NasdaqGM Healthcare Dividend Stock Picks

The healthcare sector has a higher prevalence of companies with sustainable competitive advantages compared to other sectors which implies it may continue generating above-average financial returns. Therefore, these companies provide a strong reliable stream of constant income which is a great diversifier during economic downturns. Below is my list of huge dividend-paying stocks in the healthcare industry that continues to add value to my portfolio holdings.

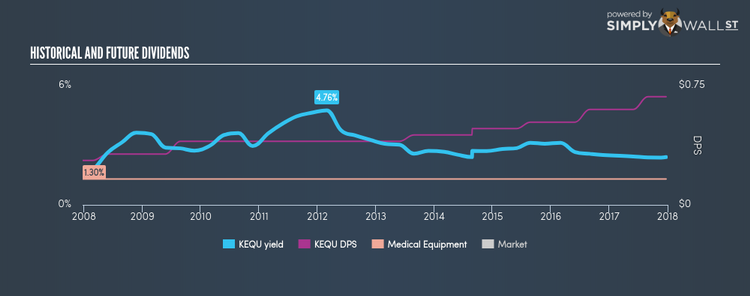

Kewaunee Scientific Corporation (NASDAQ:KEQU)

KEQU has a sizeable dividend yield of 2.40% and distributes 36.56% of its earnings to shareholders as dividends . KEQU’s DPS have risen to $0.68 from $0.28 over a 10 year period. The company has been a dependable payer too, not missing a payment in this 10 year period. It should comfort potential investors that the company isn’t expensive when we look at its PE ratio compared to the US Medical Equipment industry. Kewaunee Scientific’s PE ratio is 16.7 while its industry average is 35.5.

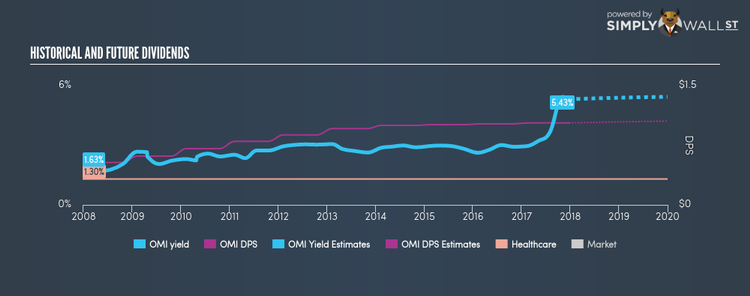

Owens & Minor, Inc. (NYSE:OMI)

OMI has an alluring dividend yield of 5.32% and their current payout ratio is 81.32% . OMI’s last dividend payment was $1.03, up from it’s payment 10 years ago of $0.4532. Much to the delight of shareholders, the company has not missed a payment during this time.

Cardinal Health, Inc. (NYSE:CAH)

CAH has a nice dividend yield of 2.95% and is distributing 52.64% of earnings as dividends . Over the past 10 years, CAH has increased its dividends from $0.48 to $1.8496. To the enjoyment of shareholders, the company hasn’t missed a payment during this period.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.