Myriad Genetics Inc (MYGN) Reports 11% Revenue Growth in Q4 and Full-Year 2023

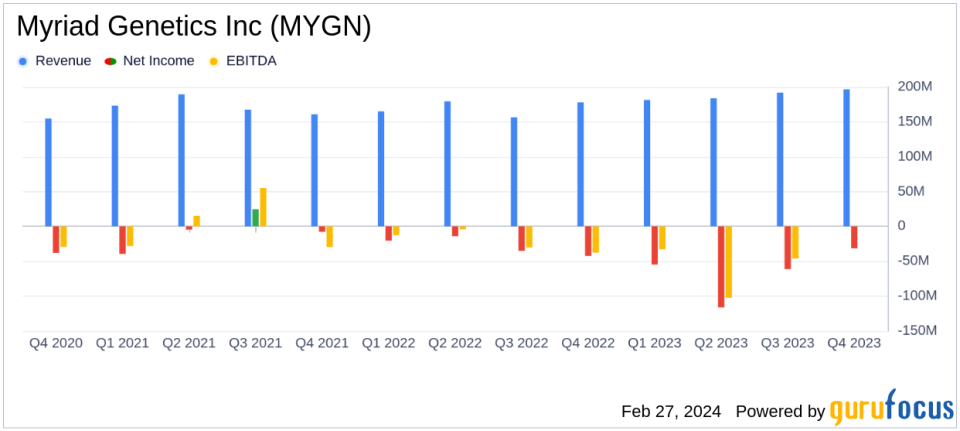

Revenue Growth: Myriad Genetics Inc (NASDAQ:MYGN) reported an 11% year-over-year increase in both Q4 and full-year 2023 revenue, reaching $197 million and $753 million respectively.

Adjusted Earnings: The company achieved a GAAP EPS of $(0.36) and an adjusted EPS of $0.04 in Q4 2023.

Testing Volume: Full-year testing volume grew by 35% year-over-year, or 18% excluding SneakPeek volume.

Operating Expenses: Q4 GAAP operating expenses were down 6% year-over-year to $166 million, with adjusted operating expenses at $130 million.

Cash Flow: GAAP cash flow from operations was $(55) million in Q4; however, adjusted cash flow from operations increased by $10 million year-over-year to $14 million.

Acquisitions: In February 2024, Myriad Genetics acquired select assets from Intermountain Precision Genomics, enhancing its oncology portfolio.

2024 Outlook: The company raised its 2024 revenue guidance to $820 - $840 million and introduced adjusted EPS guidance of $0.00 - $0.05.

On February 27, 2024, Myriad Genetics Inc (NASDAQ:MYGN), a leader in genetic testing and precision medicine, released its 8-K filing, detailing the financial results for the fourth quarter and full-year ended December 31, 2023. The company reported a robust 11% year-over-year growth in both quarterly and annual revenue, driven by significant increases in testing volumes across its product categories, particularly in prenatal and hereditary cancer diagnostics.

Company Overview

Myriad Genetics is a molecular diagnostics company that provides testing services designed to assess an individual's risk of developing a disease. The firm's products include MyRisk, a 48-gene panel for cancer risk assessment, BRACAnalysis CDx for PARP inhibitors, GeneSight for psychotropic drug responses, and Prequel for noninvasive prenatal testing. The recently launched Precise Oncology Solutions suite and the acquisition of Intermountain Precision Genomics assets further bolster the company's offerings in precision medicine.

Financial Performance and Challenges

Myriad Genetics' financial achievements in 2023 reflect the company's ability to grow amidst a challenging healthcare landscape. The 11% revenue growth signifies the company's successful expansion and adoption of its testing services. However, the company reported a GAAP operating loss of $31.4 million in Q4, an improvement from the previous year, and a GAAP EPS of $(0.36). These figures underscore the ongoing challenges in achieving profitability and managing operating expenses, which are critical for sustaining long-term growth.

The company's financial flexibility, demonstrated by the successful equity offering in November 2023, which raised net proceeds of $118 million, positions Myriad Genetics to continue investing in research and development and technology innovations. This strategic focus is essential for the company to maintain its competitive edge in the Medical Diagnostics & Research industry.

Key Financial Metrics

Myriad Genetics reported GAAP gross margins of 68.6% in Q4 2023, a slight decrease from the previous year, reflecting changes in product and volume mix. Adjusted gross margins also saw a decrease, highlighting the impact of the company's evolving product portfolio on profitability. The company's focus on cost control measures resulted in a reduction of both GAAP and adjusted operating expenses, contributing to an improved adjusted operating income of $5.7 million in Q4.

With a strong cash position of $140.9 million at the end of Q4, Myriad Genetics is well-equipped to navigate future investments and potential market fluctuations. The company's cash flow management, evidenced by the positive adjusted cash flow from operations, is a testament to its operational efficiency.

"Myriad Genetics took another important step forward in 2023 as we generated double-digit revenue growth over the prior year and achieved positive adjusted EPS in the fourth quarter. This achievement is the result of our teams hard work and focus on the needs of our patients and the healthcare providers who serve them," said Paul J. Diaz, President and CEO, of Myriad Genetics.

Analysis of Company's Performance

The company's performance in 2023 indicates a strategic pivot towards growth and operational efficiency. The increase in testing volumes and revenue growth across key product categories, such as prenatal and pharmacogenomics, showcases Myriad Genetics' ability to capture market share and respond to the growing demand for personalized medicine.

The acquisition of assets from Intermountain Precision Genomics and the introduction of new products slated for the second half of 2024 or early 2025, including Foresight Universal Plus and Precise Tumor, signal the company's commitment to innovation and expansion in the precision medicine space.

Myriad Genetics' raised revenue guidance for 2024 and the introduction of adjusted EPS guidance reflect management's confidence in the company's trajectory and its ability to deliver value to shareholders. The focus on enhancing product offerings and improving reimbursement strategies will be pivotal in achieving these financial targets.

For more detailed information on Myriad Genetics Inc (NASDAQ:MYGN)'s financial results and future outlook, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Myriad Genetics Inc for further details.

This article first appeared on GuruFocus.