Murray Stahl's Horizon Kinetics Reduces Stake in Texas Pacific Land Corp

Overview of Murray Stahl (Trades, Portfolio)'s Recent Transaction

On February 26, 2024, Murray Stahl (Trades, Portfolio)'s investment firm, Horizon Kinetics, made a notable adjustment to its investment portfolio by reducing its stake in Texas Pacific Land Corp (NYSE:TPL). The transaction involved the sale of 9,240 shares at a price of $1,560.23 each. Following this trade, Horizon Kinetics holds a total of 1,271,975 shares in TPL, which represents a 41.68% position in the firm's portfolio and a 16.57% ownership of the traded stock.

Investment Guru: Murray Stahl (Trades, Portfolio)

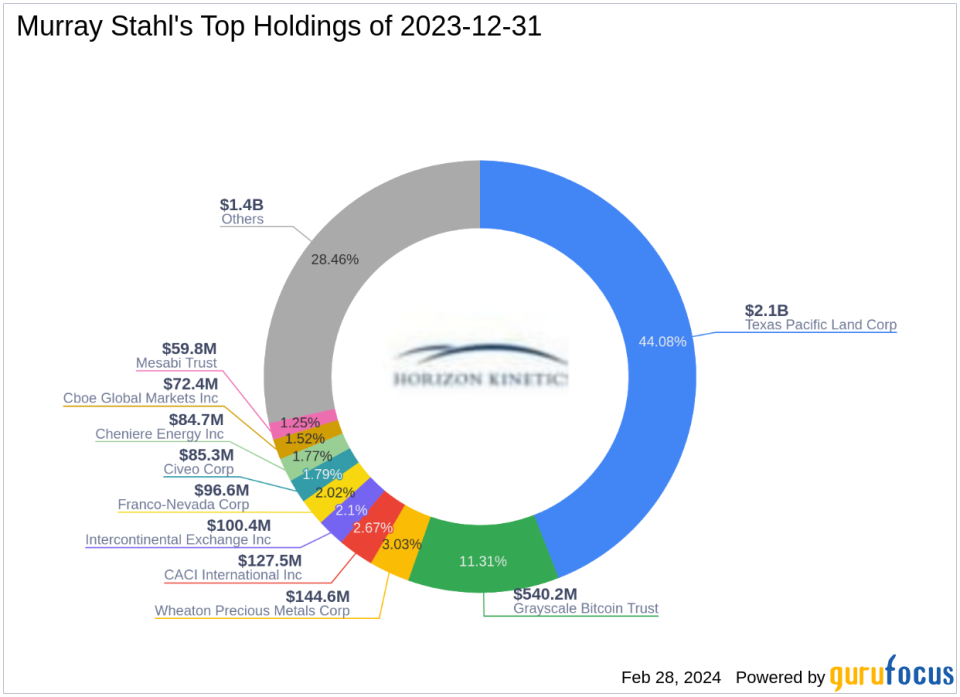

Murray Stahl (Trades, Portfolio) stands as the Chief Executive Officer and Chairman of Horizon Kinetics, boasting over three decades of experience in the investment sector. Stahl's investment philosophy is rooted in fundamental value and contrarian principles, emphasizing the importance of a long-term investment horizon over short-term market trends. Horizon Kinetics is known for its independent, fact-based research and a portfolio management approach that often reflects contrarian views. The firm's top holdings include CACI International Inc (NYSE:CACI), Intercontinental Exchange Inc (NYSE:ICE), Wheaton Precious Metals Corp (NYSE:WPM), Texas Pacific Land Corp (NYSE:TPL), and Grayscale Bitcoin Trust (GBTC), with a total equity of $4.78 billion, predominantly in the Energy and Financial Services sectors.

Introduction to Texas Pacific Land Corp

Texas Pacific Land Corp, with its stock symbol TPL, is a company primarily engaged in land sales and leases, retaining oil and gas royalties, and land management. Founded in 1975, TPL operates through two segments: Land and Resource Management, and Water Service and Operations. The majority of its revenue is generated from the Land and Resource Management segment. With a market capitalization of $11.83 billion and a stock price of $1,542.27, TPL is considered modestly undervalued with a GF Value of $1,961.60.

Impact of the Trade on Stahl's Portfolio

The recent reduction in TPL shares by Murray Stahl (Trades, Portfolio)'s firm has a moderate impact on the portfolio, with a -0.3% trade impact. This adjustment reflects the firm's strategic portfolio management decisions and may signal a shift in investment focus or a response to market conditions. The trade price of $1,560.23 is closely aligned with the current stock price, indicating a transaction executed near market valuation.

Market Valuation and Stock Performance

Texas Pacific Land Corp's current market valuation is reflected in its GF Value, which suggests the stock is modestly undervalued. The trade price of $1,560.23 is slightly above the current stock price of $1,542.27, with a price to GF Value ratio of 0.79. Since the transaction, the stock has experienced a -1.15% price change, while the year-to-date performance shows a -3.89% change.

Financial Health and Industry Position

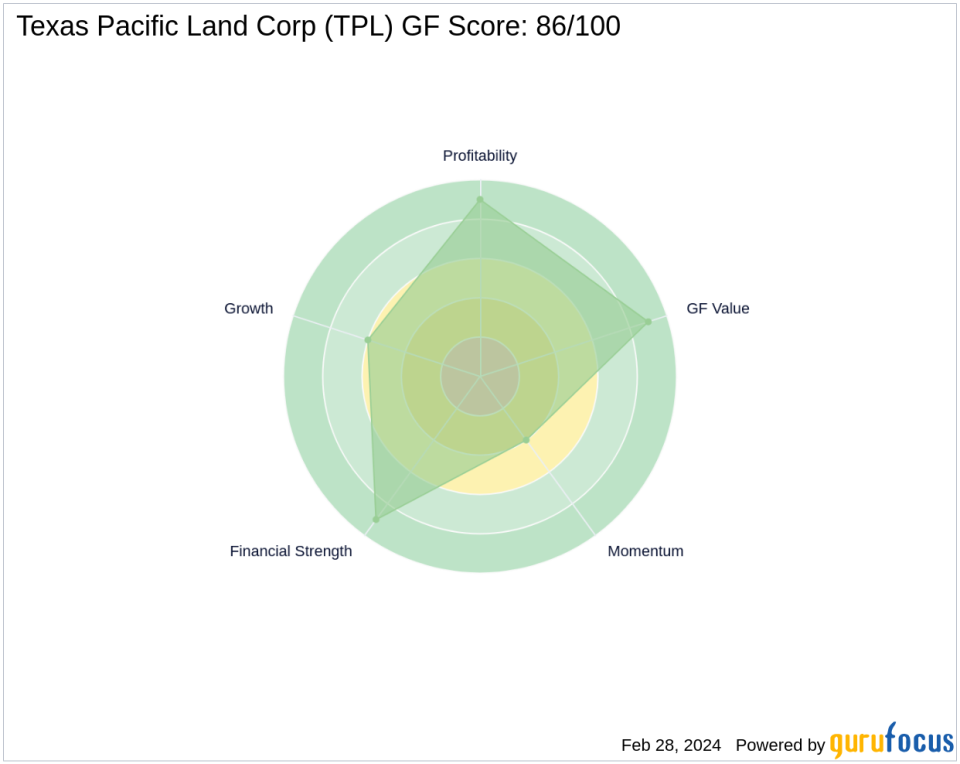

TPL's financial health is robust, with a Financial Strength rank of 9/10 and a Profitability Rank of 9/10. The company's Growth Rank stands at 6/10, while the GF Value Rank is at 9/10. TPL's industry position within the Oil & Gas sector is solid, supported by a high Return on Equity (ROE) of 45.10% and Return on Assets (ROA) of 40.01%.

Comparison with Largest Guru Shareholder

While Murray Stahl (Trades, Portfolio)'s Horizon Kinetics holds a significant position in TPL, the largest guru shareholder is GAMCO Investors. The comparative analysis of holdings between these two investment entities can provide insights into their respective investment strategies and confidence in TPL's future performance.

Conclusion: Analyzing the Transaction's Influence

Murray Stahl (Trades, Portfolio)'s recent reduction in TPL shares may reflect a strategic reallocation of Horizon Kinetics' portfolio or a response to the company's current valuation and market performance. The firm's long-term investment philosophy and contrarian approach suggest that such transactions are carefully considered within the broader context of market opportunities and the firm's investment objectives. As TPL continues to navigate the dynamic energy sector, investors will closely monitor the impact of such trades on the company's stock performance and valuation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.