Nancy Pelosi Takes Position in Palo Alto Networks

Former House Speaker and current Congresswoman Nancy Pelosi has one of the best investment track records on Capitol Hill, with her portfolio generating a 65% return in 2023. Recently, she took a position inPalo Alto Networks Inc. (NASDAQ:PANW), buying long-dated, in-the-money calls expiring in January 2025 with a strike price of $200. Let's take a closer look at her newest investment.

Company profile

Palo Alto is a cybersecurity company specializing in secure access service edge, network, cloud and endpoint security. When the company publicly debuted back in 2012, it was primarily known as a firewall company, and it still sells firewall appliances and software today.

Over the years, the company has expanded its offerings. It now sells subscriptions for cloud-based security services solutions that work in conjunction with its firewall appliances and software. It also provides SASE and cloud security offerings that are sold via subscription with pricing based on a per-user, per-endpoint or capacity-based basis.

Pelosi buys after post-earnings dip

Pelosi started her long-dated call position in Palo Alto shortly after the stock nosedived 28.50% following its fiscal second-quarter earnings report toward the end of February.

The quarter itself was solid. Revenue grew 19% to $1.98 billion, edging past the analyst consensus, while adjusted earnings of $1.46 per share handily topped analyst estimates by 16 cents. However, a lowered forecast for revenue and billings, as well as a major shift in strategy, sent the stock spiraling lower.

Palo Alto reduced its fiscal year 2025 billings forecast from a range of $10.70 billion to $10.80 billion to between $10.10 billion and $10.20 billion. Meanwhile, it lowered its revenue forecast to between $7.95 billion and $8 billion, down from a previous outlook of $8.15 billion to $8.20 billion.

The company also announced a major shift in strategy moving forward. The cybersecurity company will embark on what it calls platformization, where it will move all its individually sold point products and consolidate them onto one of its three platforms. The company said it was starting to see cybersecurity spending fatigue as customers were not getting great incremental benefits from adding new point solutions.

Management believes its shift in strategy will lead to more multi-platform wins and increase the lifetime value of customers. However, in the medium term, the company is going to offer free access to its platforms for customers that switch over.

On its fiscal second-quarter earnings call, CEO Nikesh Arora described the plan this way:

What's happening today is when I go to a customer and say, listen, I'd like to replace your estate with the entire platform. The customer says, Wait, wait a minute, I got this vendor for IPS, this for SD-WAN, this for SSC. And I got half of my firewalls from another vendor, and they all expire at different points in time. I'd love to deploy Zero Trust but it's going to take me 2, 3 years as the end of life, so these vendors happen. And I'm scared that if I rip and replace this at this point in time, is going to create execution risk, not just that, it's going to hit economic risk.' So the propositions we're going to customers is, listen, let's lay out a 2-year, 3-year cybersecurity consolidation and platformization plan. We'll go start implementing today, you pay us when they're done. So what it is, is more of a sort of like you can use our services until you have to keep paying the other vendor, we'll take it from there. But that's taking away a lot of the economic exposure and the execution risk for our customers. Now you can call that discount or you can call that a free offer. Our estimate is approximately it works out at about 6 months' worth of free product capabilities to our customers on a rolling basis. I think in about 12 months, as our offers start lapping each other, we should go back to our growth rate we've been talking about. And I think the right metric is the time frame is to look at RPO.

This is a very bold move by Palo Alto to say the least. It will greatly disrupt its own business over the next 12 to 18 months to try and convince its customers to replace disparate solutions with a single platform from Palo Alto. It is similar to when wireless or cable companies offer to buy out a customer's contract in order for them to switch service, but at a much greater price tag.

Strategically, the plan makes a lot of sense. While Palo Alto is losing out on some initial revenue, it would otherwise be pretty difficult to get customers to switch over solely to its platform given they have contracts with various vendors that finish at different times. Customers would not want to be paying for two expesive solutions at the same time.

Meanwhile, Palo Alto should be able to deliver its customers a better cybersecurity outcome with a unified platform as opposed to being part of a cobbled together endpoint cybersecurity system. In the end, this could be a win-win for both Palo Alto and its customers.

However, it is notable that rival Crowdstrike (NASDAQ:CRWD) trolled Palo Alto's comments on its earnings call, with CEO George Kurtz saying:

"Cybersecurity today is a frenetic vendor bazaar. Disjointed point feature copycat products clutter the market attempting to Band-Aid symptoms instead of curing the illness. OS vendors use their market position to create a monoculture of dependence and risk, and in many cases, serve as the breach originator. Even worse, multi-platform hardware vendors evangelized their stitched together patchwork of point products, masquerading as thinly veiled piecemeal platforms. And what organizations inevitably realize is that vendor lock-in leads to deployment difficulties, skyrocketing cost and subpar cybersecurity. The outcome is shelfware and sunk costs. ELA and bundling addiction become the only way to coax customers into purchasing nonintegrated point products. It's the organization trapped in these fragmented pseudo platforms riddled with bolt-on point products that are the ones suffering from fatigue."

Valuation

Given their high gross margins and the recurring nature of their businesses, SaaS companies are typically valued based on a sales multiple. About 80% of Palo Alto's revenue is recurring in nature.

Palo Alto is projected to generate $9.16 billion in revenue in fiscal 2025 (ending July). That would mean 80% of that amount is $7.33 billion. Based on its 2025 subscription revenue, it trades at an enterprise value/subscription revenue multiple of 11.70, while based on total revenue it trades at 9.30 times.

The company is projected to grow its revenue in the mid to high teens over the next several years.

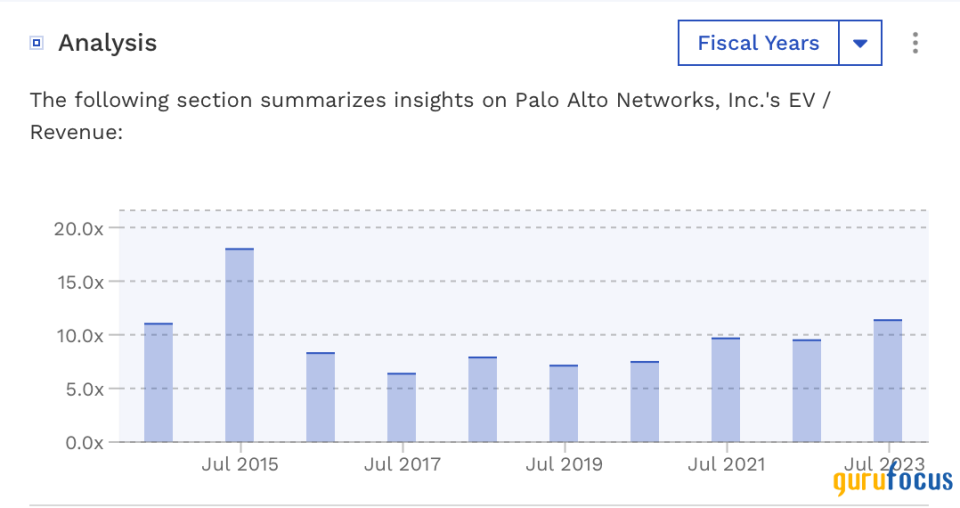

Historically, Palo Alto has generally traded between 7 to 10 times enterprise value/total revenue, which would value the company at between $223 and $308.

Conclusion

I like the strategic shift Palo Alto has made, even though it will result in some near-term pain that punishes the stock. Growth will slow moderately, but the company is still projected to solidly grow, and the new strategy should set it up for better growth in the future.

That said, the stock still is not exactly cheap by historical measures and the next year or two look will be a transitional period for the company.

This article first appeared on GuruFocus.