Myriad Genetics' (MYGN) New Platform to Advance Cancer Care

Myriad Genetics, Inc. MYGN recently launched the Myriad Collaborative Research Registry (“MCRR”) — a comprehensive pan-cancer research platform to advance patient care. Previously known as the Precise Treatment Registry, the MCRR includes new data across germline and tumor testing results from the company’s cancer products on more than one million patients.

With the latest enhancements, the MCRR is currently one of the largest pan-cancer registries freely available for research use. It also supports transparent sharing of clinical data to advance the field.

Significance of the MCRR

The MCRR is built on the leading enterprise Precision Health platform, DNAnexus and provides a secure and easy-to-use interface for scientific data analysis, collaboration and discovery. Approved by the Institutional Review Board, the registry expands access to Myriad Genetics’ extensive repository of linked genomic and clinical data for researchers to discover deeper insights and accelerate the pace of precision cancer research to better prevent, detect and treat disease.

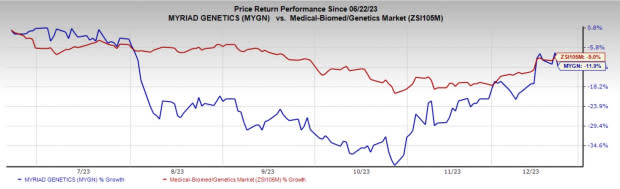

Image Source: Zacks Investment Research

The MCRR currently contains de-identified research data across a broad list of cancer indications and includes genomic test data associated with family history, ethnicity and clinical characteristics. This multi-omic resource combines diverse molecular information, encompassing germline variants, RNA-based gene expression classifiers, homologous recombination deficiency assessment, tumor variants, microsatellite instability, tumor mutation burden and PD-L1 status, together providing a holistic view for advanced insights.

The registry will continue to expand over time, incorporating patient outcomes, responses to treatment and additional tools to enhance the types of research that can be performed.

More on the News

The magnitude and scope of the MCRR underscores Myriad Genetics’ continued commitment to being a partner in the overall health data ecosystem. Building upon its open data-sharing efforts, the registry shares real-world data in a secure and interactive cohort browser.

Per MYGN’s spokesperson, the purpose of the registry is to advance the understanding of cancer by getting this expansive data set into the hands of interested researchers, enabling them to easily access and assess the data, run their own queries and test hypotheses to advance patient care.

Industry Prospects

Per a report by Precedence Research, the global cancer therapeutics market was valued at $164 billion in 2022 and is expected to witness a CAGR of 9.2% up to 2032.

Other Notable Developments

The company offers genetic tests that help assess the likelihood of developing diseases or their progression and guide treatment decisions across medical specialties, aiming to significantly improve patient care and lower healthcare costs. One of its key areas of focus lies in the field of Oncology, where the company possesses specialized products, capabilities and expertise.

Earlier in October 2023, MYGN and renowned Sample to Insight solutions provider QIAGEN announced a master collaboration agreement to develop companion diagnostic tests in the field of cancer. The alliance between QIAGEN and Myriad Genetics brings together the respective strengths of each partner. The partnership aims to deliver innovative services and products to pharmaceutical companies, enabling the development and commercialization of proprietary cancer tests for the U.S. clinical market and providing distributable companion diagnostic test kits for the global market.

Price Performance

In the past six months, Myriad Genetics shares have decreased 11.9% compared with the industry’s decline of 9%.

Zacks Rank and Key Picks

Myriad Genetics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM. Haemonetics and DexCom each presently carry a Zacks Rank #2 (Buy), and Insulet sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has risen 8.2% in the past year. Earnings estimates for Haemonetics have increased from $3.86 to $3.89 in 2023 and $4.11 to $4.15 in 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for Insulet’s 2023 earnings per share have moved up from $1.90 to $1.91 in the past 30 days. Shares of the company have dropped 30.1% in the past year compared with the industry’s decline of 1.6%.

PODD’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.43 to $1.44 in the past 30 days. Shares of the company have increased 2.7% in the past year compared with the industry’s growth of 4.1%.

DXCM’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report