National Fuel Gas (NFG) to Post Q3 Earnings: What's in Store?

National Fuel Gas Company NFG is scheduled to release third-quarter fiscal 2022 earnings on Aug 4 before market open. National Fuel Gas reported an average surprise of 9.89% in the last four quarters.

Let’s see how things have shaped up before the upcoming earnings announcement.

Factors to Note

An improvement in commodity prices and higher production from acquired assets in the Appalachian region are likely to have boosted the performance in the third quarter of fiscal 2022. The stable performance of National Fuel Gas’ regulated businesses is likely to have boosted earnings and cash flow in the third quarter. The expanding operations and growth in the interstate pipeline are likely to have generated additional revenues in the fiscal third quarter.

Expectation

The Zacks Consensus Estimate for third-quarter fiscal 2022 earnings is pegged at $1.47 per share, indicating an increase of 58.1% from the year-ago reported figure.

The Zacks Consensus Estimate for fiscal third-quarter 2022 sales is pegged at $562.7 million, indicating an increase of 42.7% from the year-ago reported figure.

What the Quantitative Model Predicts

Our proven model does not conclusively predict an earnings beat for NFG this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that is not the case here as you will see below.

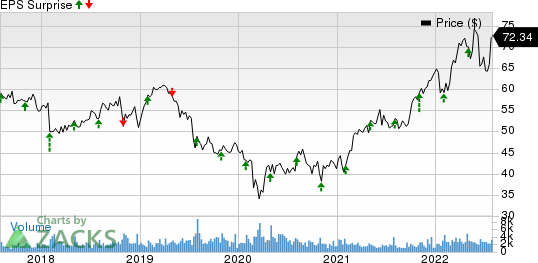

National Fuel Gas Company Price and EPS Surprise

National Fuel Gas Company price-eps-surprise | National Fuel Gas Company Quote

Earnings ESP: National Fuel Gas has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Currently, National Fuel Gas carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Investors can consider the following players from the same sector who have the right combination of elements to beat earnings in the upcoming releases.

Entergy Corporation ETR is likely to come up with an earnings beat when it reports second-quarter results on Aug 3 before market open. Entergy has an Earnings ESP of +0.35% and carries a Zacks Rank #3 at present. ETR’s long-term (three to five years) earnings growth is projected at 6.7%.

Atmos Energy ATO is likely to come up with an earnings beat when it reports third-quarter fiscal results on Aug 3 after market close. Atmos Energy has an Earnings ESP of +1.35% and carries a Zacks Rank #2 at present. ATO’s long-term earnings growth is projected at 7.4%.

Spire Inc. SR is likely to come up with an earnings beat when it reports second-quarter results on Aug 4 before market open. Spire has an Earnings ESP of +6.66% and carries a Zacks Rank #3 at present. SR’s long-term earnings growth is projected at 5%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Entergy Corporation (ETR) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

National Fuel Gas Company (NFG) : Free Stock Analysis Report

Spire Inc. (SR) : Free Stock Analysis Report

To read this article on Zacks.com click here.