Mustang (MBIO) Up 9% on Rare Blood Cancer Study's Upbeat Data

Shares of Mustang Bio MBIO were up 9.2% on Jun 12 after management announced updated results from a cohort of an ongoing single-institution phase I/II study evaluating its lead clinical candidate MB-106 in patients with Waldenstrom macroglobulinemia (“WM”), a rare form of blood cancer.

Data from the study showed that treatment with MB-106 exhibited a favorable safety and efficacy profile in WM patients, all (n=6) of whom were previously treated with Bruton's tyrosine kinase (“BTK”) inhibitors and their disease continued to progress while on BTK inhibitors.

Per management, participants treated with MB-106 achieved an overall response rate (“ORR”) of 83%, including two complete responses (“CR”). One of the patients who achieved CR remains in remission at 22 months. Also, none of the patients started treatment with an additional anti-WM treatment following MB-106 administration.

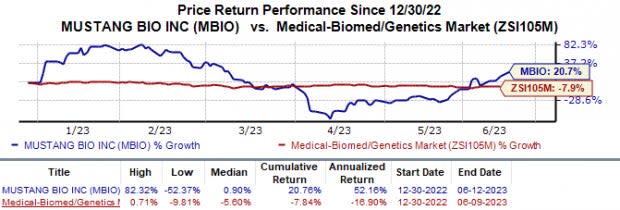

Mustang Bio’s stock has risen 20.7% in the past year against the industry‘s 7.8% decline.

Image Source: Zacks Investment Research

A CD20-targeted autologous CAR T cell therapy, MB-106, is being developed in the above-mentioned phase I/II study to treat patients with relapsed or refractory B-cell non-Hodgkin lymphomas (“B-NHLs”) and chronic lymphocytic leukemia (“CLL”). This study is being sponsored by Fred Hutchinson Cancer Center (“Fred Hutch”), Mustang’s research collaborator. MB-106 was licensed by Fred Hutch to Mustang in 2017.

Currently, there are no FDA-approved CAR T treatments in WM indication. Mustang believes that MB-106 has the potential to address a significant unmet need. The FDA has granted orphan drug designation to MB-106 in WM indication based on data from a company-sponsored phase I/II multicenter study evaluating MB-106 in patients with relapsed or refractory B-Cell NHL or CLL.

A popular drug approved in WM indication is Imbruvica, which is jointly marketed by pharma giants J&J JNJ and AbbVie ABBV. The AbbVie-J&J partnered drug was the first FDA-approved therapy in WM indication. A BTK inhibitor, AbbVie/J&J’s Imbruvica is also approved by the FDA in CLL and small lymphocytic lymphoma (“SLL”) indications.

ABBV and J&J co-exclusively market Imbruvica in the United States. However, J&J has an exclusive license to market the drug outside the United States and shares profits from the drug’s ex-U.S. sales with AbbVie.

Mustang Bio, Inc. Price

Mustang Bio, Inc. price | Mustang Bio, Inc. Quote

Zacks Rank & Stocks to Consider

Mustang Bio currently carries a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Another better-ranked stock in the overall healthcare sector is Novartis NVS, which carries the same rank as that of MBIO.

In the past 60 days, estimates for Novartis’ 2023 and 2024 earnings per share have increased from $6.57 to $6.72 and $7.08 to $7.26, respectively. Shares of Novartis are up 10.2% in the year-to-date period.

Earnings of Novartis beat estimates in each of the last four quarters, witnessing an average earnings surprise of 5.15%. In the last reported quarter, Novartis’ earnings beat estimates by 10.32%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Mustang Bio, Inc. (MBIO) : Free Stock Analysis Report