Murray Stahl's Q2 2023 13F Filing Update: Key Trades and Portfolio Overview

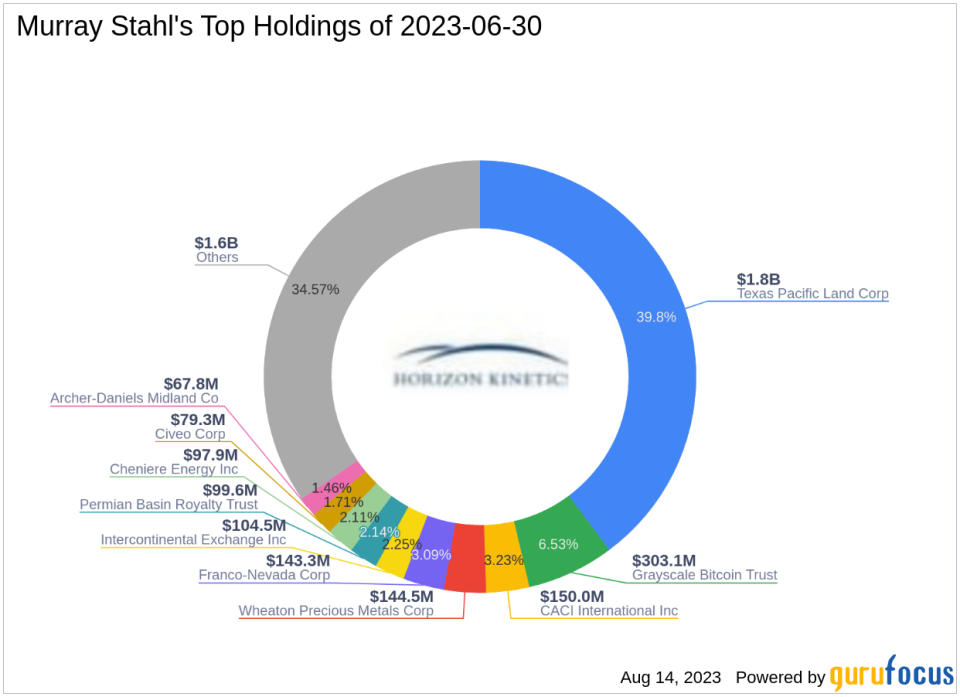

Renowned investment guru, Murray Stahl, recently filed his 13F report for the second quarter of 2023, which concluded on June 30, 2023. Stahl's portfolio, valued at $4.64 billion, comprised 336 stocks. His top holdings included Texas Pacific Land Corp (NYSE:TPL), Grayscale Bitcoin Trust (GBTC), and CACI International Inc (CACI), accounting for 39.80%, 6.53%, and 3.23% of the portfolio, respectively.

Top Three Trades of the Quarter

Stahl's most significant trades for the quarter involved TPL, Brookfield Corp (NYSE:BN), and Cameco Corp (NYSE:CCJ).

Texas Pacific Land Corp (NYSE:TPL)

Stahl reduced his investment in TPL by 20,667 shares, impacting the equity portfolio by 0.6%. The stock traded at an average price of $1,503.51 during the quarter. As of August 14, 2023, TPL's price stood at $1,876.11, with a market cap of $14.40 billion. The stock has returned 12.90% over the past year. GuruFocus gives TPL a financial strength rating of 10 out of 10 and a profitability rating of 10 out of 10. TPL's valuation ratios include a price-earnings ratio of 34.71, a price-book ratio of 16.23, a PEG ratio of 1.45, an EV-to-Ebitda ratio of 26.55, and a price-sales ratio of 22.21.

Brookfield Corp (NYSE:BN)

Stahl also reduced his investment in BN by 811,363 shares, impacting the equity portfolio by 0.51%. The stock traded at an average price of $31.81 during the quarter. As of August 14, 2023, BN's price stood at $34.34, with a market cap of $53.90 billion. The stock has returned -20.67% over the past year. GuruFocus gives BN a financial strength rating of 3 out of 10 and a profitability rating of 9 out of 10. BN's valuation ratios include a price-earnings ratio of 381.56, a price-book ratio of 1.35, a PEG ratio of 23.85, an EV-to-Ebitda ratio of 10.21, and a price-sales ratio of 0.58.

Cameco Corp (NYSE:CCJ)

Stahl established a new position in CCJ, purchasing 728,312 shares, which now account for 0.49% of the equity portfolio. The stock traded at an average price of $28.09 during the quarter. As of August 14, 2023, CCJ's price stood at $34.8, with a market cap of $15.10 billion. The stock has returned 37.12% over the past year. GuruFocus gives CCJ a financial strength rating of 7 out of 10 and a profitability rating of 5 out of 10. CCJ's valuation ratios include a price-earnings ratio of 225.97, a price-book ratio of 3.39, an EV-to-Ebitda ratio of 48.41, and a price-sales ratio of 9.57.

About Murray Stahl (Trades, Portfolio)

Murray Stahl (Trades, Portfolio) is a highly respected figure in the investment world, known for his unique investment philosophy that focuses on value investing. He seeks out undervalued companies with strong fundamentals, potential for growth, and a competitive edge in their respective markets. His investment decisions are often characterized by a long-term perspective and a keen understanding of market dynamics.

About the Companies

Texas Pacific Land Corp is one of the largest landowners in the state of Texas, with substantial oil and gas royalties. Grayscale Bitcoin Trust is a digital currency investment product that individual investors can buy and sell in their own brokerage accounts. CACI International Inc is a multinational professional services and information technology company. Brookfield Corp is a leading global alternative asset manager, focused on investing in long-life, high-quality assets across real estate, infrastructure, renewable power, and private equity. Cameco Corp is one of the world's largest uranium producers.

This article first appeared on GuruFocus.