National Beverage Corp (FIZZ) Reports Increased Earnings and Sales in Winter Quarter

Net Sales: Increased to $270,065 thousand from $268,483 thousand in the prior year.

Net Income: Rose to $39,592 thousand, up from $34,361 thousand year-over-year.

Earnings Per Share (EPS): Improved to $0.42, both basic and diluted, compared to $0.37 in the previous year.

Trailing Twelve Months Performance: Net sales reached $1,181,078 thousand with net income totaling $169,314 thousand.

Product Innovation: Introduction of new LaCroix flavor, Mojito, and recognition as one of The Most Trusted Brands in America.

Strategic Focus: Emphasis on health-conscious products without caffeine or alcohol, and sustainable packaging.

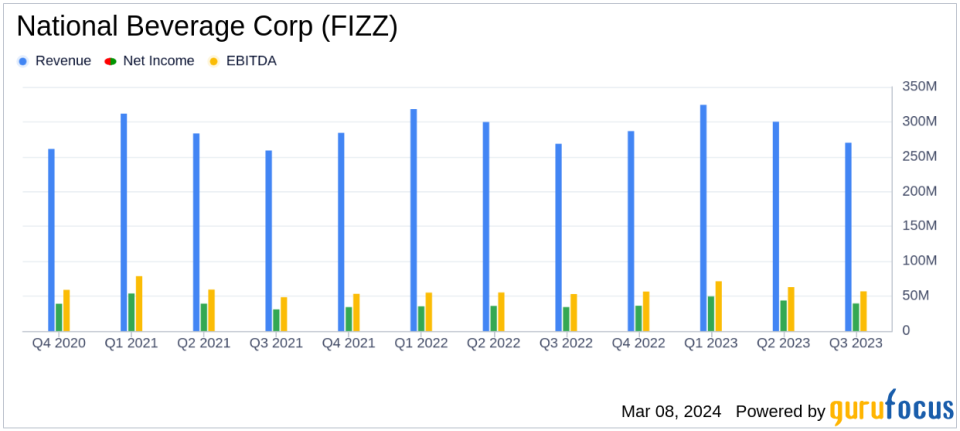

National Beverage Corp (NASDAQ:FIZZ) released its 8-K filing on March 7, 2024, announcing its financial results for the third quarter ended January 27, 2024. The company, known for its popular LaCroix sparkling water and a portfolio of health-oriented beverages, reported its eleventh consecutive quarter of record sales, alongside significant growth in gross profits and operating income.

Financial Performance and Company Strategy

The company's net sales saw a modest increase to $270,065 thousand, up from $268,483 thousand in the prior year. More notably, net income experienced a significant jump to $39,592 thousand from $34,361 thousand, reflecting a strong year-over-year growth. Basic and diluted earnings per share both improved to $0.42, up from $0.37. Over the trailing twelve months, National Beverage Corp achieved net sales of $1,181,078 thousand and net income of $169,314 thousand.

National Beverage Corp's commitment to innovation and consumer health continues to be a driving force behind its success. The introduction of the new LaCroix flavor, Mojito, exemplifies the company's strategy to innovate within its product lines. This focus on health and wellness, coupled with an emphasis on sustainable packaging, aligns with consumer trends and has helped solidify the brand's position in the market.

Challenges and Outlook

Despite the positive results, National Beverage Corp faces the challenge of maintaining its growth trajectory in a highly competitive industry. The company's strategy of avoiding the extension of its brands into caffeinated or alcoholic products may limit its market reach but aligns with its health-centric brand image. The company's financial philosophy, which prioritizes strong cash flows and eschews long-term debt, positions it well for sustainable growth and shareholder returns.

In conclusion, National Beverage Corp's latest earnings report reflects a company that is successfully navigating the competitive beverage industry through a focus on health-conscious products and innovation. With a strategic emphasis on sustainable practices and a strong financial footing, National Beverage Corp appears poised to continue its pattern of growth and profitability.

Explore the complete 8-K earnings release (here) from National Beverage Corp for further details.

This article first appeared on GuruFocus.