National Fuel Gas' (NFG) Board Approves 4.2% Dividend Hike

National Fuel Gas Company NFG recently announced that the board of directors has approved a 4.2% increase in the quarterly dividend rate. The revised quarterly dividend will be 49.5 cents, payable on Jul 14, 2023, to shareholders of record at the close of business on Jun 30, 2023.

The company’s new annualized dividend rate is $1.98 per share, resulting in a dividend yield of 3.84%. This marks the 53rd straight year of increase in annual dividend rate by the board of directors, reflecting its strong performance. The current dividend yield is better than the Zacks S&P 500 composite’s 1.71%. It has paid out $1.4 billion in dividends since 2012.

Can We Expect Hikes in the Coming Years?

National Fuel Gas’ acquisition of Shell’s upstream and midstream assets in Pennsylvania for $500 million boosted its earnings and production. The highly-accretive acquisition of Appalachian upstream and midstream assets in July 2020 further boosted production levels and proved reserves of the company. The current development activities are focused primarily on the Marcellus and Utica shales.

NFG invested $829 million in fiscal 2022. The company aims to invest in the range of $830-$940 million in 2023. Total capital expenditure in the first six months of 2023 was $496.4 million. It has invested $2.4 billion since 2010 in midstream operations to expand and modernize its pipeline infrastructure for gaining access to Appalachian production. The company has more than $500 million in pipeline projects planned over the next five years.

These expanding operations of National Fuel Gas generate stable cash flow and assist management in carrying on with shareholder-friendly initiatives.

Utilities’ Legacy of Dividend Payment

The companies involved in utility services generally have stable operations and earnings. Consistent performance and the ability to generate cash flows allow utilities to reward shareholders with regular dividend. National Fuel Gas has been distributing dividend for 120 consecutive years.

Recently, Chesapeake Utilities Corp. CPK, American Water Works Company Inc. AWK and The Southern Company SO raised their quarterly dividend rate by 10.3%, 8% and 2.9%, respectively.

The Zacks Consensus Estimate for CPK’s 2023 earnings per share (EPS) is pegged at $5.32, implying a year-over-year increase of 5.6%. The current dividend yield is 1.86%.

The Zacks Consensus Estimate for AWK’s 2023 earnings per share is pegged at $4.77, implying a year-over-year increase of 5.8%. The current dividend yield is 1.94%.

The Zacks Consensus Estimate for SO’s 2023 earnings per share is pegged at $3.61, implying a year-over-year increase of 0.3%. The current dividend yield is 3.97%.

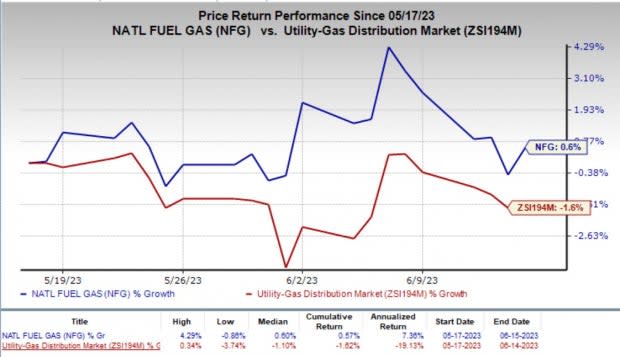

Price Performance

In the past month, National Fuel Gas’ shares have gained 0.6% against the industry’s decline of 1.6%.

Image Source: Zacks Investment Research

Zacks Rank

National Fuel Gas currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southern Company (The) (SO) : Free Stock Analysis Report

Chesapeake Utilities Corporation (CPK) : Free Stock Analysis Report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

National Fuel Gas Company (NFG) : Free Stock Analysis Report