Murray Stahl's Recent Transaction in Civeo Corp

Overview of Murray Stahl (Trades, Portfolio)'s Stock Transaction

On December 31, 2023, Horizon Kinetics, under the leadership of Murray Stahl (Trades, Portfolio), adjusted its holdings in Civeo Corp (NYSE:CVEO) by reducing its position. The firm sold 327,944 shares at a price of $22.85 each. Following this transaction, the firm's total share count in Civeo Corp stood at 3,734,335, which represents a 1.69% position in the firm's portfolio and a significant 25.30% ownership of the traded company.

Profile of Murray Stahl (Trades, Portfolio)

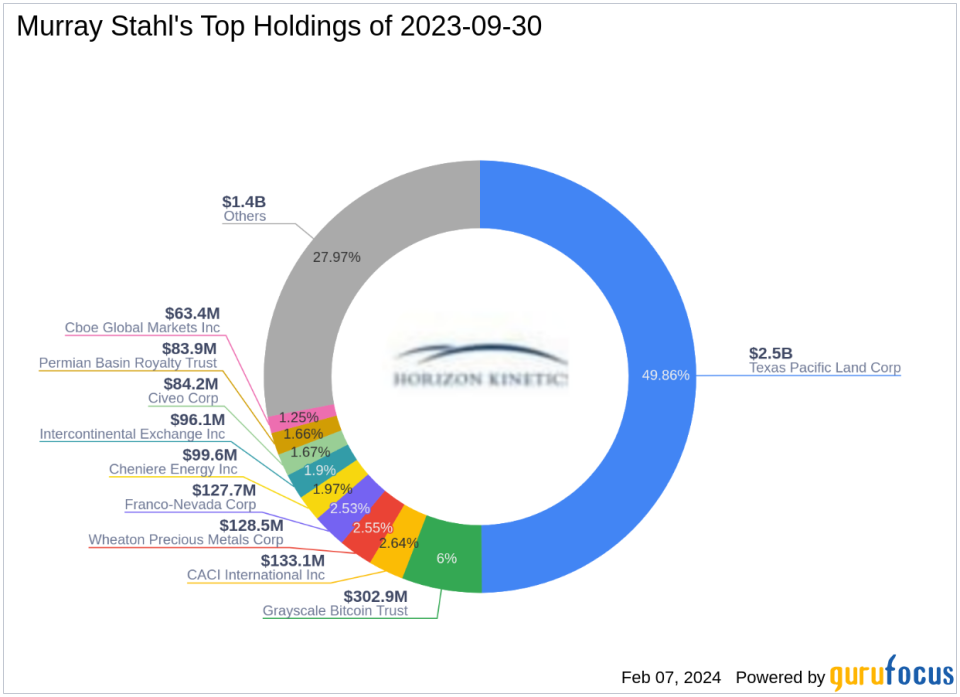

Murray Stahl (Trades, Portfolio) stands at the helm of Horizon Kinetics as its CEO and Chairman, bringing over three decades of investment experience. The firm, co-founded by Stahl, is known for its fundamental value and contrarian investment philosophy. Horizon Kinetics emphasizes the importance of a long-term investment horizon to harness the power of compounding, often adopting positions contrary to market trends. Stahl's extensive background includes a tenure at Bankers Trust Company and leadership roles in various investment committees and exchanges.

Overview of Civeo Corp

Civeo Corp, operating in the USA, Canada, and Australia, specializes in providing hospitality services to the natural resources industry. Since its IPO on May 19, 2014, the company has offered comprehensive services, including lodging, catering, and maintenance. With a market capitalization of $325.885 million, Civeo operates across several active resource regions and segments its revenues across accommodation, food service, mobile facility rental, and other services.

Analysis of the Trade Impact

The recent sale by Murray Stahl (Trades, Portfolio) has slightly decreased the firm's exposure to Civeo Corp, with the trade impact on the portfolio being a modest -0.15%. Despite this reduction, the firm maintains a substantial stake in the company, indicating a continued belief in its value proposition within the portfolio's composition.

Civeo Corp's Stock Performance and Valuation

Civeo Corp's stock is currently trading at $22.1, slightly below the GF Value of $23.96, suggesting it is fairly valued. The stock has experienced a -3.28% decline since the transaction date and a significant -91.53% drop since its IPO. Year-to-date, the stock has seen a -1.38% change, reflecting a cautious market sentiment towards the company.

Civeo Corp's Financial Health and Growth Prospects

Civeo Corp's financial health, as indicated by its Financial Strength rank of 5/10, and Profitability Rank of 4/10, shows room for improvement. The company's Growth Rank is also positioned at 4/10. With a Piotroski F-Score of 4 and an Altman Z score of -0.16, the company's financial stability could be a concern. However, the company has shown a revenue growth of 9.50% over the past three years, indicating some potential for growth.

Sector and Market Context

Murray Stahl (Trades, Portfolio)'s investment strategy heavily features the energy and financial services sectors. Civeo Corp, while part of the business services industry, is closely tied to the natural resources sector, aligning with Stahl's top sector focus. The firm's top holdings include CACI International Inc (NYSE:CACI), Franco-Nevada Corp (NYSE:FNV), and Wheaton Precious Metals Corp (NYSE:WPM), among others, reflecting a diversified yet strategic approach to sector investment.

Conclusion

Murray Stahl (Trades, Portfolio)'s recent transaction in Civeo Corp holds significance for value investors, as it reflects a strategic adjustment rather than a complete exit. The firm's sustained large position in Civeo Corp suggests a continued confidence in the company's value proposition. Investors will be watching closely to see how this trade influences the performance of both Murray Stahl (Trades, Portfolio)'s portfolio and Civeo Corp's stock in the future.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.