Murray Stahl's Horizon Kinetics Reduces Stake in Texas Pacific Land Corp

Overview of Murray Stahl (Trades, Portfolio)'s Recent Transaction

On February 5, 2024, Horizon Kinetics, under the leadership of Murray Stahl (Trades, Portfolio), made a notable adjustment to its investment portfolio by reducing its stake in Texas Pacific Land Corp (NYSE:TPL). The firm sold 5,870 shares of TPL at a price of $1,428.98 per share. This transaction resulted in a 0.46% change in the firm's holdings, decreasing its total share count to 1,281,215. The trade had a modest impact of -0.17% on the portfolio, reflecting a strategic shift in the firm's investment stance regarding TPL.

Profile of Murray Stahl (Trades, Portfolio) and Horizon Kinetics

Murray Stahl (Trades, Portfolio) stands as the Chief Executive Officer and Chairman of Horizon Kinetics, a firm he co-founded, bringing over three decades of investment expertise to the table. Stahl's role extends to Chief Investment Officer and head of the Investment Committee, influencing key portfolio management decisions. Horizon Kinetics is known for its fundamental value and contrarian investment philosophy, emphasizing long-term investment horizons over short-term market trends. The firm's approach is grounded in extensive, independent research, often leading to contrarian views aimed at capitalizing on market myopia.

Insight into Texas Pacific Land Corp

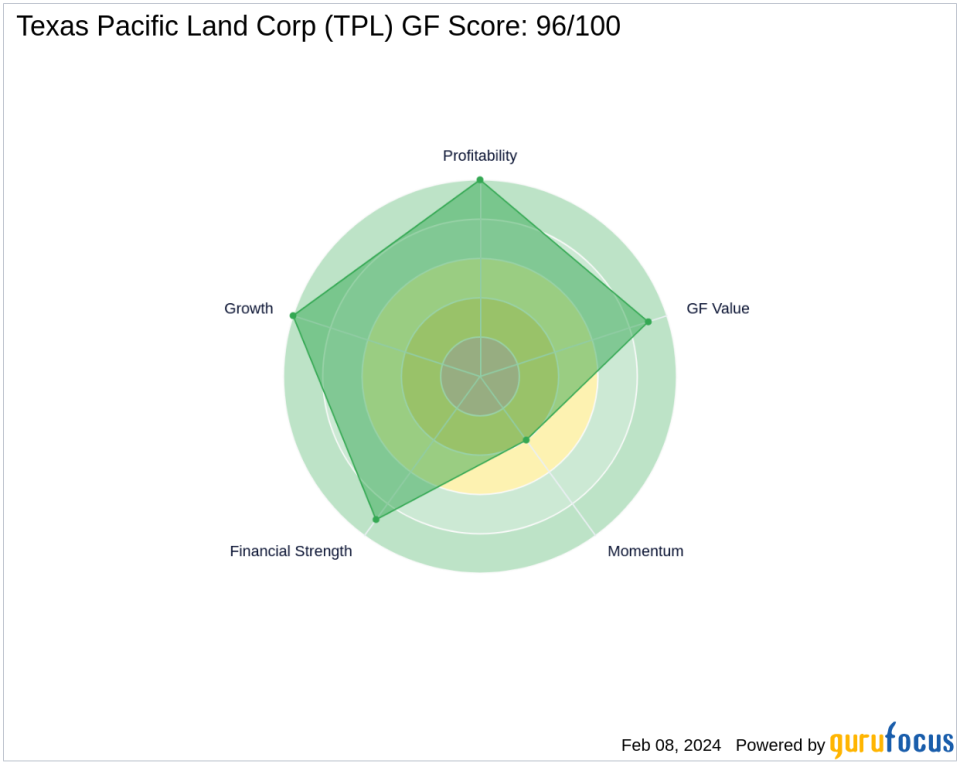

Texas Pacific Land Corp, with its operations rooted in the USA since its IPO in 1975, is primarily involved in land sales and leases, retaining oil and gas royalties, and land management. The company operates through two segments: Land and Resource Management, and Water Service and Operations. With a market capitalization of $11.3 billion and a stock price of $1,472.50, TPL has been classified as modestly undervalued by GuruFocus, with a GF Value of $1,905.92. The company's financial health is reflected in its GF Score of 96/100, indicating a high potential for outperformance.

Trade Impact on Murray Stahl (Trades, Portfolio)'s Portfolio

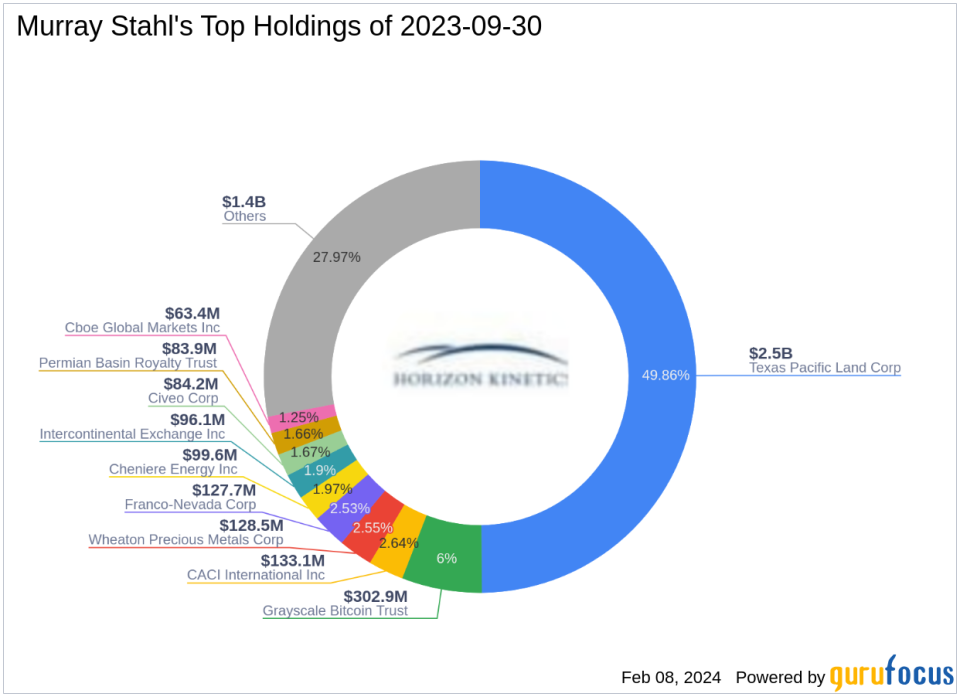

The recent reduction in TPL shares by Horizon Kinetics signifies a recalibration of the firm's investment strategy, with TPL now accounting for 36.32% of the firm's portfolio and 16.69% of the firm's holdings in TPL. This move aligns with the firm's philosophy of adjusting positions based on valuation and market opportunities.

Market Position and Valuation of TPL

Texas Pacific Land Corp's current market capitalization stands at $11.3 billion, with a stock price of $1,472.50. The company's stock is considered modestly undervalued, with a GF Value of $1,905.92 and a price to GF Value ratio of 0.77. The stock has experienced a gain of 3.05% since the transaction date, although it has seen a year-to-date price change ratio of -8.23%.

Sector and Portfolio Context

Within Murray Stahl (Trades, Portfolio)'s portfolio, TPL plays a significant role, particularly in the Energy sector, which is the firm's top sector, followed by Financial Services. TPL's position in the portfolio is juxtaposed with other investments in similar sectors, reflecting the firm's strategic allocation and diversification efforts.

Performance Metrics and Future Outlook for TPL

Texas Pacific Land Corp has demonstrated historical performance and growth metrics that are noteworthy, with a GF Score of 96/100, indicating strong potential for future performance. The company's financial strength, profitability, and growth are further underscored by high rankings in Financial Strength (9/10), Profitability Rank (10/10), and Growth Rank (10/10).

Market Reactions and Trends Following the Transaction

Following Horizon Kinetics' reduction in TPL shares, the stock price has shown an upward movement, with a 3.05% increase post-transaction. This suggests a positive market reaction, although it is essential to consider broader market trends and investor sentiment towards TPL for a comprehensive understanding of the stock's trajectory.

In conclusion, Murray Stahl (Trades, Portfolio)'s Horizon Kinetics' recent reduction in TPL shares reflects a strategic portfolio adjustment. With TPL's strong financial metrics and a modestly undervalued status, the transaction's influence on both the stock and the firm's portfolio will be closely monitored by investors seeking to understand the implications of this investment decision.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.