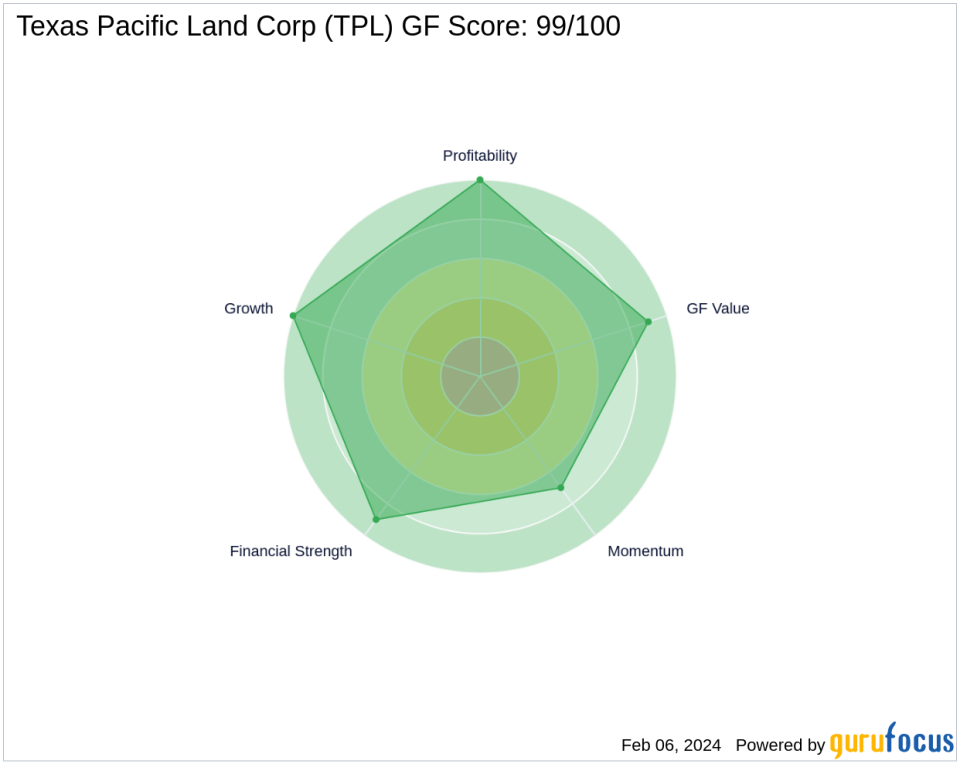

Financial Health and Performance Rankings of TPL

Texas Pacific Land Corp boasts a strong GF Score of 99/100, indicating the highest potential for outperformance. The company's Financial Strength is impressive with a 9/10 rank, supported by a robust Profitability Rank of 10/10 and a Growth Rank of 10/10. TPL's GF Value Rank and Momentum Rank are also high at 9/10 and 7/10, respectively.

Market Context and Stahl's Positioning

Murray Stahl (Trades, Portfolio)'s firm is heavily invested in the Energy and Financial Services sectors, with top holdings including CACI International Inc (NYSE:CACI), Franco-Nevada Corp (NYSE:FNV), and Wheaton Precious Metals Corp (NYSE:WPM). TPL remains a significant holding despite the recent reduction. The largest guru shareholder in TPL is GAMCO Investors, although the exact share percentage is not disclosed.

Implications of the Trade

The reduction in TPL shares by Murray Stahl (Trades, Portfolio)'s firm could have various implications. It may reflect a strategic reallocation of assets within the portfolio or a response to market conditions. The trade's impact on the portfolio is notable, and the reasons behind this decision could be significant for investors following Stahl's investment moves. As TPL continues to perform strongly in terms of financial health and growth metrics, the firm's future positioning in this stock will be closely watched by the investment community.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.