MVB Financial Corp (MVBF) Reports Solid Q4 Earnings Amid Banking Challenges

Net Income: $7.9 million for Q4 2023, with EPS of $0.62 basic and $0.61 diluted.

Net Interest Income: Increased by 4.2% to $31.3 million in Q4, driven by margin expansion.

Loan Growth: Balance sheet loan to deposit ratio improved to 79.9%.

Asset Quality: Nonperforming loans decreased by 22.0% to $8.3 million.

Capital Ratios: Enhanced with the Community Bank Leverage Ratio at 10.5%.

Dividend: Quarterly cash dividend maintained at $0.17 per share.

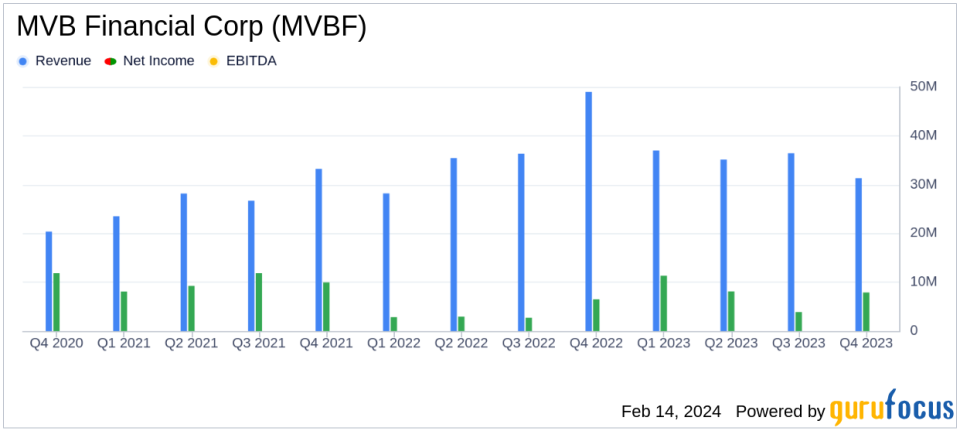

MVB Financial Corp (NASDAQ:MVBF) released its 8-K filing on February 14, 2024, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a bank holding entity providing community banking, mortgage banking, insurance, and wealth management services, reported a net income of $7.9 million, or $0.62 basic and $0.61 diluted earnings per share for Q4 2023.

Financial Performance and Challenges

MVB Financial faced a challenging banking environment in 2023 but emerged with strong fourth-quarter results. The company's net interest income increased by 4.2% to $31.3 million, with a net interest margin improvement of 17 basis points to 4.04%. This growth was primarily due to higher average loan balances and a favorable shift in the mix of earning assets and deposit funding. However, the company also experienced a decrease in total deposits by 4.5%, reflecting a strategic reduction in higher-cost funding.

Financial Achievements

The company's financial achievements are significant in the banking industry, where net interest income and loan growth are critical performance indicators. MVB Financial's loan growth of 2.1% and the improved loan to deposit ratio underscore the company's solid lending activities and financial health. Additionally, the improvement in asset quality, with nonperforming loans declining to $8.3 million, reflects the company's effective risk management.

Key Financial Metrics

Key metrics from MVB Financial's income statement and balance sheet include a 106.7% increase in earnings per share to $0.62 and a decline in noninterest expense by 7.9% to $28.3 million. The company's balance sheet strength is evident in the increased book value per share to $22.68 and tangible book value per share to $22.43. These metrics are important as they indicate the company's profitability, efficiency, and shareholder value.

"MVB closed a challenging year for the banking industry with strong fourth quarter results... Team MVBs resilience and adaptability enabled us to navigate the disruptive industry events last year, and now leave us well-positioned to drive further improvement in earnings and profitability as market conditions begin to turn favorably," said Larry F. Mazza, Chief Executive Officer, MVB Financial.

Analysis of Performance

MVB Financial's performance in the fourth quarter demonstrates resilience in a difficult market. The company's strategic focus on optimizing its funding mix and controlling expenses, alongside its ability to capitalize on fintech-related fee income growth, has positioned it for continued success. The stable dividend payout also signals confidence in the company's earnings stability and commitment to shareholder returns.

For a detailed view of MVB Financial Corp's financial results and strategic initiatives, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from MVB Financial Corp for further details.

This article first appeared on GuruFocus.