Myriad Genetics' (MYGN) New Partnerships Aid Amid FX Woes

Myriad Genetics MYGN has been benefiting from strategic alliances and a strong product portfolio. However, rising expenses have been denting profits. The stock carries a Zacks Rank #3 (Hold) currently.

As a leading name in genetic testing and precision medicine, Myriad Genetics believes that the key opportunities to grow its Oncology business are the expansion of companion diagnostics, market expansion through new clinical guidelines and new offerings. The company is looking to cash in on the vast potential in the breast cancer screening market. Also, per a report by Grand View Research on Medium, the breast cancer screening market in the United States is expected to reach roughly $6.8 billion by 2028.

In the third quarter of 2023, hereditary cancer testing volumes from the oncology business rose 15% year over year, well above the estimated industry growth, reflecting an enduring franchise and improved brand reputation. Prolaris — the prostate cancer test — continued its momentum, with third-quarter revenues up 18% year over year.

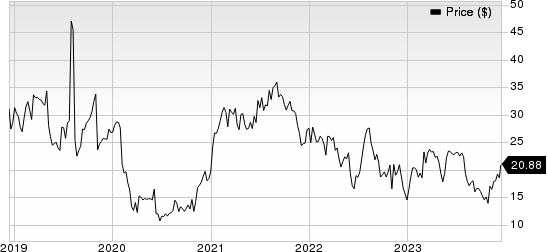

Myriad Genetics, Inc. Price

Myriad Genetics, Inc. price | Myriad Genetics, Inc. Quote

The company entered into a collaboration with Memorial Sloan Kettering Cancer Center to study the use of minimal residual disease (MRD) testing in breast cancer. The research project will use Myriad Genetics' MRD testing platform. This tumor-informed high-definition assay uses whole-genome sequencing to achieve high sensitivity and specificity for circulating tumor DNA (ctDNA). Myriad Genetics' MRD test was selected for its anticipated higher sensitivity and specificity than many other ctDNA offerings.

Myriad Genetics' progress across the globe with respect to myChoiceCDx test seems impressive. The company continues to record strong revenue growth from companion diagnostics, including significant revenue share from its proprietary myChoiceCDx test.

In September 2023, Myriad Genetics announced two key milestones in its strategic partnership with Illumina. The collaboration brought together Myriad’s MyChoice CDx homologous recombination deficiency technology and Illumina’s expertise in comprehensive genomic profiling to broaden clinical research opportunities and drive CDx development for gene-based therapies.

On the flip side, Myriad Genetics has been grappling with escalated expenses for a while. Although the company is gradually coming out of the impact of the two-and-a-half-year-long healthcare crisis, deteriorating international trade, with global inflationary pressure leading to a tough situation related to raw material and labor costs, as well as freight charges and rising interest rates, has put the medical device space in a tight spot.

In the third quarter of 2023, Myriad Genetics’ Research and development expenses rose 17.1% year over year to $24 million. SG&A expenses increased 4.3% to $136.1 million in the reported quarter.

Myriad Genetics receives a considerable portion of its revenues and pays a portion of its expenses in foreign currencies. As a result, the company remains at risk of exchange rate fluctuations between foreign currencies and the U.S. dollar. If the dollar strengthens against foreign currencies, the translation of foreign currency-denominated transactions will result in decreased revenues, operating expenses and net income. Management fears this may not be significantly offset by increased revenues.

Moreover, management does not currently utilize hedging strategies to mitigate foreign currency risk. The strengthening of the dollar has affected many U.S. companies trading in foreign currencies lately.

In the year ended Dec 31, 2022, MYGN’s revenues were negatively impacted by nearly $10.4 million due to foreign currency fluctuations.

Key Picks

Some better-ranked stocks in the broader medical space are Insulet PODD, Haemonetics HAE and DexCom DXCM. While Insulet presently sports a Zacks Rank #1 (Strong Buy), Haemonetics and DexCom carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. Shares of the company have decreased 40.9% in the past year compared with the industry’s decline of 7%.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Haemonetics’ stock has risen 11.6% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 for 2023 and from $4.07 to $4.11 for 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.41 in the past 30 days. Shares of the company have fallen 7.8% in the past year compared with the industry’s decline of 7.1%.

DXCM’s earnings surpassed estimates in the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report