Is Myriad Genetics (MYGN) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

Value-focused investors are always on the hunt for stocks that are priced below their intrinsic value. One such stock that merits attention is Myriad Genetics Inc (NASDAQ:MYGN). The stock, which is currently priced at 16, recorded a loss of 2.91% in a day and a 3-month decrease of 31.86%. The stock's fair valuation is $23.9, as indicated by its GF Value. However, investors need to consider a more in-depth analysis before making an investment decision.

Understanding the GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. It is calculated based on historical multiples, GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of the business performance.

Despite its seemingly attractive valuation, certain risk factors associated with Myriad Genetics (NASDAQ:MYGN) should not be ignored. These risks are primarily reflected through its low Piotroski F-score of 2, Altman Z-score of 1.09, and the company's revenues and earnings have been on a downward trend over the past five years, which raises a crucial question: Is Myriad Genetics a hidden gem or a value trap?

Breaking Down the Piotroski F-score and Altman Z-score

The Piotroski F-score, created by accounting professor Joseph Piotroski, is a tool used to assess the strength of a company's financial health. The score is based on nine criteria that fall into three categories: profitability, leverage/liquidity/ source of funds, and operating efficiency. The overall score ranges from 0 to 9, with higher scores indicating healthier financials. Myriad Genetics's current Piotroski F-Score, however, falls in the lower end of this spectrum, indicating potential red flags for investors.

The Altman Z-score, invented by New York University Professor Edward I. Altman in 1968, is a financial model that predicts the probability of a company entering bankruptcy within a two-year time frame. The Altman Z-Score combines five different financial ratios, each weighted to create a final score. A score below 1.8 suggests a high likelihood of financial distress, while a score above 3 indicates a low risk.

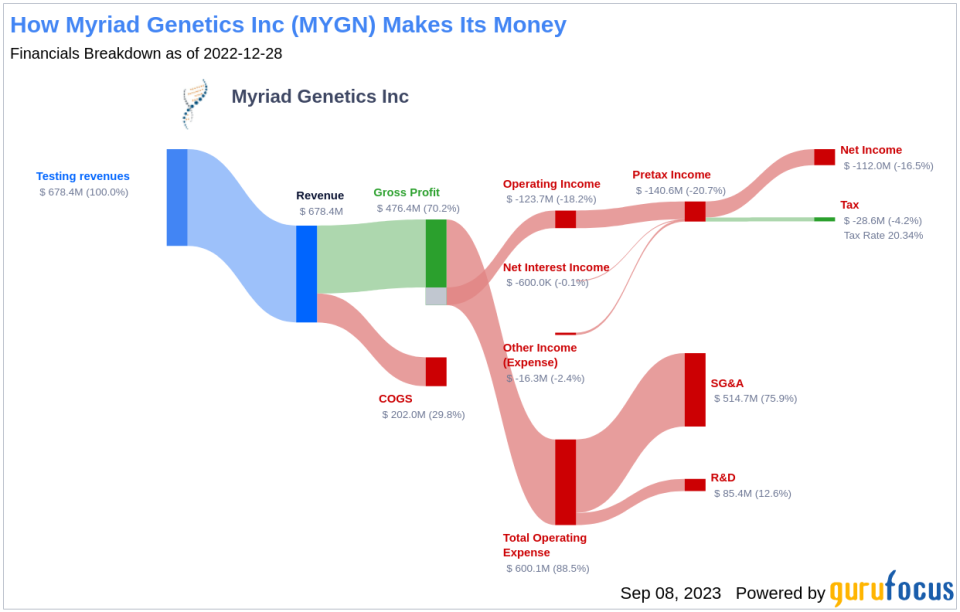

Company Introduction

Myriad Genetics is a molecular diagnostics company that provides testing services designed to assess an individual's risk of developing a disease. The firm produces MyRisk, a 48-gene panel with the capability to identify the elevated risk of developing 11 types of cancer. Other diagnostic products include BRACAnalysis CDx, the FDA-approved companion diagnostic for PARP inhibitors; GeneSight, which helps improve responses to psychotropic drugs for patients suffering from depression; and Prequel, a noninvasive prenatal test.

Conclusion

Based on the analysis, Myriad Genetics Inc (NASDAQ:MYGN) appears to be more of a value trap than an undervalued gem. Despite its seemingly attractive valuation, the company's weak financial health, as indicated by its low Piotroski F-Score and Altman Z-Score, along with the declining revenues and earnings, suggest potential troubles for investors. Therefore, thorough due diligence is crucial before making an investment decision.

GuruFocus Premium members can find stocks with high Piotroski F-score using the following Screener: Piotroski F-score screener .

GuruFocus Premium members can find stocks with high Altman Z-Score using the following Screener: Walter Schloss Screen .

Investors can find stocks with good revenue and earnings growth using GuruFocus' Peter Lynch Growth with Low Valuation Screener.

This article first appeared on GuruFocus.