Myers Industries Inc (MYE) Reports Mixed Financial Results Amid Operational Challenges

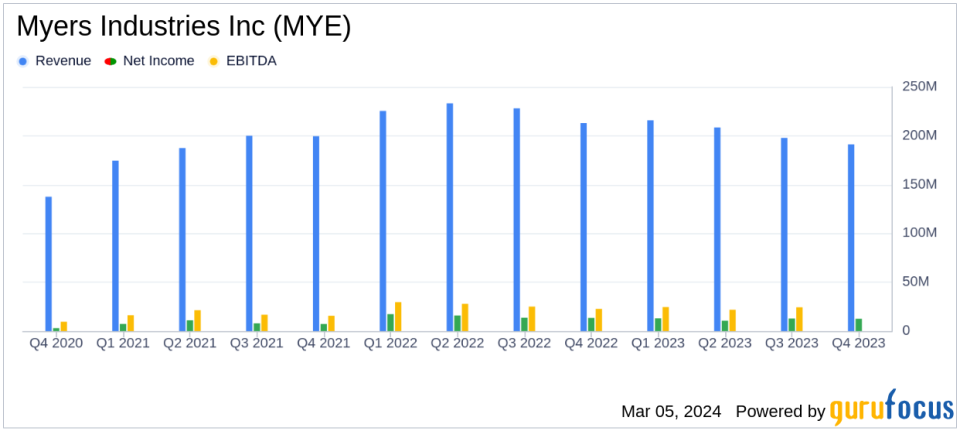

Net Sales: Decreased by 9.6% to $813.1 million in FY 2023 from $899.5 million in FY 2022.

Gross Margin: Improved slightly by 40 basis points to 31.9% in FY 2023.

Net Income: GAAP net income per diluted share fell to $1.32 in FY 2023 from $1.64 in FY 2022.

Adjusted Earnings: Adjusted earnings per diluted share decreased to $1.39 in FY 2023 from $1.68 in FY 2022.

Cash Flow: Operating cash flow increased by $13.6 million and free cash flow increased by $15.0 million in FY 2023.

Acquisition: Closed on the acquisition of Signature Systems, expected to enhance long-term margin and EPS growth profiles.

2024 Outlook: Anticipates net sales growth of 15% - 20% and adjusted earnings per diluted share range of $1.30 to $1.45.

On March 5, 2024, Myers Industries Inc (NYSE:MYE) released its 8-K filing, detailing the financial outcomes for the fourth quarter and full year ended December 31, 2023. The company, a prominent manufacturer of polymer and metal products and distributor for the tire, wheel, and under-vehicle service industry, faced several challenges throughout the year, including cyclical headwinds in key end markets. Despite these challenges, Myers Industries managed to achieve one of its top years for adjusted earnings per share, adjusted EBITDA, and revenue.

Financial Performance Overview

For the full year 2023, Myers Industries reported net sales of $813.1 million, a decrease from the previous year's $899.5 million. The company's gross margin saw a slight improvement, rising to 31.9% from 31.5%. However, GAAP net income per diluted share decreased to $1.32, down from $1.64 in the prior year. Adjusted earnings per diluted share also saw a decline, falling to $1.39 from $1.68.

The Material Handling segment experienced a decrease in net sales, primarily due to reduced demand in the RV, Marine, and Consumer end-markets. However, the segment's operating income increased by 43.5% to $29.9 million, with an operating income margin increase to 23.6%. The Distribution segment, on the other hand, faced a disappointing performance with a decrease in net sales and operating income, attributed to a short-term decline in sales volume and revenue.

Strategic Moves and Future Outlook

Myers Industries' President and CEO Mike McGaugh highlighted the company's resilience and the benefits derived from the early implementation of the Myers Business System, which has driven operational excellence. The acquisition of Signature Systems is expected to diversify the company's end-market exposure and enhance its margin and EPS growth profiles.

Looking ahead to fiscal year 2024, Myers Industries anticipates improved profitability with net sales growth of 15% - 20% and an adjusted earnings per diluted share range of $1.30 to $1.45. The company also expects to capture annualized run-rate operational and cost synergies of $8 million by 2025 from the Signature Systems acquisition.

Myers Industries remains committed to its long-term strategy and will be hosting an Investor and Analyst Day on March 19, 2024, to outline its outlook and showcase its diverse product portfolio.

Balance Sheet and Cash Flow Highlights

As of December 31, 2023, Myers Industries had $30.3 million in cash on hand and a total debt of $67.2 million. The company generated $86.2 million in cash flow from operations and $63.3 million in free cash flow for the full year of 2023, marking an increase from the previous year. Capital expenditures for the year were $22.9 million, slightly lower than the $24.3 million spent in 2022.

Myers Industries' financial results reflect a company navigating through market challenges while leveraging its operational strengths and strategic initiatives to position itself for future growth. Investors and stakeholders will be watching closely as the company continues to execute its strategy in the coming year.

For more detailed information and analysis on Myers Industries Inc (NYSE:MYE)'s financial results, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Myers Industries Inc for further details.

This article first appeared on GuruFocus.