Myriad Genetics (MYGN) Expands Pharma Services With New Pact

Myriad Genetics, Inc. MYGN entered into a non-exclusive collaboration with Personalis through which Myriad will market the Personalis ImmunoID NeXT ultra-comprehensive biomarker discovery platform to its pharmaceutical partners. Financial terms of the deal were not disclosed.

The collaboration will expand Myriad Genetics pharma services.

More on the News

Personalis' ImmunoID NeXT technology, which the top 20 worldwide biopharma companies have used, is the most discriminating platform for powering drug development biomarker initiatives. It offers high-quality exome/transcriptome assays for FFPE cancer tissues.

Strategic Efforts

Several companion diagnostic pharmaceutical partners are requesting whole exome and whole transcriptome testing on the tumors of their patients. Myriad Genetics' goal is to provide its customers with complete menu access and the company is thrilled to enhance its offering by leveraging Personalis' high-quality assays.

Through this collaboration, partners will utilize the MyRisk Hereditary Cancer Test, BRACAnalysis CDx and/or MyChoiceCDx cancer tests.

Industry Prospects

Per a report by Reports And Data, the global precision oncology market is expected to reach $99.72 billion in 2027 from $49.98 billion in 2019 at a CAGR of 9.9%. Factors like rising cancer incidences and growing awareness pertaining to molecular-level diagnosis and treatment are likely to drive the market for the same.

Progress Within Testing Menu

During third-quarter earnings update, Myriad Genetics talked about continuous gain in share in the hereditary cancer market, with volumes rising 18% year over year in the third quarter. This was driven by competitive account wins and increased adoption by providers of myRisk.

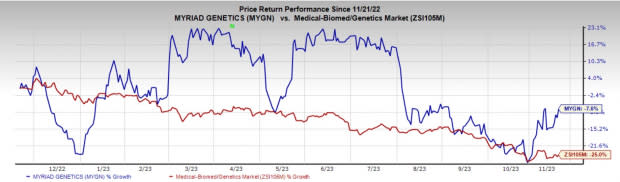

Image Source: Zacks Investment Research

In the third quarter, hereditary cancer testing volumes from the oncology business rose 15% year over year, well above the estimated industry growth, reflecting enduring franchise and improving its brand reputation. Prolaris — the prostate cancer test — continued its momentum, with third-quarter revenues up 18% year over year.

In September 2023, Myriad Genetics announced two key milestones in its strategic partnership with Illumina. The collaboration brings together Myriad’s MyChoice CDx homologous recombination deficiency (HRD) technology and Illumina’s expertise in comprehensive genomic profiling to broaden clinical research opportunities and drive CDx development for gene-based therapies.

Price Performance

In the past year, MYGN’s shares have declined 7.6% compared with the industry’s fall of 25%.

Zacks Rank and Key Picks

Myriad Genetics carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM. While Haemonetics and DexCom carry a Zacks Rank #2 (Buy), Insulet sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has risen 11.6% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 in 2023 and $4.07 to $4.11 in 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. Shares of the company have plunged 40.9% in the past year compared with the industry’s decline of 7%.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.41 in the past 30 days. Shares of the company have fallen 7.8% in the past year compared with the industry’s decline of 7.1%.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report