MYR Group Inc (MYRG) Posts Record Revenues and Net Income for Full Year 2023

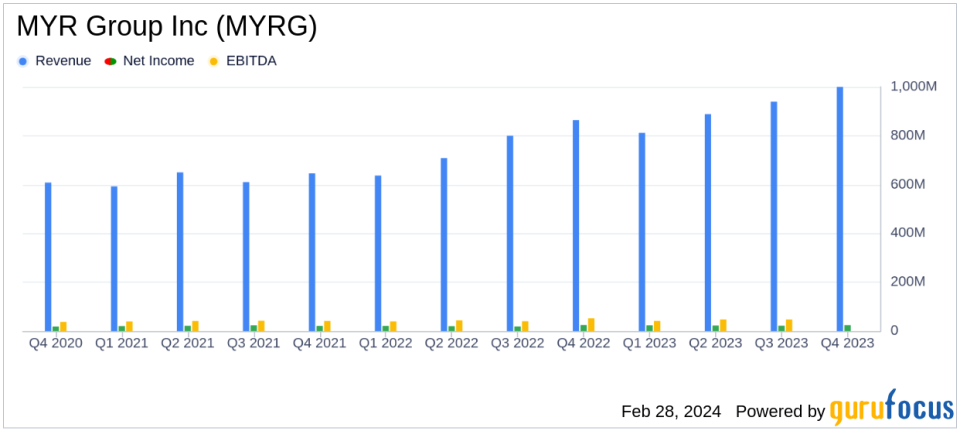

Record Revenues: MYR Group Inc (NASDAQ:MYRG) reported record annual revenues of $3.64 billion for 2023, a 21.1% increase from the previous year.

Net Income: Full-year net income reached $91.0 million, or $5.40 per diluted share, up from $83.4 million, or $4.91 per diluted share in 2022.

EBITDA: The company achieved a record full-year EBITDA of $188.2 million.

Backlog: MYR Group Inc (NASDAQ:MYRG) ended the year with a strong backlog of $2.51 billion, indicating a healthy bidding environment.

Gross Margin: Gross margin decreased to 10.0% for the full year of 2023 from 11.4% for the full year of 2022, primarily due to labor and project inefficiencies and rising costs.

On February 28, 2024, MYR Group Inc (NASDAQ:MYRG), a leading specialty electrical construction service provider in the United States and Canada, announced its fourth-quarter and full year 2023 financial results through its 8-K filing. The company operates through two segments: Transmission & Distribution (T&D) and Commercial & Industrial (C&I), offering a range of services including design, installation, maintenance, and repair of electrical infrastructure.

Financial Performance and Challenges

MYR Group Inc (NASDAQ:MYRG) finished the year with a solid financial performance, setting a record high for the ninth consecutive year. The company's fourth-quarter net income was $24.0 million, a slight decrease of 2.2 percent over the same period in 2022. Despite challenges such as labor and project inefficiencies, supply chain disruptions, and inclement weather, the company's revenues, consolidated gross profit, and EBITDA increased compared to the fourth quarter of 2022. The company's backlog, a key indicator of future revenue, remained robust at $2.51 billion.

Financial Achievements and Industry Significance

The record revenues and net income are significant achievements for MYR Group Inc (NASDAQ:MYRG) and the construction industry, reflecting the company's ability to grow amidst a challenging economic environment. The strong backlog suggests a sustained demand for the company's services, which is crucial for long-term growth. These financial achievements are particularly important as they demonstrate the company's resilience and strategic positioning in the specialty electrical construction market.

Key Financial Metrics

MYR Group Inc (NASDAQ:MYRG)'s financial strength is further illustrated by its balance sheet and cash flow statements. As of December 31, 2023, the company had $442.4 million of borrowing availability under its $490 million revolving credit facility. The company's ability to maintain a strong liquidity position is essential for funding operations and capitalizing on growth opportunities.

"We finished 2023 with solid financial performance in the fourth quarter, and annual revenues of $3.64 billion, setting a record high for the ninth consecutive year," said Rick Swartz, MYRs President and CEO. "The dedication and talent of our team members contributed to our growing success in 2023. Market indicators remain positive, and by leveraging proven business strategies and remaining committed to providing customers with quality, safe, and dependable results, we believe we are well-positioned for continued growth in 2024."

Analysis of Company Performance

MYR Group Inc (NASDAQ:MYRG)'s performance in 2023 reflects a company that is effectively navigating a complex market landscape. The increase in revenues and net income, despite a decrease in gross margin, indicates the company's ability to manage costs and improve operational efficiency. The strong backlog suggests that MYR Group Inc (NASDAQ:MYRG) is maintaining its competitive edge and is expected to continue its growth trajectory in the coming year.

In conclusion, MYR Group Inc (NASDAQ:MYRG)'s latest earnings report showcases a company that has achieved significant financial growth and is poised for future success. The company's record revenues and net income, combined with a solid backlog, position it well within the specialty electrical construction industry. Value investors and potential GuruFocus.com members may find MYR Group Inc (NASDAQ:MYRG) an attractive opportunity based on its strong financial fundamentals and positive outlook.

Explore the complete 8-K earnings release (here) from MYR Group Inc for further details.

This article first appeared on GuruFocus.