N-able Inc (NABL) Reports Solid Revenue and EBITDA Growth in Full-Year 2023

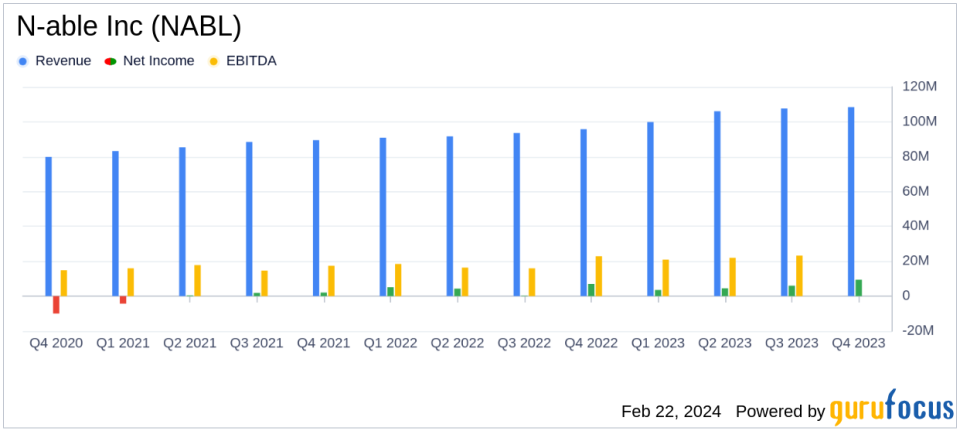

Full-Year Revenue Growth: N-able Inc (NYSE:NABL) achieved a 13.5% increase in total revenue year-over-year, reaching $421.9 million.

Adjusted EBITDA Margin Expansion: Full-year adjusted EBITDA margin improved significantly by over 300 basis points to 34.0%.

Net Income Growth: GAAP net income for the year stood at $23.4 million, translating to $0.13 per diluted share.

Fourth Quarter Highlights: Q4 revenue rose to $108.4 million, a 13.2% year-over-year growth, with subscription revenue up by 13.6%.

Financial Outlook: For full-year 2024, N-able anticipates revenue growth of 9% to 10% and an adjusted EBITDA margin of 34% to 35%.

Balance Sheet Strength: As of December 31, 2023, the company reported $153.0 million in cash and cash equivalents and a total debt of $335.0 million.

On February 22, 2024, N-able Inc (NYSE:NABL), a leading provider of cloud-based software solutions for managed service providers (MSPs), released its 8-K filing, announcing its financial results for the fourth quarter and full-year ended December 31, 2023. The company, which primarily operates in the United States but also has a significant presence in the United Kingdom and other international regions, reported a year of strong performance and growth.

Company Overview

N-able Inc is a provider of essential IT management software for MSPs, enabling them to effectively support SMEs in their digital transformation journeys. With a suite of management, security, automation, and data protection solutions, N-able is strategically positioned to address the increasing challenges faced by MSPs and SMEs, such as security threats, compliance standards, and IT complexity.

Performance and Challenges

Despite the challenges posed by a dynamic market environment, N-able Inc has delivered a robust performance with a total revenue increase of 13.5% year-over-year, demonstrating the company's ability to grow amidst adversity. The company's president and CEO, John Pagliuca, highlighted the strong demand for IT management software and the company's success in exceeding top and bottom-line expectations. CFO Tim O'Brien emphasized the double-digit revenue growth and significant EBITDA margin expansion, which reflect the company's operational efficiency and product roadmap advancements.

Financial Achievements

The company's financial achievements are particularly noteworthy in the software industry, where recurring revenue and margins are key indicators of performance. N-able Inc's subscription revenue growth and adjusted EBITDA margin expansion signify the company's successful business model and operational excellence. These achievements are crucial as they demonstrate the company's ability to scale profitably while continuing to invest in product development and market expansion.

Key Financial Metrics

Key financial metrics from the income statement include a GAAP gross margin of 83.8% and a non-GAAP gross margin of 84.6% for the full year. The balance sheet shows a solid cash position, and the cash flow statement reflects strong cash generation capabilities. The company's TTM Dollar-Based Net Retention Rate of 110% underscores the effectiveness of its customer retention strategies.

Management Commentary

"Our 2023 performance was strong, and we believe lays the groundwork for a successful 2024," said N-able president and CEO John Pagliuca. "Our fourth quarter results exceeded expectations on the top and bottom lines capping a successful year where we advanced our product roadmap, expanded our cross-sell opportunity, and drove double digit revenue growth while growing our full-year adjusted EBITDA margin by over 300 basis points," added N-able CFO Tim OBrien.

Analysis of Performance

N-able Inc's performance in 2023 reflects a company that is effectively executing its growth strategy and delivering value to its customers and stakeholders. The company's focus on expanding its product offerings and cross-selling opportunities has translated into tangible financial results. Looking ahead, the company's 2024 outlook suggests a continued trajectory of growth, albeit at a slightly moderated pace compared to 2023.

The company's financial results are preliminary and subject to final review. Investors and stakeholders are encouraged to review the detailed financial tables and reconciliations of GAAP to non-GAAP financial measures provided in the earnings release to gain a comprehensive understanding of N-able Inc's financial position and performance.

For more detailed information and analysis, readers are invited to visit GuruFocus.com, where they can find in-depth financial data and expert commentary on N-able Inc (NYSE:NABL) and other companies of interest to value investors.

Explore the complete 8-K earnings release (here) from N-able Inc for further details.

This article first appeared on GuruFocus.